Geopolitical US-Russia clash

April 5, 2022

Since years we are blaming Americans for bombing, striking innocent nations, often saying that the business of the USA is war. You have to live in another world or be a total economical and geopolitical ignorant if you really have no idea why USA from time to time bomb and discipline other nations. I’ll be far far away from my personal comments here, trying to write this article as much apolitical/unemotional as I can, trying to see view of 2 sides.

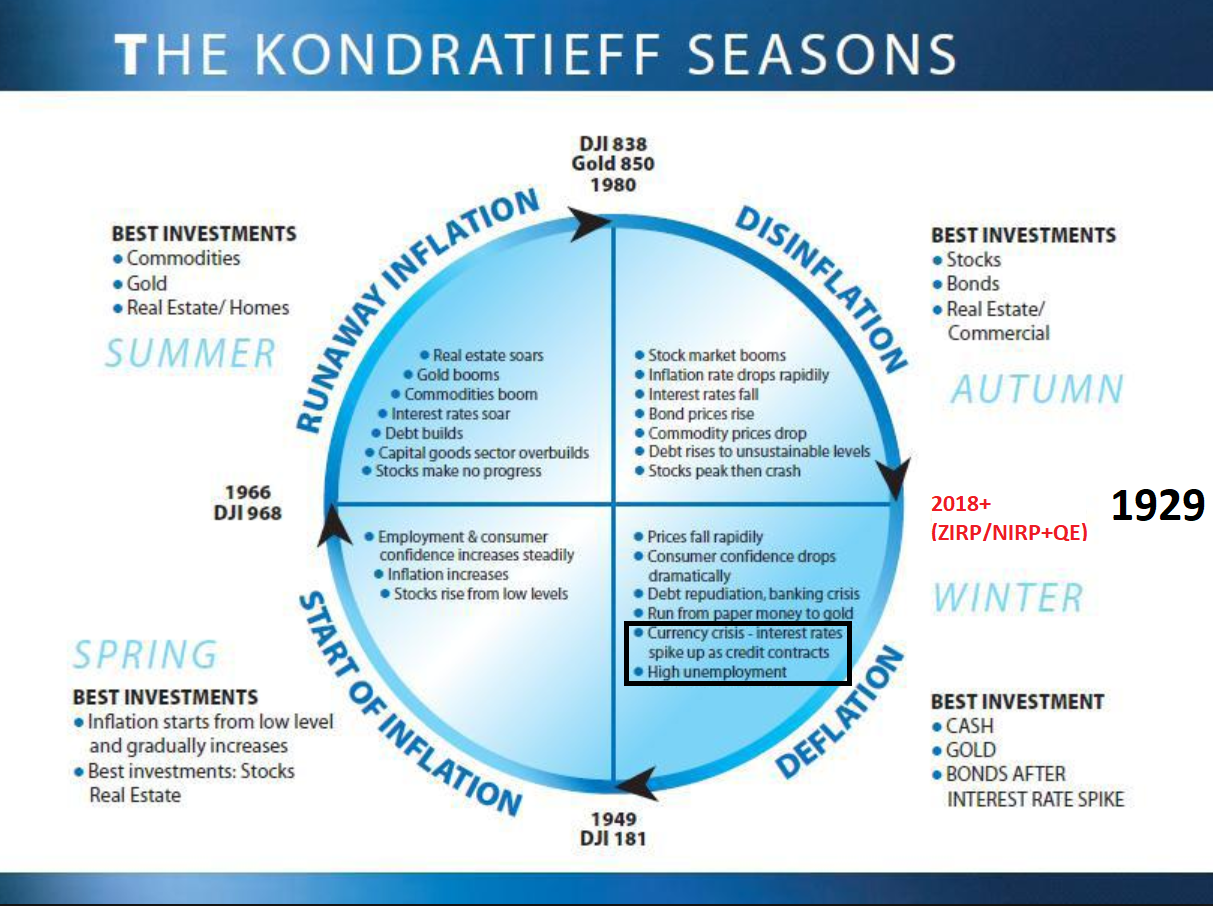

Reminder of Kondratiev cycle

Because I wrote about it so many times, I’ll just concentrate today just on one fact, where geopolitical issues kick in. Last time cold-war kicked in when the economy made a transtion from secular inflation to secular disinflation (“Runaway inflation” period). Now it’s the opposite. Economy launched a transferring mechanism from secular disinflation to secular inflation – that also leads to geopolitical clashes (“Deflation” period). To see the real power of the geopolitics we need asset deflation to progress, and as I’ve been saying :

Deflation during secular disinflationary cycle progressing using inflationary spikes

Geopolitical moves happen in Deflationary areas (WW2) and Runaway Inflationary areas (Cold War)

We live in 40Ys in disinflation a capitalism, clean the counter-producivity for 20Ys restoring middle class and 40Ys in inflationary period rebuilding productivity to kill down inflation.

