This is the final call for the Yuan

January 5, 2026

This is a kind of continuation of this topic. Taking some assumptions created by technical junctions from topic blow, I’ll try to find a dependency on the 2nd economy in the world. If you haven’t read this topic you won’t understand what I’m taking about now.

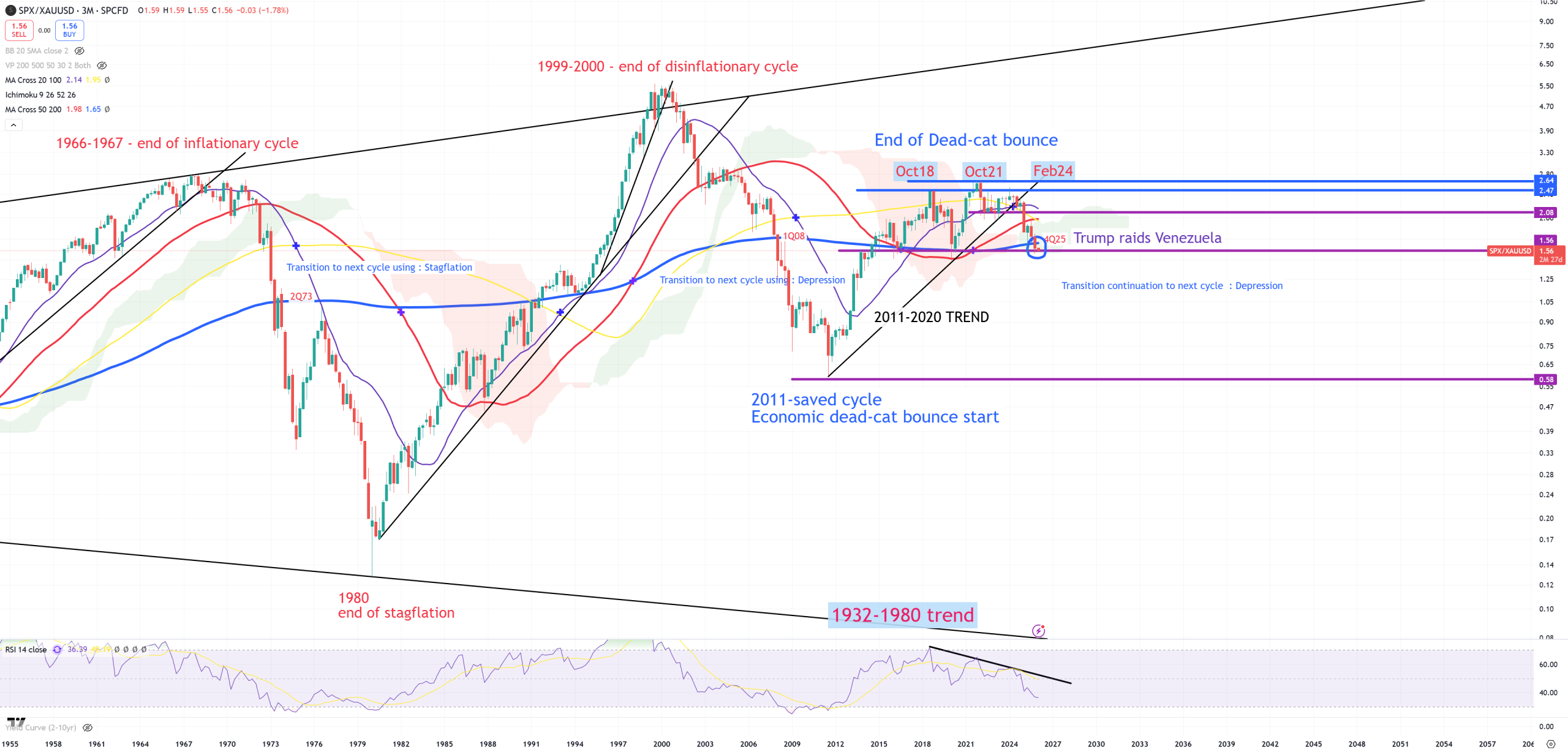

China is shocked what Trump did. A moment ago Russia + China was calling USA a falling power, but now they are both in a corner. Look when this situation has been changed – when both cycle indicators DJI/GOLD and SPX/GOLD have officially closed the doors for the 5th time in 100Ys.

The power of the $$$ is the weakness of the Yuan

That’s my statement. Even more – you only trade 2 assets – Yuan or $$$ and rest is a derivative of this trade these days. When USDCNH goes down = $$$ going down and when USDCNH goes up = $$$ goes up.

Yuan is probably more important in global economy these days than $$$ – because it’s China that leads this secular disinflationary cycle. Thanks to Chinese manufacturing we have rates falling, but what’s next?

Just like I was waiting THE MOST for SPX/GOLD breaking (3M)MA200 in 2025 I was asking myself all the time on which support/MA USDCNH will stop, especially if we consider last possible DXY support around 96.5 and the lowest trend around 98 :

DXY on (3M) view

To be honest I though initially that around 1Q25 everything will be done. This DXY support around 102-103 will be hold as DJI/GOLD was breaking (3M)MA200 the same time, but that’s the weirdest cycle ever and it wasn’t so simple, because the same time SPX/GOLD decided not to confirm DJI/GOLD (3M)MA200 break until 4Q25.

Now we have a confirmation from both cycle indicators and a question where USDCNH stopped. Stock markets really hates USDCNH going up but love USDCNH going down.

USDCNH : Below it’s 3M view. So let’s see all support / MA levels.

So just like DJI/GOLD broke (3M)MA200 in 1Q25 there was a spike of USDCNH around 7.37 but nothing happened, this resistance 7.36 still holds. We moved down to another support 7.20 and another support 6.78 which is (3M)MA20 and bottom in Ichmoku cloud.

On (M) it managed to blow (M)MA50 a bit to hold 6.97 support, lower (M)MA100 is 6.88

Looking on FXI : I think this 42$ is the last possible moment to reverse placing this rally as a “bear market rally”. Just like 6.78 is last support for USDCNH, this 42$ is last resistance for FXI.

And my observation is : markets in current times always going towards their last possible technical level. Blue (M)MA200 is secular bear market and soon we’re going to get an answer if this blue (M)MA200 break was just to touch its last resistance or maybe not.

Look how technical charts align towards SPX/GOLD, DJI/GOLD, US03MY and soon probably 10Y/3M uninversion.

Anyway, after last cycle indicator SPX/GOLD collapse, it’s really fair to ask a question what is the real value of Yuan.

This 1Q25 “on the watch” topic below has so far not materialized, because SPX/GOLD did not confirm the break. Now it did since 4Q25. So this delay between 1Q25 (DJI/GOLD cycle indicator collapse) and 4Q25 (SPX/GOLD cycle indicator collapse) allowed $$$ to drop and forced market to rally. And again this is the first time ever those 2 cycle indicators broke (3M)MA200 with so big difference.