Next stop – currency crisis?

February 13, 2019

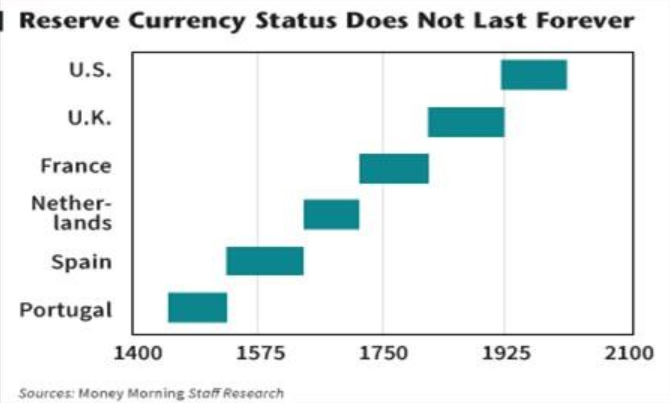

If we take a deeper look how economy deflates due to excessive amount of debt we should start digging inside the reserve currency. Reserve currency cycle period takes around 100Ys. If we look at below table we can see USD is reaching the tipping point. Same time considering we’re ending 90Y deflationary cycle with ZIRP/NIRP+QE we might see last giga wealth transfer and new world order. Let’s see how long each reserve currency lasts :

Last deflationary cycle allowed the transfer from UK to US as a reserve currency, the question is what will be next as 90Y deflationary cycle from 1929 seems to be about blow up(?). Many people claims that suddenly FED will QE the economy, I don’t think so it will happen. They start talking about QE4 the same time dumping treasuries using QT. Even Powell a moment ago told that first rate cuts later maybe QE. That is quite smart because when the world will be on fire due to 250T$ debt explosion, FED might again help and print some USD at the end, pretending they rescue the economy.

USD bears are telling that fiat currencies are backed by nothing, well USD is actually backed by something really important. It’s 700B$ military spending and petro-dollar status. When Libian Muammar Al Gathafi wanted to sell oil using golden-dinnar he was raided. Remember Iraq and weapons of mass destructions which have never been found? Hussajn also wanted to abandon $ and sell oil in EUR. He was raided and killed. Venezuela, Maduro? He also wanted to sell oil in EUR – strange things happened as suddenly a coup occured and a guy called Juan Guaido appeard on the scene backed by US who has frozen all Maduro assets and official told he’s the president. Iran and cut from Swift, because they wanted to sell oil in EUR? Last time China was trying to create oil yuan contracts, but a moment later China is on their knees with T$ debts record amount of defaults and companies that pay back bonds by inventories. Probably nothing, but it seems it’s all about the $ and if US Government will have to chose to QE till infinity or bust pensions and save the $, they will definatelly choose option #2. US is definatelly harder to defend its postion as China and Russia are colluding, but US brought the Chinese on the verge of collapse and probably huge social unrest in China which might lead to remove Xi and coup against communism as it is as bad as hell as their stupidity created biggest deflation since ages. Russia had to dump US Treasuries, pretending to buy gold and run away from $, but that was a pure PR move as they needed $ to pay their expenses.

