Why in 2008 we did not enter into a bigger crisis – technical analysis of this moment

November 10, 2025

Technical charts first – events (which you can’t predict) to confirm those charts will arrive later, so stop predicting events and start analysing charts

That’s my key motto.

Today we’re going to see why 2008 did not push global economy into bigger problems and how bond market knew about tools like QE. We’re also take this interpretation into 2025.

My observation needs to be as easy and simple as possible. We need to answer using 4 key charts what’ll happen in the next crisis.

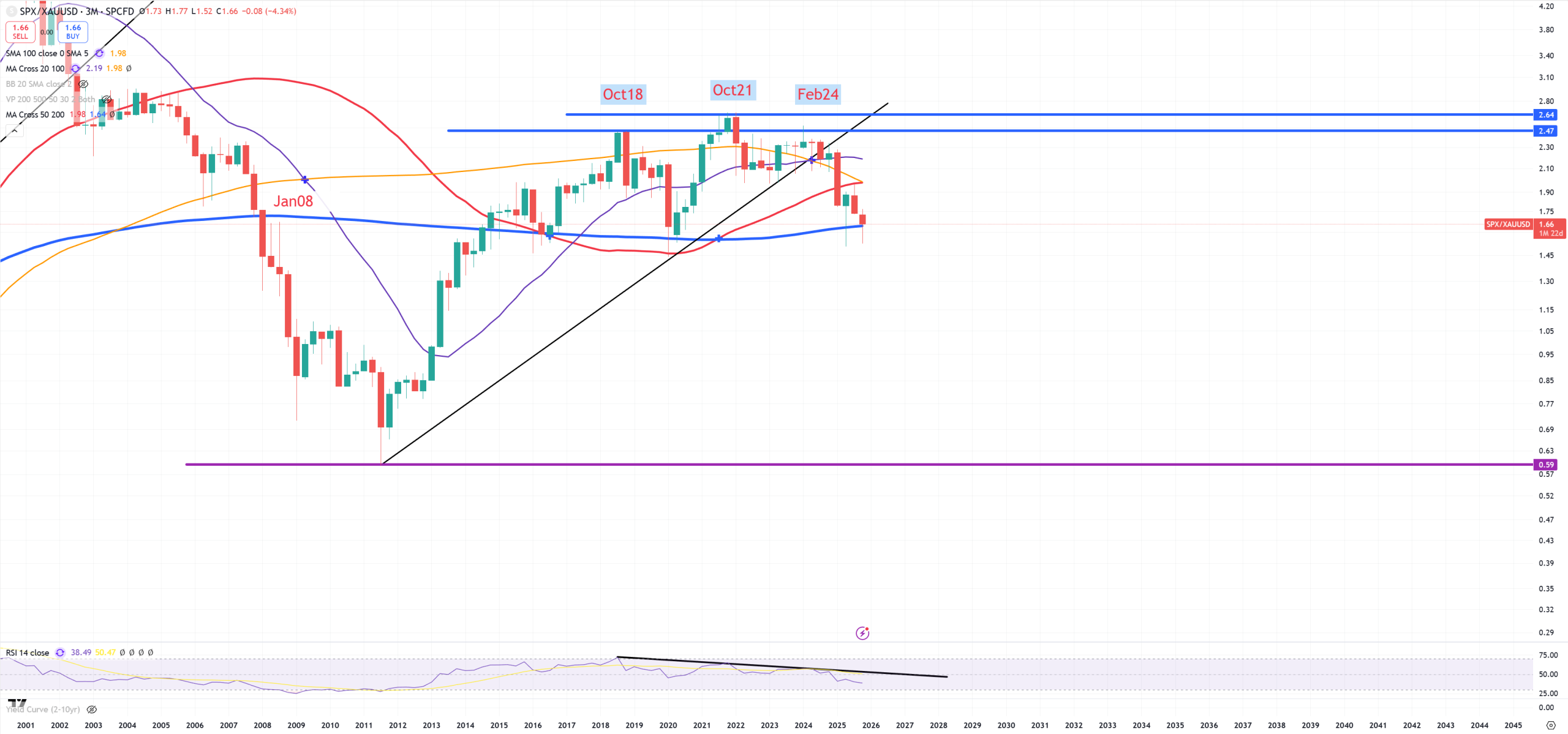

DJI/GOLD plunging below (3M)MA200 in Jan 2008. My observation is : (3M)MA200 is the KEY Moving Average that points to troubles in DJI/GOLD and SPX/GOLD ratios.