Rest explanations about secular cycles you can get from my previous blog entries.

Introduction

While around 80-90% of this text is my own point of view and observation, 10-20% of some information are being taken and put together from various different texts, charts, interviews and other reliable sources. I’m trying to be as impartial as it is possible, showing the general geopolitical interest based on economical cycle and introduce my view on West, Russia and China, and their economical dependency.

I’ll introduce “freedom” as a key economical power builder, which allowed USA to build its hegemony and at the end I’ll try to show market technicals – which market points for a winner in this game?

Russian imperialism, multipolarity steps

Geopolitics is now more important than the economy and inflationary/deflationary pain. At least for some time until it’ll break the economy and the economy will become more important than geopolitics. Still so many people don’t even recognize there’s something called geopolitics. Geopolitical problems often come when big cycle changes.

Alexander Dugin – if you don’t know this guy you should better read about him. I call this guy the key ideologist standing behind Russian imperialism and geopolitical strategy. He’s been doing it since 90s and looks like Kremlin really loved Dugin’s theories and implemented it in their geopolitical imperial strategies.

For me (personally) this guy is just a bit crazy and not sticking to the 21st century reality, but I’ll talk about that later. This guy tries to find an answer on a hot topic – why USSR failed and broke apart, so Russia can rebuild its new imperial power trying to avoid mistakes which led to its collapse in 90s.

He splits power into 2 pieces and he thinks the power is allocated based ONLY on geographical regions.

So power #1 is based on :

- innovations

- capitalism

- technology

- consumerism

- free market

Power #2 is based on :

- military power

- dignity

- tradition

- religion

- family

- conservatism

- market based on national interests

Based on Dugin’s theory Ukraine stays in geographical power #2, so 2014 Euro-Maidan was considered by Dugin’s as an artificial try of the West (or better Power #1) to spread interests to the East, so automatically Putin took Crimea and Donbas to counter-balance it. Worth to be noticed that Dugin’s favorite geopolitic he loves to repeat is Zbigniew Brzezi?ski, national security advisor of president Carter’s administration and Polish immigrant, standing behind a strategy of USSR collapse.

Without Ukraine Russia isn’t any empire

Zbigniew Brzezinski

Fun fact is that the son of Zbigniew Brzezi?ski, Mark is today the US Ambassador in Poland, a country which took key responsibility for all refugees from Ukraine.

The West believes it’s the only one power in geopolitical game, Putin didn’t want to agree on that, so that’s why Ukraine was attacked to show the whole world is not unipolared based on the Western values, but according to Russia (and China as well) it’s multipolared, so the war on Ukraine isn’t about any commodity backed currency (that’ll come maybe later) but if you agree that the world isn’t really ruled only by the Western values. Even Lavrov confirms that thesis :

There’s also a big problem with Dugin’s approach. He just doesn’t see one key thing. Geopolitics isn’t the answer on everything like he claims. Last time USSR geopolitical strategies led to economical collapse, something Dugin forgets. His idea is to consider people as the non thinkable mass (something opposite what US claims, but something what China thinks too) and countries close to Russia can’t be independent just because geography doesn’t allow for that. Yes – you’re reading it write – all about geography according to Dugin. That’s why Putin went all in before invasion and wanted to move out NATO back to German borders. Now or never.

Russia says they’re defending their own values, but for me Russia really doesn’t have any values :

- Military power – we all exaggerated it what the West tend to do since WW2, especially if Dugin treats people like non-thinkable mass, the life of a human isn’t really worth 1$ for Russia, while most money on military spending seems to be simply stolen.

- Dignity – is leaving dead young soldiers on the battle-ground a dignity or killing civilians?

- Religion – in Russia is more hierarchical than the worst US corporation and at its top is … Vladimir Putin not really the God. Cyril I the leader of Russian Church is a close friend of Vladimir Putin (or the tsar).

Most of them are totally fake and Russia believes in them same time doing everything against them. The true power is being done using freedom and democracy so far considering history represented so far by the USA hegemony, something Ukraine understood after 2014.

Now take a look at top Russian oligarchs and their kids. Where they live? London, United States, Switzerland – everywhere but not in Russia. They just suck Russia from money and investing on the West what forces me to ask questions like :

If Russia’s values are so valid why most countries want to be under USA influence getting true economical power, so do Russian oligarchs moving their kids out of Russia?

Do you remember Poland transformation in late 80s, when it went under USA influence replacing Russian values towards freedom and democracy? Ukraine wants the same once from 2014 Ukrainians started moving to Poland to work bringing money back to Ukraine. Both countries in 90s started from the same level. I think it’s one of the best short films showing Polish transformation replacing Dugin’s Power #2 values towards Power #1. Took 30Ys.

