Is Japan entering a sovereign debt crisis?

May 10, 2025

It’s time to ask this question for the first time. Is Japan done?

In reality I raised the question about it in 2020, where I claimed, BoJ lost the game, they just don’t know about it yet.

Japan is really imporant nation for the world, not because of their economy but because of their currency. It’s the Yen that is moving the stocks in some kind of indirect way, as the whole world is running on the carry trade strategies.

Time was flying and BoJ still didn’t get the memo, they lost the game. Maybe they did but couldn’t admit their failure.

Everybody was shocked, but in reality BoJ lost the game in 2020.

But the situation started to get even worse :

To bust its bond market even more :

To prepare to go higher :

To finally reach this :

So initially this collapse of the bond market exacerbated JPY collapse (USDJPY going higher) which was super bullish for stocks, but suddenly when USDJPY hit 160 rapidly raising long end rates started to put big pressure on USDJPY pair and had to cancel the collapse of JPY.

As you see I put my thesis that USDJPY shaping TLT value. USDJPY hit 160 in June/July 2024, while in October 2023 TLT hit 82$. It’s not exactly 1:1, but if we put TLT and inverted USDJPY you see more or less it works :

And this collapse of USDJPY to 300 would be super bullish for stocks, but the same time USDJPY hit 160 resistance SPX hit its 1929-2000 trend line :

USDJPY = 160 resistance :

You clearly see black trend line on USDJPY with 112 (and blue (M)MA200 is around this level too) which is a base case for a typical retest.

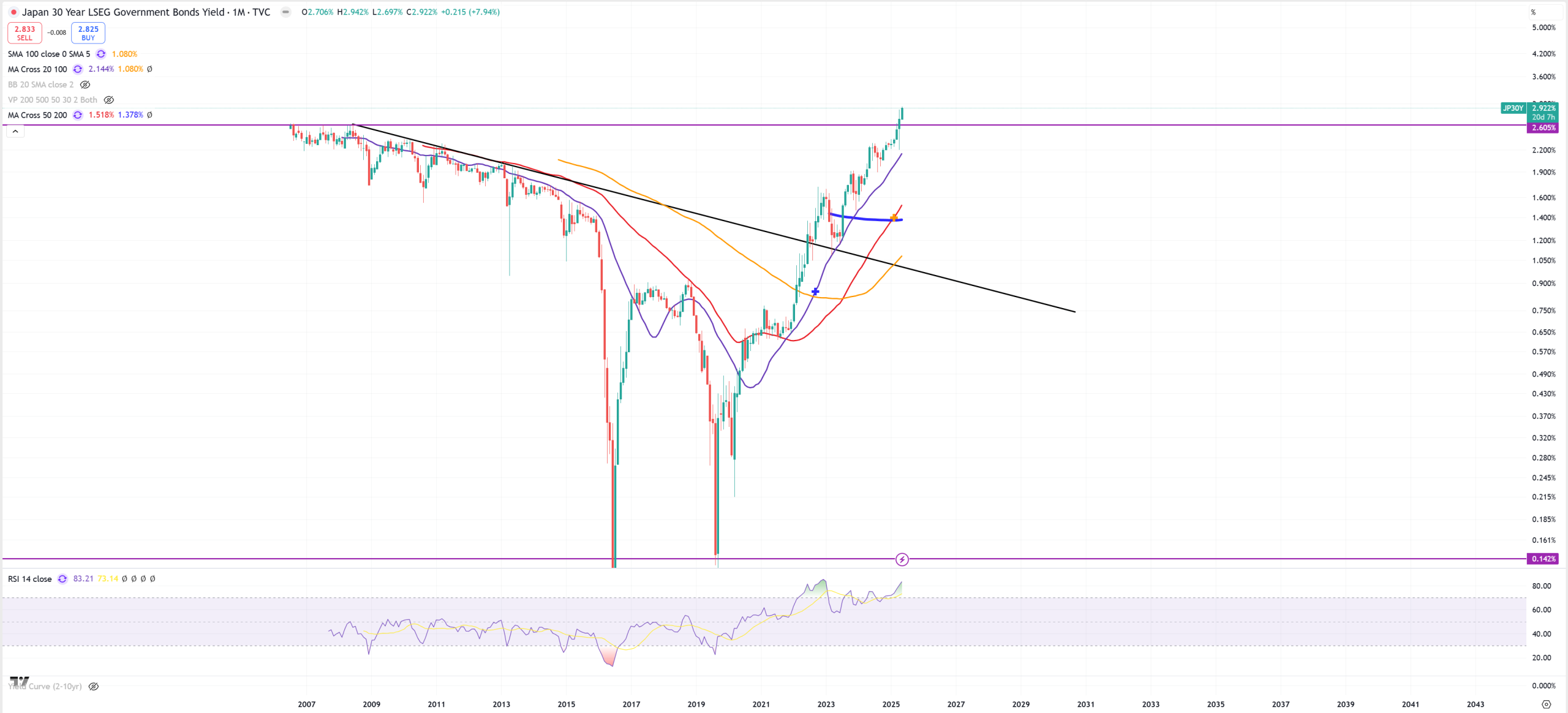

JP30Y – breaking big level :

USDJPY should go lower because JP30Y is going bust telling us that Japan is entering a death spiral.

Long end just does not believe more debt will bring any growth in Japan, so it’s repricing payback of the old debt sending long end yields towards infinity. That’s how we can interpret this behavior without going back into worthless financial specific gibberish.

And in reality I can’t find a better summary of it what SightBringer said. Japan can’t go back to NIRP and can’t really do QE as tensions around monetary system is growing. Looks like G7 countries will soon act like OPEC countries = “I don’t care about others”.

As I’ve said many times, secular disinflationary cycle progressing using inflationary spikes. The more you try to avoid it the bigger the offset will be in demographics, and collapsed demographics is the massive deflation. Japanese break of JP30Y is a sign, just like SP500 hitting 1929-2000 trend. Those two signs are combined of course. That all comes with NIKKEI225 hitting 1990 top and now retesting (M)MA20 :

We need to mention here China too :

CNHJPY – Chinese Yuan is about to lose vs JPY if this pair move lower. We have multiple top with a false break.

In both 2015 and 2022, Chinese stock market tanked heavily once this pair moved lower :