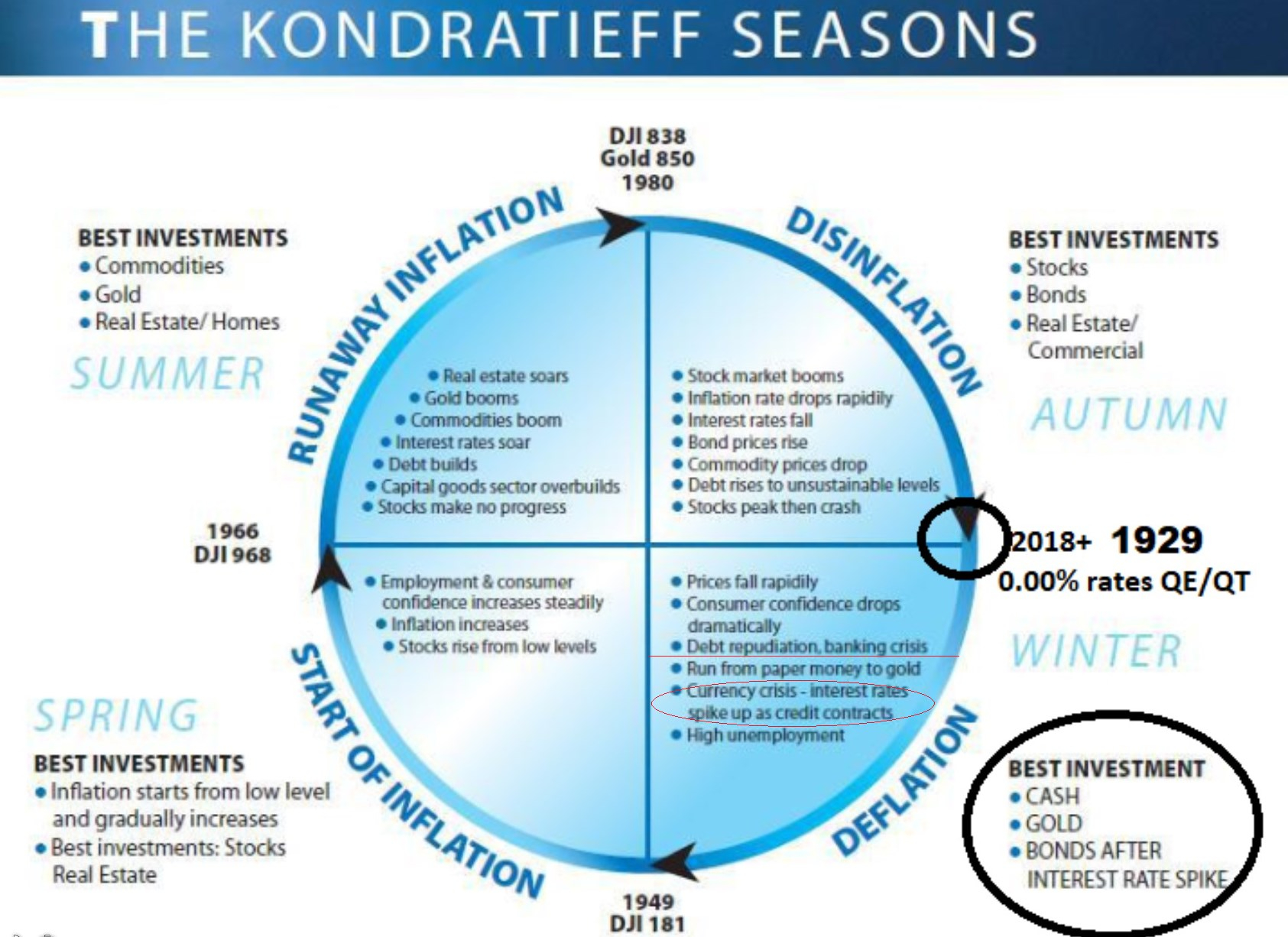

Let’s back to the economy cycle :

The first point of the bubble deflation is consumer confidence which drops like a stone in line with consumer spending. QE’d/ZIRPed/NIRPed economy just hit a wall and as all remember economy can’t take more. Central Bankers are trying like crazy to explain us that new SDR and one currency is great and will support more negative rates in line with e-money which can’t be taken out from the banks, but I still can’t believe looking at EURO zone, where 1 currency dedicated to so inequaled society will bring peace and prosperity in reality created biggest inequality and frustration which is just about to burst like a war. You can’t have prosperity putting wealthy and responsible nation in the same bag with lazy loafers who love to take money for free because they can. It’s not working, so 1 global currency won’t work too, but that might be just a kind of desperation from Central Banks, because they must know, once the bubble will blow up, all will have to find guilty ones. Looking what type of populists start winning elections pointing that bankers are responsible for all the mess we’re just a moment from a step where finally some central bankers will start going to jail.

So, once the consumer spending drops to zero, we should start currencies crisis. We all should remember, that globally we can’t have spreading inflation across the globe. Somewhere has to be deflation, somewhere inflation. The measure where it might happen lays in reserve currency index. Low index = inflation is killing US, deflation is exported outside US, high index = deflation is killing US, inflation is exported outside US.

