Crypto on the edge of its first technical bear market ever recorded. Was a time for crypto, now time for gold and silver.

January 20, 2026

All charts and their alignments must be closed. While I described the key setup here :

If you haven’t read this, I encourage you – it’s really short, but you’ll get an idea how I interpret market cycles and pointing for big moments.

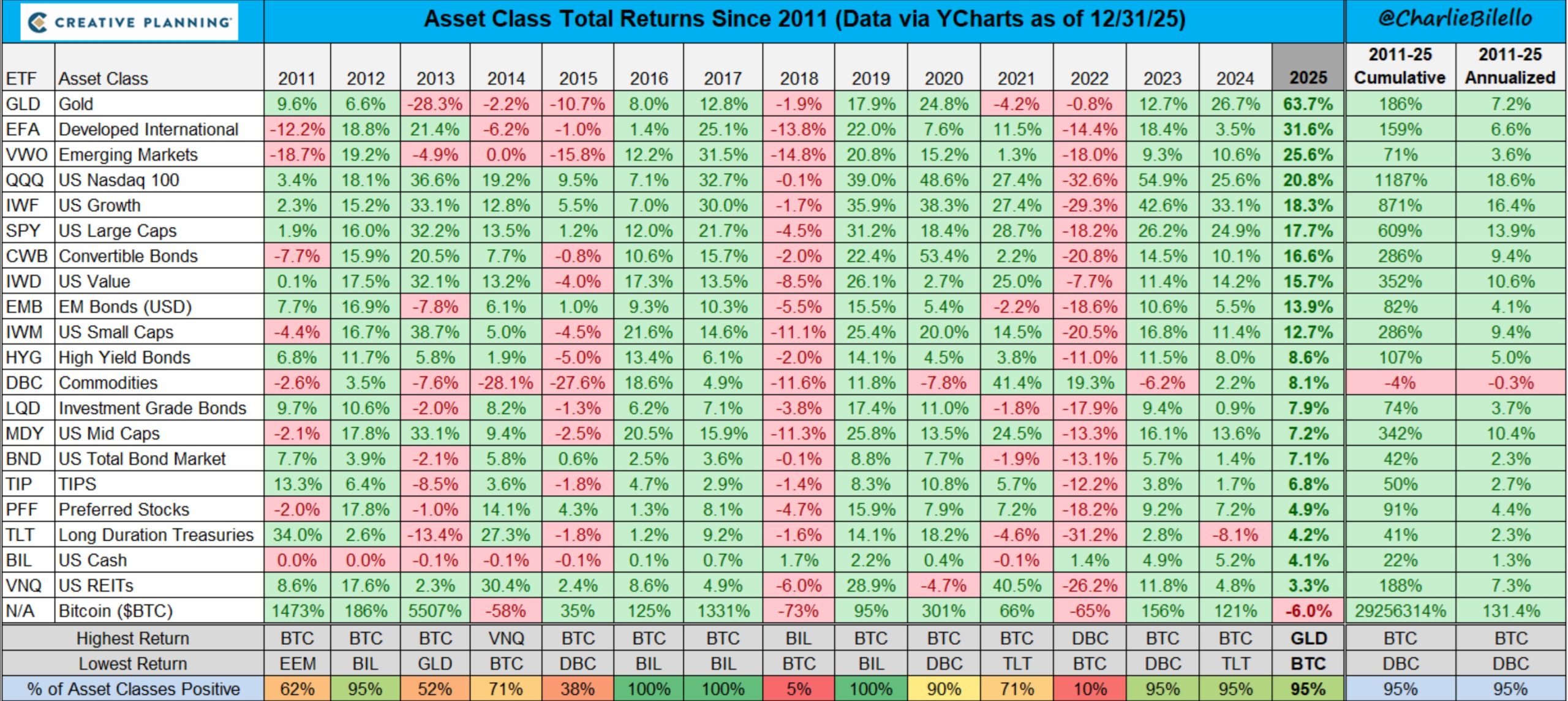

In one point I shared my view why crypto is on the edge of its first technical bear market ever. Maybe 2025 results were some kind of a prediction. @CharlieBilello as usual posted o X the summary of each year. What is surprising is the pair “Highest Return” vs “Lowest Return” which has not happened in a history, but it might give us a hint what’ll happen.