SPX/GOLD also plunging below (3M)MA200 – also in Jan 2008

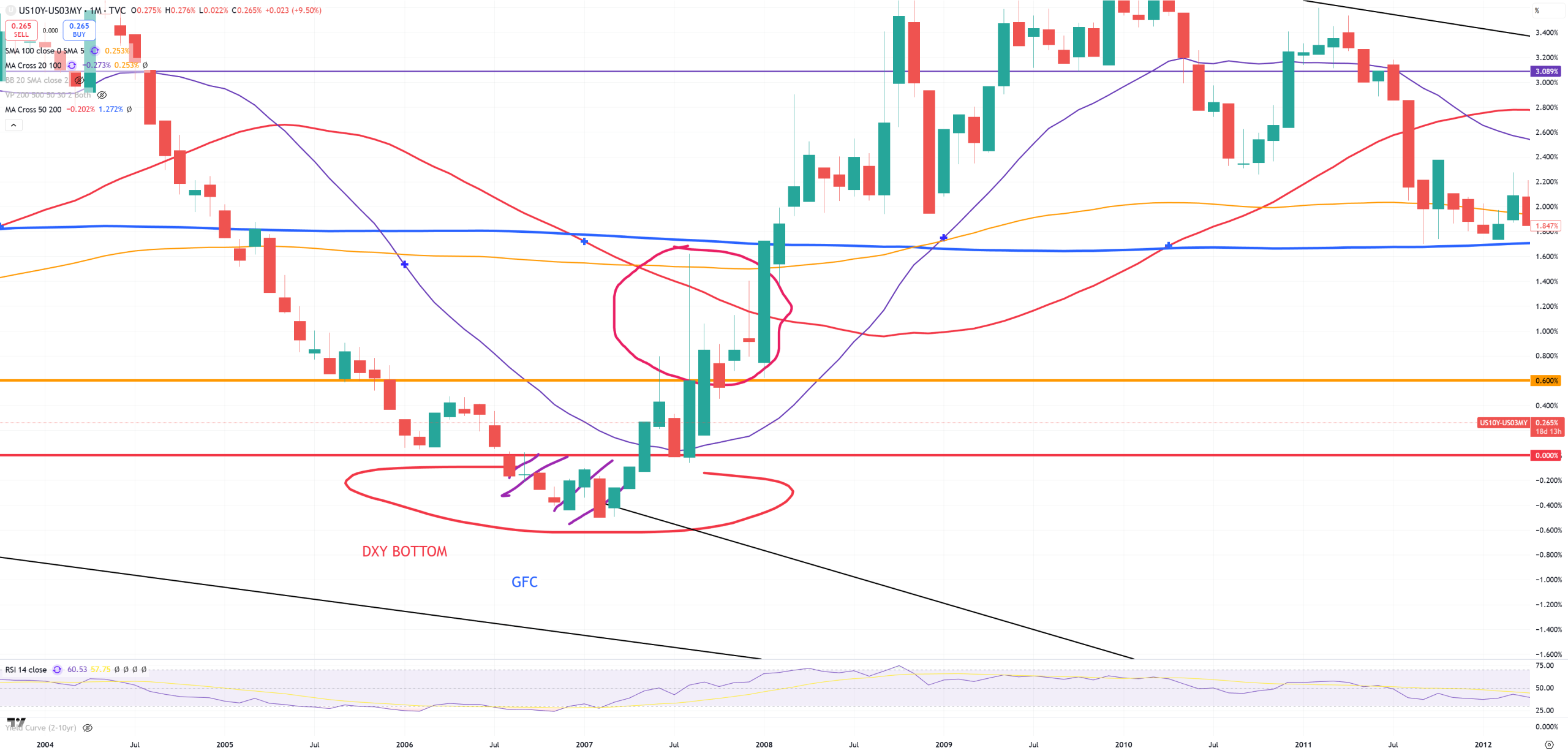

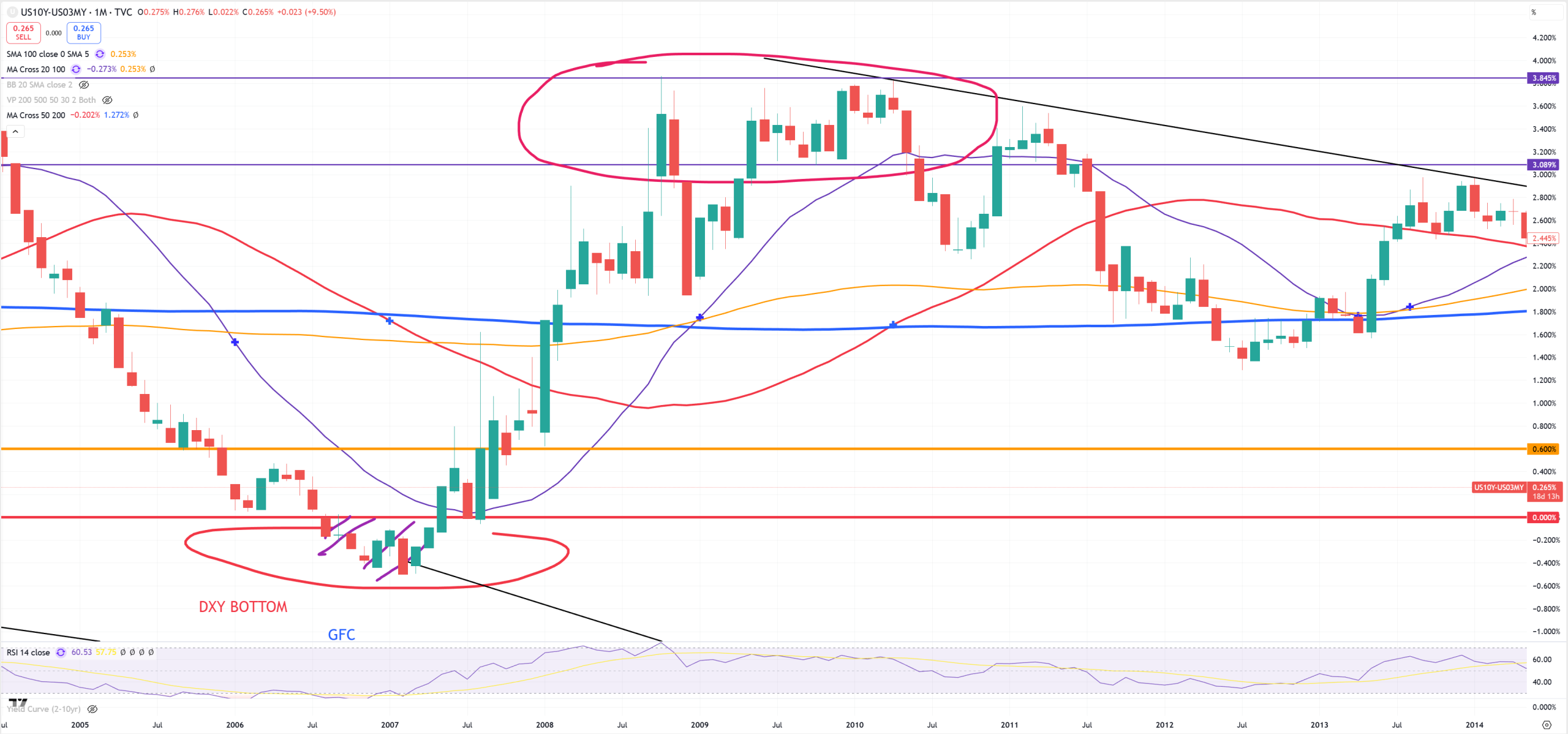

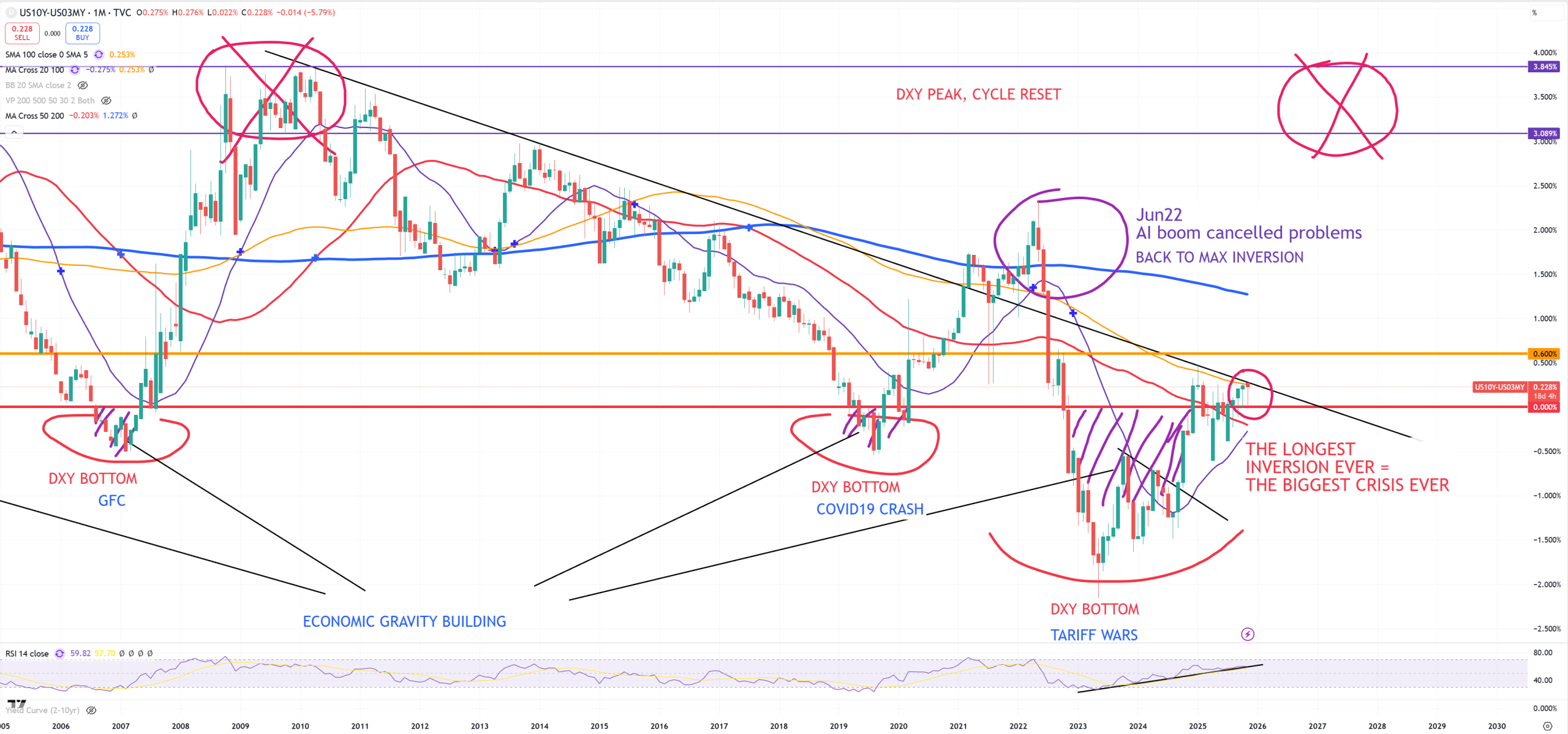

10Y/3M started to uninvert blowing up +60bps post inversion. We passed +60bps in September 2007 and break red (M)MA50 in January 2008 = bad things are ahead of us.

US03MY – we broke red (M)MA50 on the beginning of November 2007. My observation is : (M)MA50 is the key Moving Average that points to troubles, but in a combination with uninverting 10Y/3M.

SPX – additionally SP500 did double top with 2000 peak

Comparing 10Y/3M vs DJI/GOLD ratio

