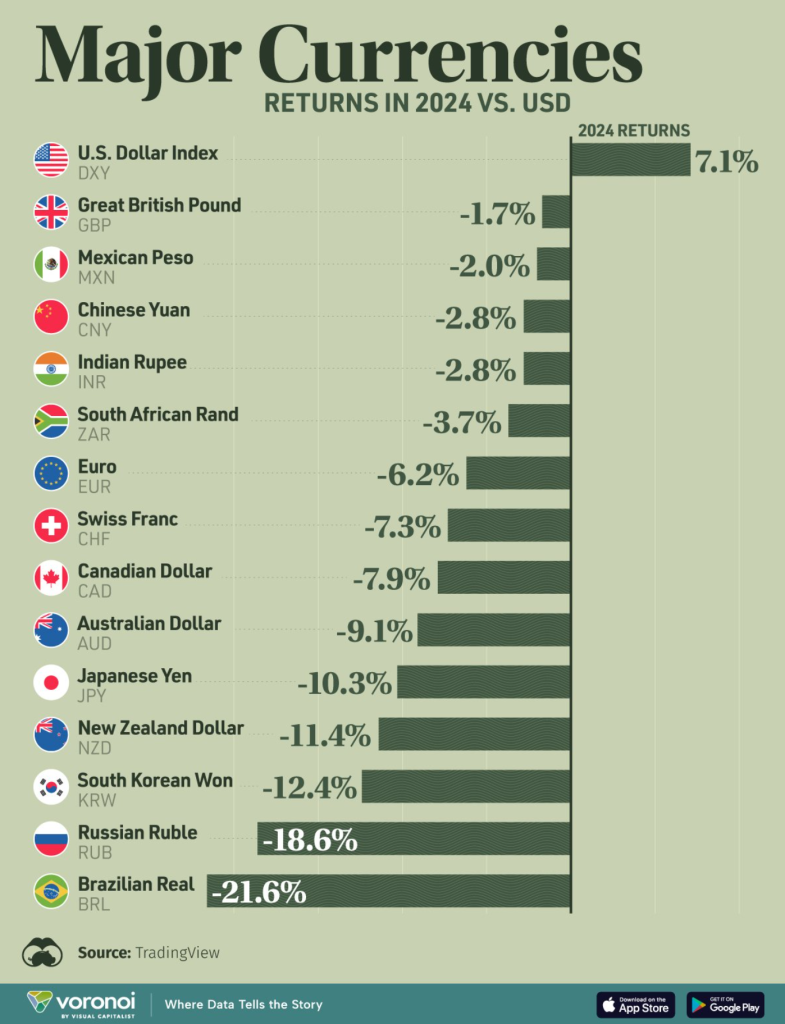

$$$ breaking, rest of the currencies are tanking. Yuan on the watch

January 8, 2025

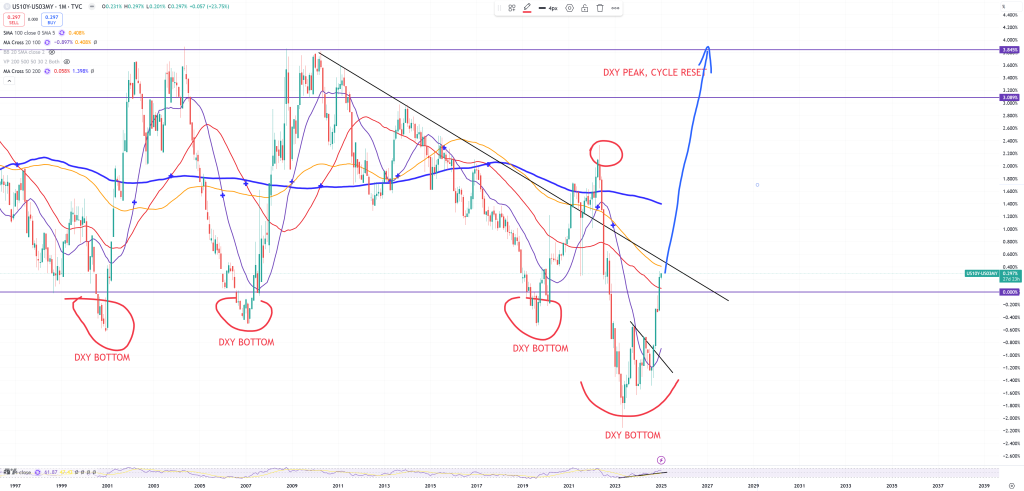

I must admit MMT was never on my bingo card. Post 2020 crash, I was expecting some kind of dead-cat bounce, some retests to take everything down, but suddenly MMT came in and changed the whole view also taking yield-curve back down to inversion and keeping 10y/3m for the longest period recorded up to almost 800 days.

So finally DXY is reaching around 110, while Yuan getting towards critical 7.36 level and 10y/3m moved just a bit to +35bps.

USDCNH and key 7.36-7.37 resistance

DXY – is running above key support 100-103 back above 2011 key trend, after 2 false breaks mostly connected with : direct stimulus checks and infinite Chinese stimulus. Both failed to tap the $$$ what isn’t really surprising.

Just look on the basic math here. In 2022 DXY reached 115 (red circle) when 10y/3m was like +230bps, now it’s 110 and 10y/3m is almost 10 times less +29bps. It’s considered new cycle begins when 10y/3m runs > 350bps. As you see here, since 2009 we have never had cycle reset = we have never had a bear market, as 10y/3m has not touched levels above +300bps.

To confirm above’s thesis you can take a look on SPX and key red (M)MA50 which is a typical natural border between bull/bear. SPX has never breached this MA since its 2011 break, but it hit perfectly trend line on 1929 and 2000 peaks.