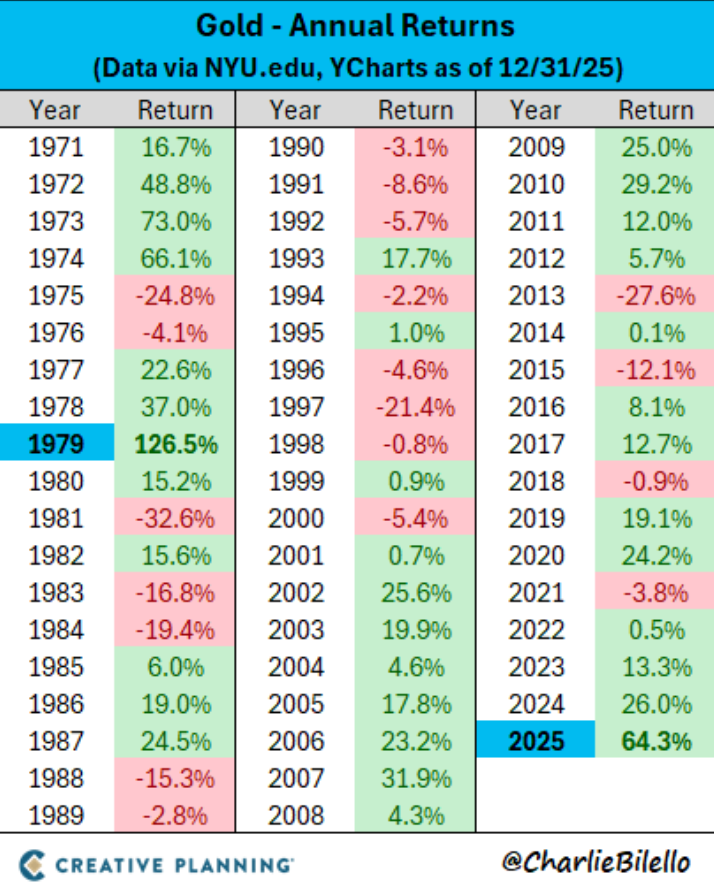

1980 was the last year of “secular downturn – cycle transition towards disinflationary cycle”. Took 14 years, starting 1966.

In 1973 SPX/GOLD & DJI/GOLD broke (3M)MA200 confirming “closing all the doors” to execute transition to new cycle. That’s what happened in 2025 too.

Is GOLD surprising? Not at all and I think that’s still not the end of gold going up :

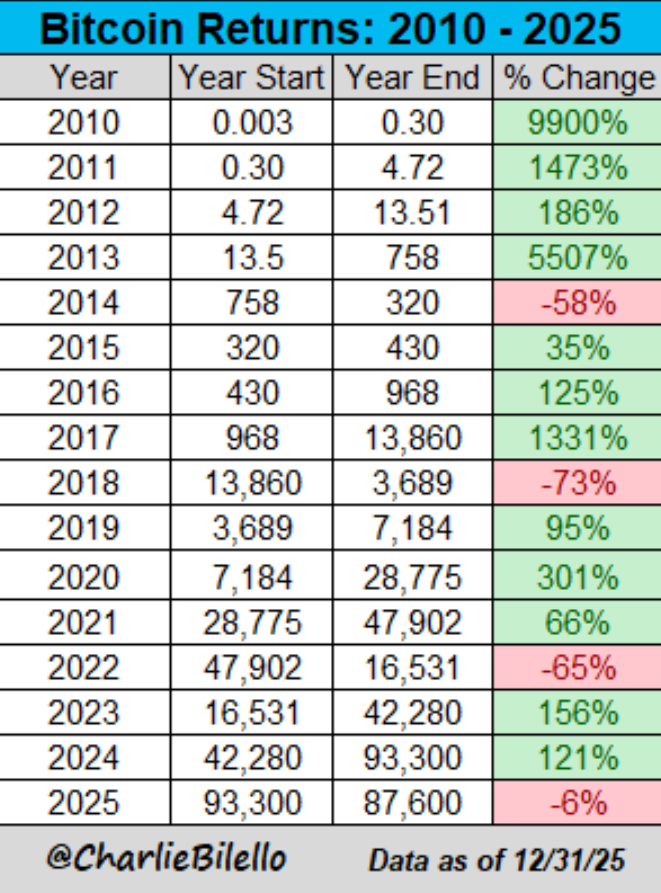

Now let’s take a look on BTC returns :

2014, 2018, 2022 was just a correction in the same mega super bull market.