US as an owner of reserve currency has a greatest benefit ever. They can do nothing, import everything, export just printed USD and live till the end of the bubble so around 100Ys. Trump wants to move back factories to US, ok, but what he has done? The world is floating with $ debt. Trump just wants to remove $ from around the globe and move it to US. Effect? Simple – T$ debt outside US starts to have decent problems how to pay it back once $ are missing.

Switching from reserve currency to new one is not a simple thing. It requires usually big war or some scary event. So scary that the whole society will have to adopt new rules. Those scary events usually happens during deflationary busts, because in our case debt repudiation creates bank runs and massive bankruptcies and it’s all about the $.

Some people tells gold is a replacement, well yes, but ask 99.9% of people if they will have to chose gold or dollars, I bet most of them will take dollars.

So how does it look like? Considering we’re at the final bubble on QE/ZIRP bubble let’s take a look at couple of currency pairs. Debt deflation is nothing more than reserve currency spike to “infinity”. The bank runs for 250T$ debt is so strong that FED won’t be even able to QE so big amount of $, as consumer credit contraction turns money supply only towards QE. FED is not able to print 50T$ probably, so it might be really big fun.

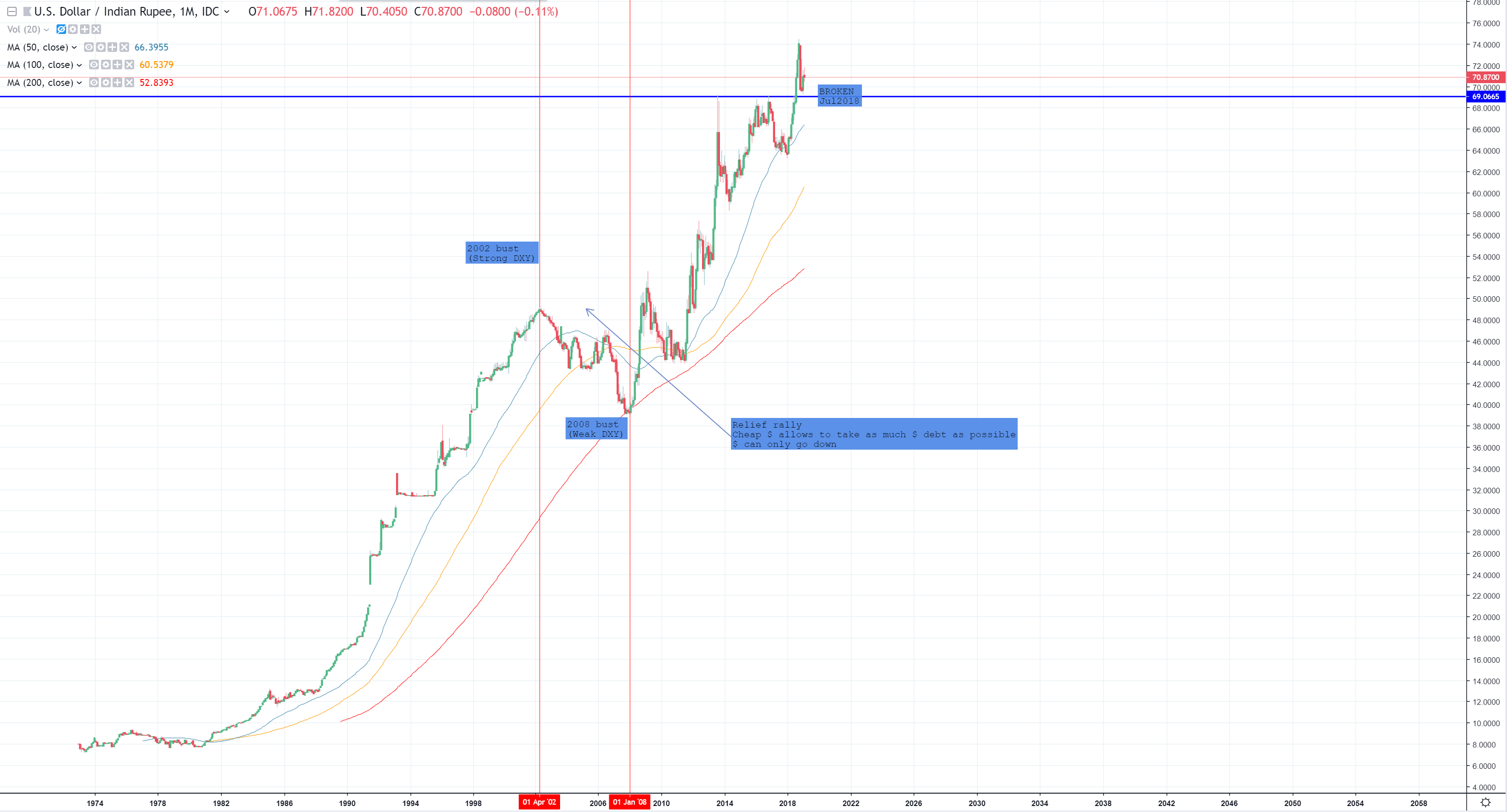

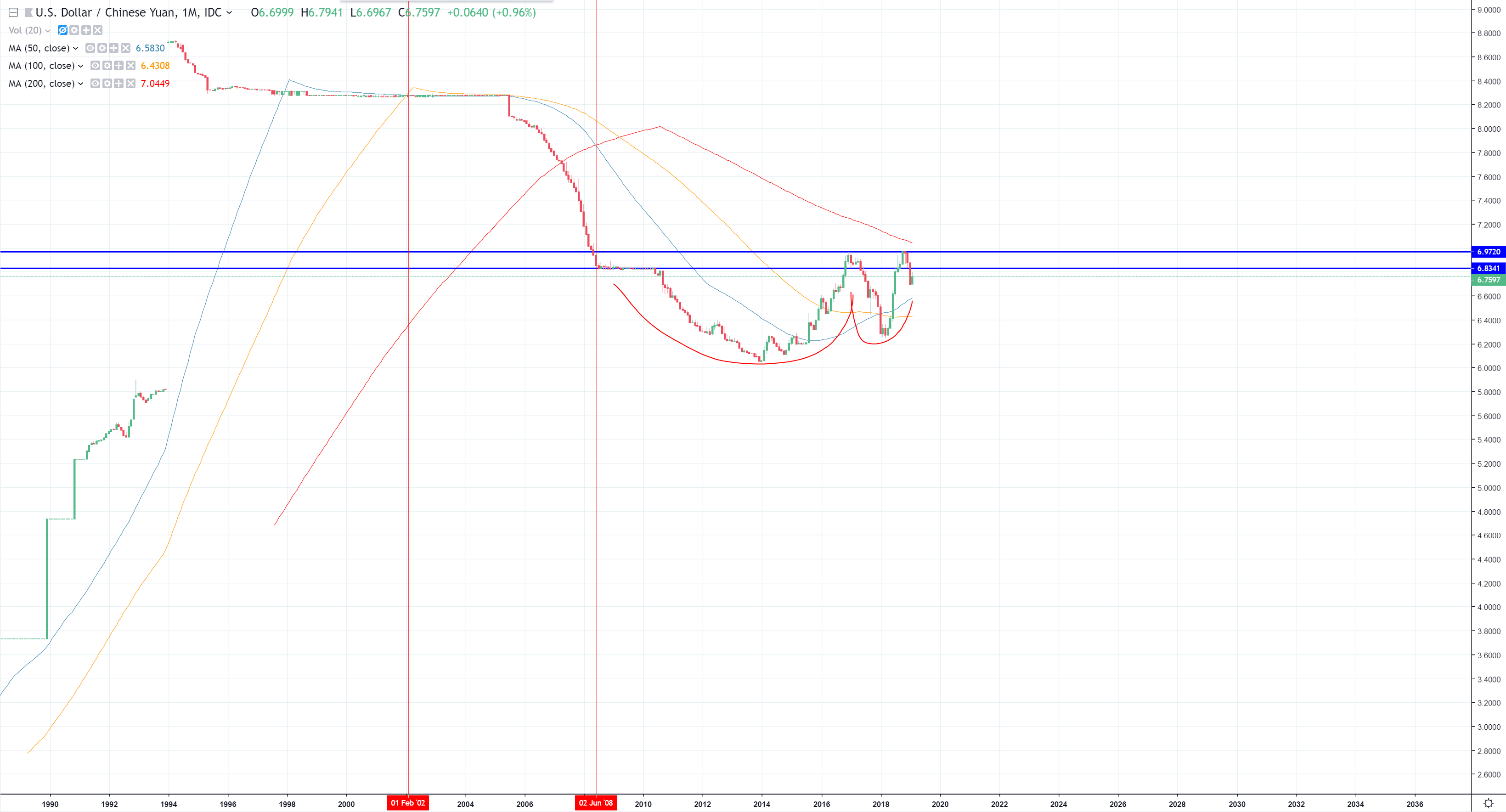

So, let’s see. I selected couple of USDxxx pairs and let’s see how they behave during final topping from 2000-2019 – during top of the deflationary phase.

USDINR – India (zoom the chart to look for details (CTRL+roll on your mouse between left and right button) – Broken trend now during small relief rally allowed their Central Bank to cut rates from 6.5% to 6.25% – won’t last forever.

USDCNY – China – they are the biggest beneficiary of the big cycle and 1980-2019+ deflation. That was their economy cycle and probably that will be them who will have to blow up the bubble.