Chinese ETF : FXI rejecting (M)MA50 and considering yield-curve uninversion and the fact that China and Hong-Kong are still two key main bear markets, rejecting (M)MA50 often leads to crash.

Situation isn’t better around EWH so Hong-Kong is also plunging. My old bet saying USDHKD must give up on the upcoming yield-curve uninversion to full cycle reset (10y/3m > +350bps).

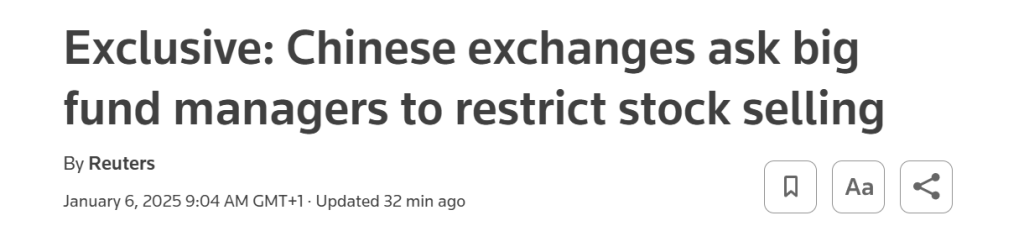

China is begging the market, but the gravity is doing its own job :

Bond yields in China have gone in a kind of inverted exponential pattern. (M)RSI is just 15. The big question is why yields can go up from here in China.

Economy is going to recover … or … trust in Yuan is going to crater after years of false data and mismanaging the economy by CCP. This’ll put China in a Great Depression 2.0 (similar to US between 1929-1932) which I expect since some time if you follow me long enough.

Conclusion : Buying time by all those “money printing mechanisms” has enormous consequences ending up by lifting $ to very high levels. Other currencies will be blowing up just way way faster.

Something we can see right now in 2024 and probably in 2025 it should speed up, unless they’ll find another way to push yield-curve back down, but so far both MMT and infinite stimulus in China failed what you can see on the DXY chart, how during those two events DXY was trying to break the 2011 trend but it failed :

The power of the $ is the weakness of the Yuan, so I expect a lot of Yuan weakness after 7.36 break which will send 10y/3m even higher.

[…] $$$ breaking, rest of the currencies are tanking. Yuan on the watch […]