Time to finally look on the charts

BTC/GOLD and key levels (W)MA200 & (M)MA50

Very rare to see (M)MA50 higher than (W)MA200, but let’s start from the red (M)MA50 – a natural border between technical bull & bear. Big moment in January 2026

blue (W)MA200 – a little bit lower, but also a big moment.

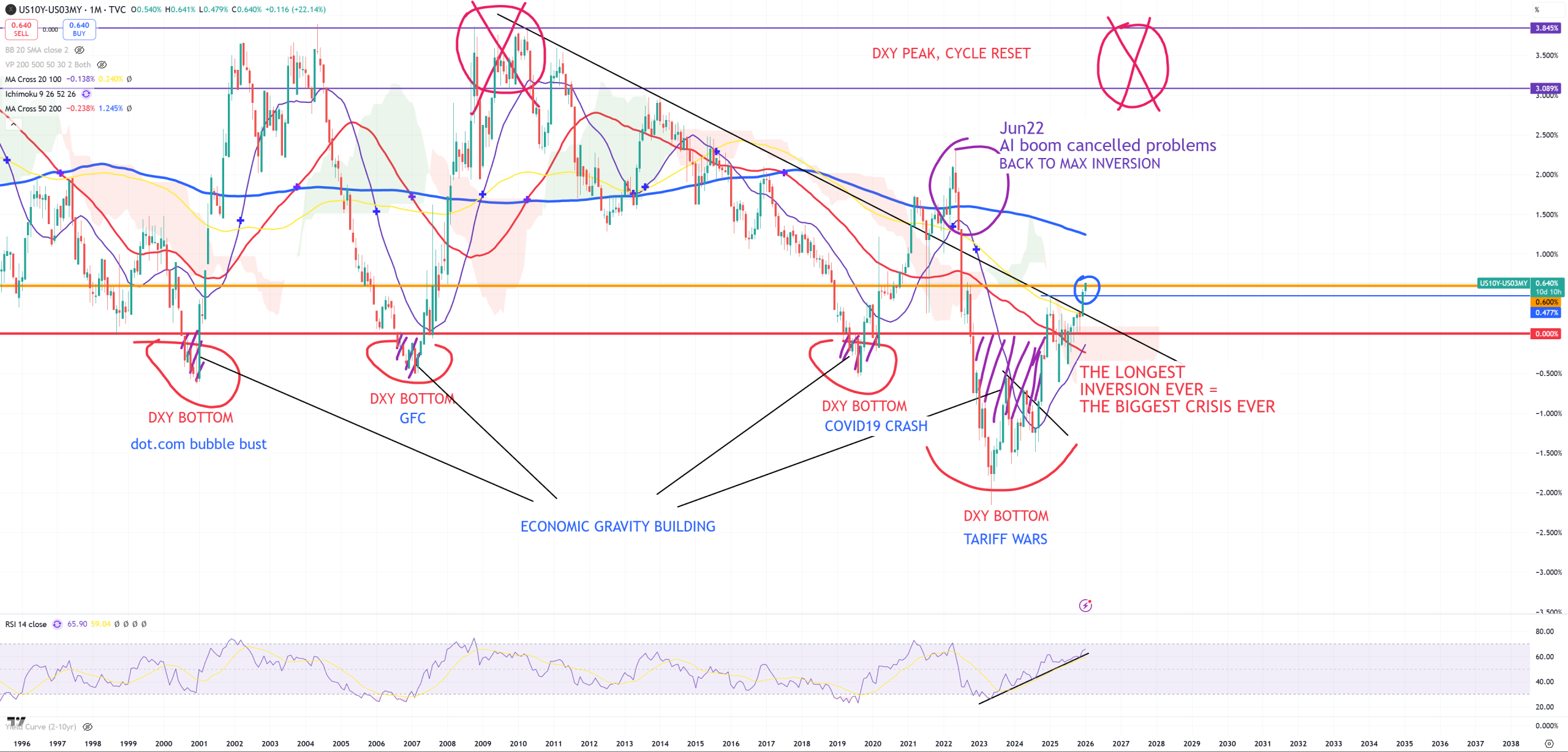

Considering 10y/3m finally breaks +60bps post inversion it’s got very high chances to break those MA and open the first ever true technical bear market for BTC, and probably another try for stocks bear market, as last try was saved around 2022.

10y/3m closes according to my model stock market.Together with US03MY breaking (M)MA50, breaking +60bps after inversion is a done deal unless this time is different?

Cycle indicators (DJI/GOLD & SPX/GOLD) have closed the doors some time ago.