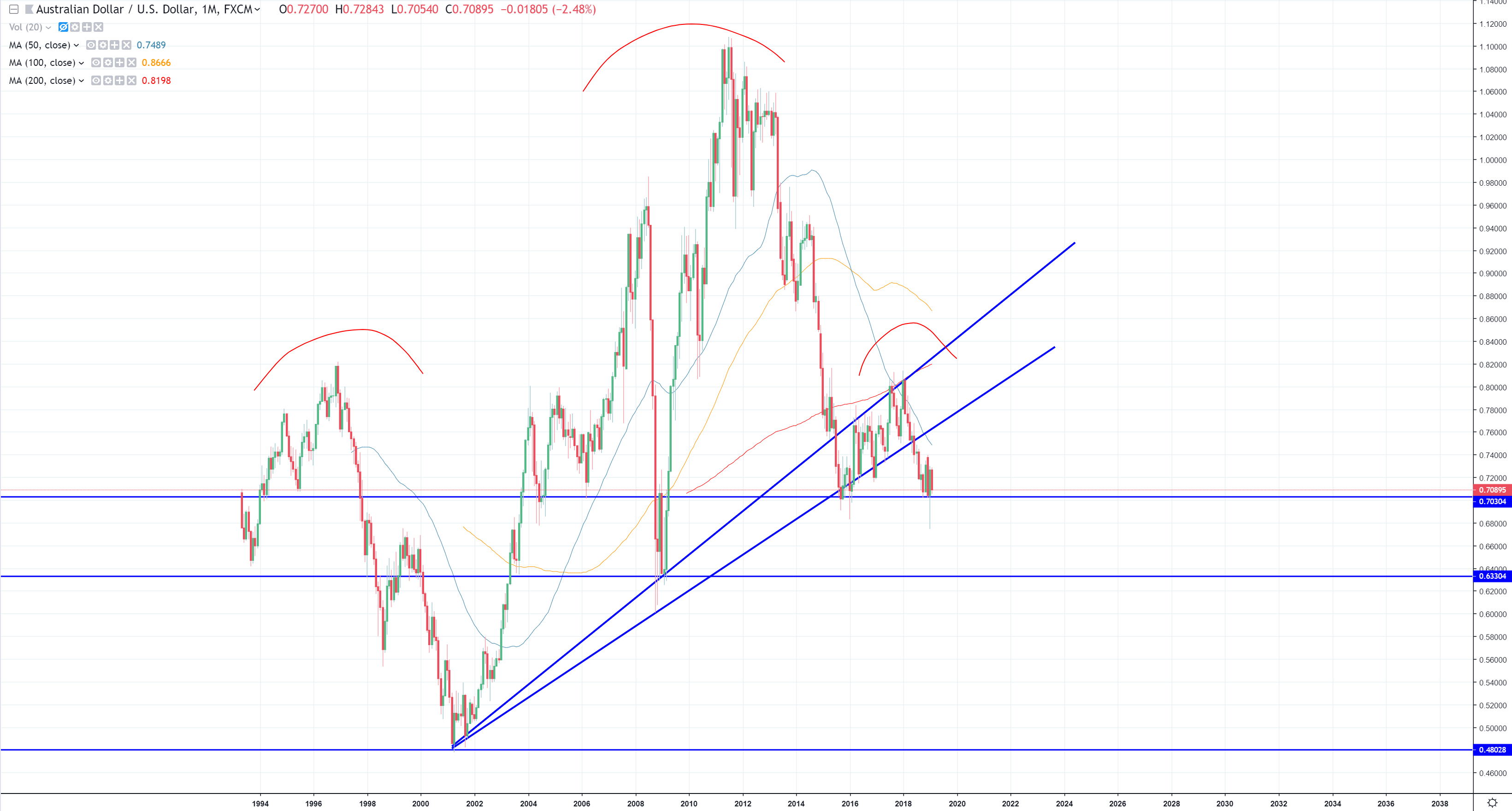

AUDUSD – Australia – deflationary proxy strictly connected with USDCNY, so AUDUSD exploaded to the downside what might give a clue that days for USDCNY to blow up above magic 7.00 are counted.

USDCAD – Oil proxy

USDBRL – Brasil, the last Emerging Market country that is not fully “wiped-out” by raising $

USDJPY – really curious about this currency, but according to the cycle it must go up, despite lots of opinion it will drop like a stone. In 2001 it was going higher all the time dot.com bubble was bursting. It will create so big DXY effect that will cripple down all US Corporations by earnings recession due to strong DXY.