During the bottom in 2009 we see 10Y/3M reaching > 350bps post inversion = cycle bottom. It was banging to this 350bps level till April 2010 = bad things are behind us and only good things will happen.

While DJI/GOLD just reached 5.72 around 1 year later after 10Y/3M peaked (April 2010) and started flattening from +350bps.

I personally think this DJI/GOLD ratio will hit 1932-1980 trend, it means DJI/GOLD will hit 0.5, but as you saw in 2009, 10Y/3M reaching +350bps pointed us for a reversal in economic cycle

How in looks today? You all know because I’ve been banging those charts all the time

DJI/GOLD and (3M)MA200 broken in Jan 2025

SPX/GOLD and (3M)MA200 NOT BROKEN – In all cases those 2 ratios were always covered 1:1 during 1931, 1937, 1973, 2008 breaks down (So SPX/GOLD break = DJI/GOLD break), but not in 2025

US03MY – broke (M)MA50 in October 2025 and November 2025 is now below (M)MA50 (so far).

And the key question, where will be DJI/GOLD when 10Y/3M will hit 350bps? On 0.5 or higher? Because if higher we’ll get another recovery cycle.

But so far not much happened. SPX/GOLD has not broken (3M)MA200, 10Y/3M has not crossed +60bps. It might of course change very quickly because my main observation is everything aligns to US03MY (M)MA50 break fast.