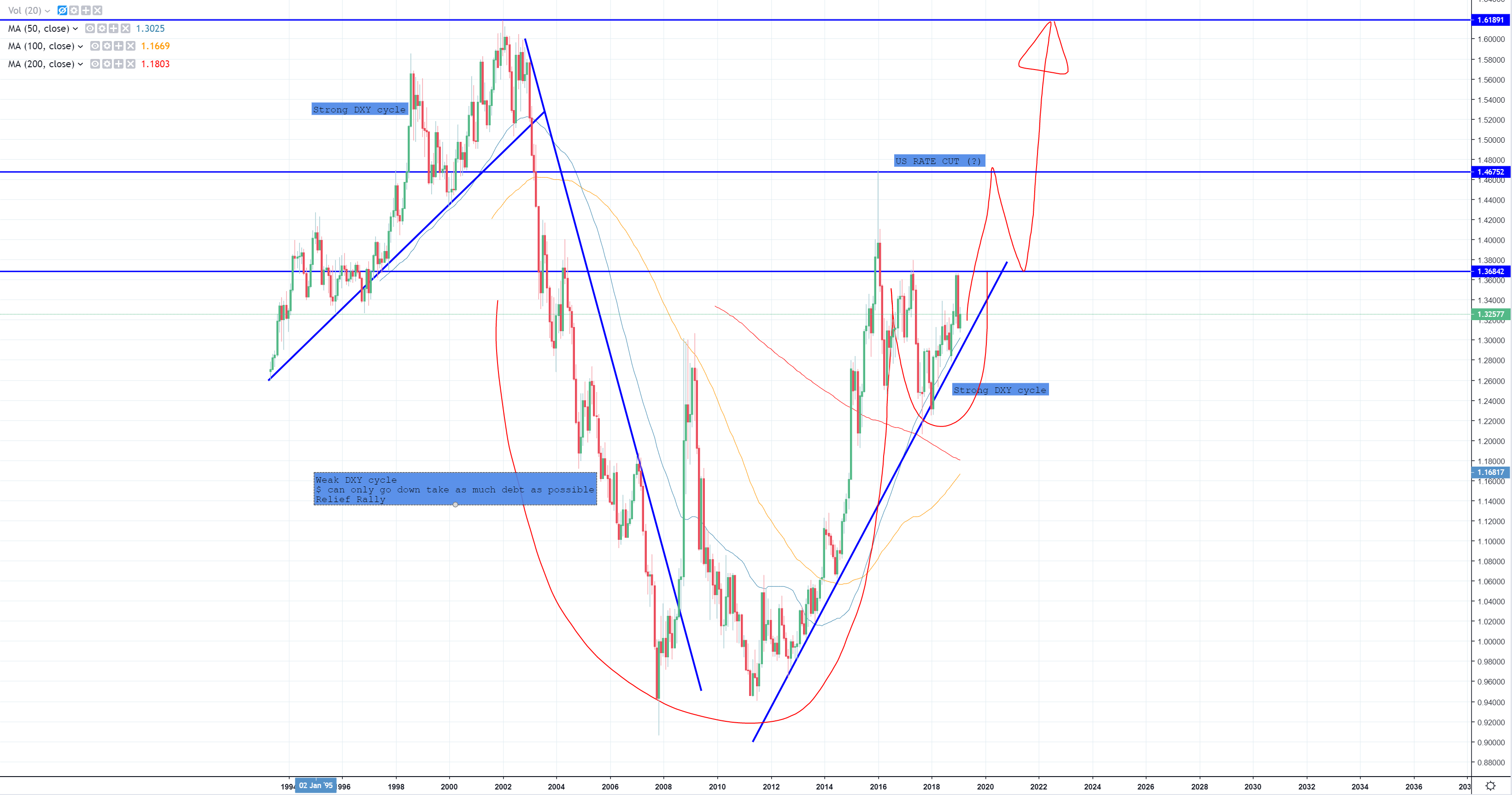

EURUSD – this pair is like 40% of DXY. I bet that like in 1991 USSR was hammered down due to DXY raise, this time EUR will be hammered too and forced to break EURO-ZONE(?) – that would have been a very nice deflationary bust.

USDTRY – canary in a coal mine of EU banking sector, running parabolic with a small correction in my opinion.

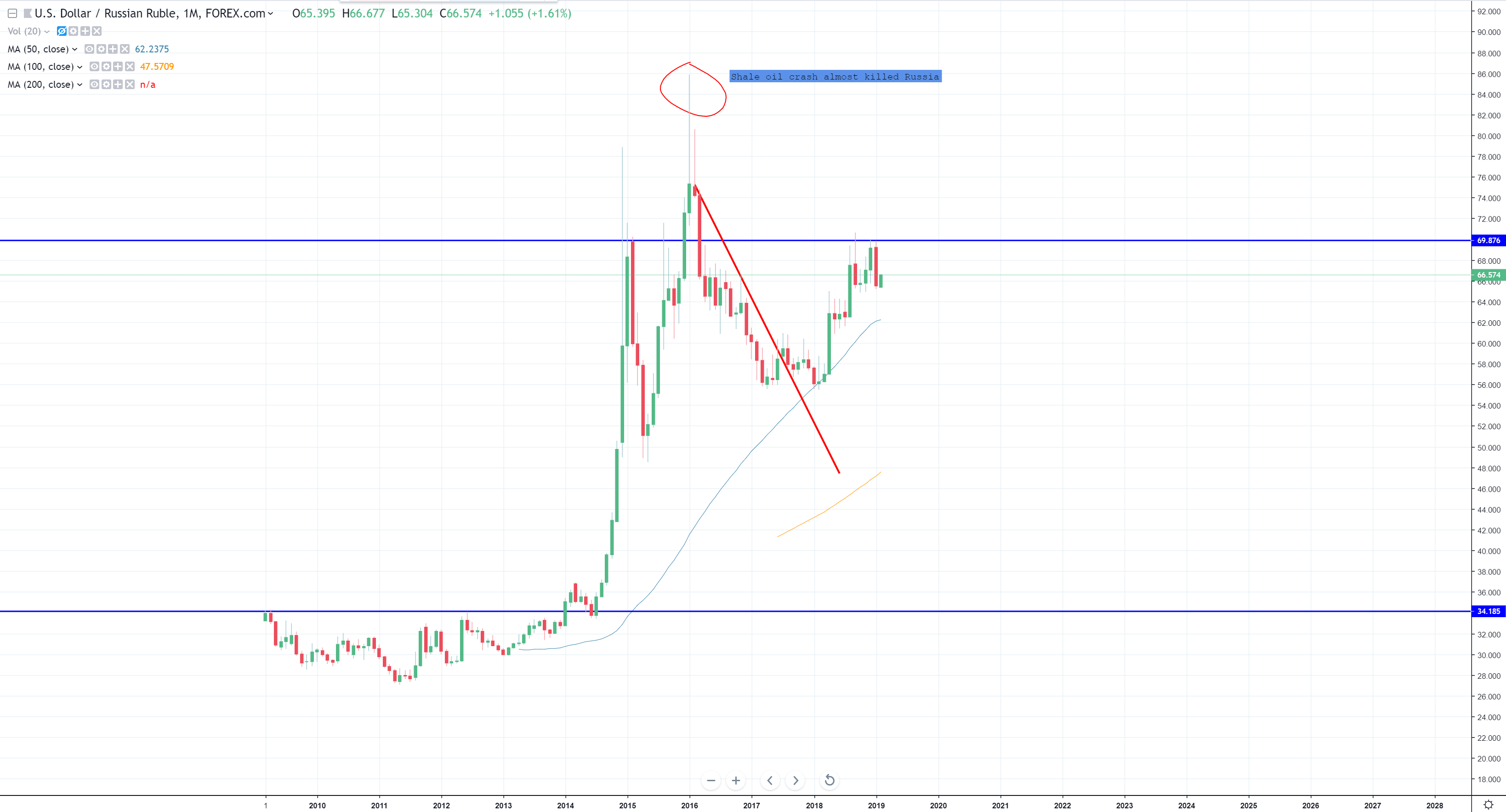

USDRUB – going slowly higher. 2015 shale oil crash almost bankrupt the whole banking sector there and created huge inflation and panic. This country benefits only from oil & gas export. What will happen when economy turns down and oil will crash again due to lack of demand?

One of the key point of the final bubble deflation is raising interest rates as credit contracts. What does it mean? The debt is so huge that once credit starts to contract as demand falls of a cliff inflation picks up, DXY should go parabolic and economy which turns towards recession needs to raise rates to fight inflation which was created by deflationary bust (same time lowering rates in US and more QE won’t be sufficient enough to weaken the $)

What will happen later? Who knows for now, but history tells more QE won’t solve the problem. I think we might have an impulse wave to crash DXY a moment with QE4 but it won’t help for a long time as economy needs to clean and FED can’t print 250T$. All we know from economy cycle is the fact that after deflatinary spike which will spread inflation around the globe forcing people to make bank runs. The same time US Corporations will be suffering from huge earnings recession and probably most of the zombie companies will be forced to go bust as well. Later some scary event will force us to find a new solution to switch to probably socialism and full inflationary environment which will last for next 50Ys.?

Deficits are raising, economy is slowing US needs to extend its power by all options. Who will pay for next 10T$ deficits? I don’t know, but if I were US Government I would have forced EU Banks to collapse create a big deflation and force other nations to go back to their own currencies which should have been backed by USD. Another 10T$ deficits approved, but that will just be enough fuel for the dead cat bounce on USD which at the end will end like all currencies. Imagine 250T$ is blowing up, it’s just a matter of Deutsche Bank which is now to big to be bailed out. Imagine DXY to reach 160 point and just think if you are prepared if that opportunity will occur. Banks will be trying hard (I hope so) to counter the crisis, but we all know they don’t have enough ammo to fight the next one crisis. If you think PPT and FED will prop it up till infinity? No they don’t have such big power to fight against credit contraction which force global consumption to drop. Any Central Bank won’t be able to force Mr. Smith who lost his job to buy more houses and more cars.

Once the $ will spike up to “infinity” that probably will be best moment to buy gold, but as Kondratiew Winter occur best allocation class is still :

Physical cash (reserve currency)

Physical gold

So you can spend your money at the bottom do buy cheap assets during deflationary spike, when inflation will start to kick in.

What might happen? Here we go :

Or better :

Cyprus Financial Crisis (no money on ATMs and closed banks are something normal. Only CASH)

Or like in Iceland in 2008 where people lost all their money.

We need to be really careful, because if system is having too much debt and can’t take more this shot will surprise a lot of people