Many don’t remember Anatoly Serdyukov – he was a minister of Russian Defence between 2007-2012. This guy really was interested in big deep reforms of Russian Army seeing all its problems, recognizing how not modern it is. Guess what happened. He was kicked out and replaced by Sergei Shoigu – master of PR which mostly allowed (that’s my personal opinion) the military budget to be stolen around Russian elites. That says a lot about political problems around Kremlin. An army of kleptocratic Yes men living on myths of WW2.

Even top Russian propagandists start seeing that it’s a failure. Just watch the second video from Strelkov. We’ll come later to some conclusions if this war was a silly decoy for Russia which entered into it with a strong believe it’s so easy.

General view US-Russia

There’s no doubt US leads the world, constant globalization which is an effect of growing capitalism (secular disinflation) requires from time to time confirmation who is the leader. The era of petrodolar still keeps going but many countries don’t like and would love to get rid of it. If you try you got a 95% chance US will arrive with its 800B$/Y spending U.S. Army which will knock to your door if you won’t really be disciplined here, so we can say the guarantee of the US supremacy is nothing more and nothing less just U.S. Army. Libia, Iraq, Syria – examples.

Russia would be a great US partner but only under pro-European leader like Navalny, I really know lots of Ukrainian people and some Russians. Western Ukrainians they felt the love to the Western culture and probably Russian people especially living in St.Petersburg or Moscow love the Western culture too. I asked some Ukrainian people who migrated to the West since 2014 after Crimea annexation what they think about the West-NATO. They mostly said – they changed their view, as during their primary school they were told West and NATO are just hunting on mother Russia (USSR) what now they see nothing from those things happening at all – yeah it was a shock for them, so the Western influence has started spreading towards Ukraine since 2014.

But, Russia got Putin. Putin always dreams about “Big Russia” thanks to Dugin. Together with his administration (all are his friends are boomers generation) dreams about his influence even towards Lisbon the end of Europe and restoring USSR power. He basically keeps treating Europe as his area of influence, trying to do everything to get his target and because he’s getting older he had to make a final move. Plan is simple – push US out from EU influence (Eastern Europe at the beginning), get Russian dominance, get technology and place new borders of influence.

Some people like Ukrainian adviser to the head of the office of the president of Ukraine predicted everything in 2019 very precisely – that wasn’t really hard if you knew how Russia thinks thanks to Dugin. They had some time to prepare Ukraine for the war, understanding the only one possibility to save their country is to get more towards the West with all pros and cons of it. If you ask me how Ukraine was moved to the West? The answer is – Crimea in 2014. Putin push Ukraine towards the West by himself thinking maybe he will cool down Ukraine and scare them. Western values are spreading because freedom/democracy is the top power no matter how big the West problems actually have. It’s so easy to read Russia as long as you follow Dugin.

Each year Putin was buying more part of Germany and France. His influence over far right parties was getting bigger and bigger. EU economy loved cheap commodities and ECB with ultra-super-cheap money added just a giantic fuel on big consumption style mostly in unproductive way, which benefited Russia too. Putin didn’t forget about his own nation, as an autocracy (if you rule for 20Ys+ it’s is an autocracy), you have to remove people’s rights blinding them with the Western culture – I’m not saying West isn’t doing the same, but so far on much much lower scale in general.

He was doing it slowly but methodically, the same type of strategy he was doing with foreign West countries. Addicting key EU economies more and more from cheap commodities raising through the years an army of ex-top-EU-politicians “yes men” who were getting huge amount of money from lobbying on Putin’s side. Putin was lobbing so much, nobody saw even his wars.

He is really good at those games, and I’ve never treated Putin as a mad man rather a strategic genious and it hasn’t changed. So as USA keeps trying to get their influence level in EU, Russia was trying everything to kick them out from it.

Democracy has one big advantage, when you change people in power regulary, they keep concentrating on different aspects of problems, in autocracy you won’t be able to see it, though you got stuck in one way of thinking only.

The information in democracy flows from the bottom to the top – so leaders can listen to the crowd. In autocracy information flows from top to the bottom – so you have no idea what people think in reality and you will be really surprised at the end.

US Army fights in the name of freedom – very easy to justify, Russian Army fights in the name of fake news delivered by Russian propaganda which just got confronted with the reality.

That’s how Putin IMO made some terrible mistakes which in autocracy often means death or … switching to North Korea and US felt the blood. I’m far far away from saying Ukraine will win or Russia will win the war, but I’m saying based on some facts (which aren’t surprising) that :

- There’s a big chaos in Russia – as an autocracy everybody was saying Putin what he wanted to listen – all is fine – I have no doubts about it, Russia is stunned what happened in Ukraine.

- Russian Army slowly realized they are not fighting in the name of “freedom”. That means the ultimate morale must go down, totally opposite to Ukrainian Army. You need to lie even more in that case.

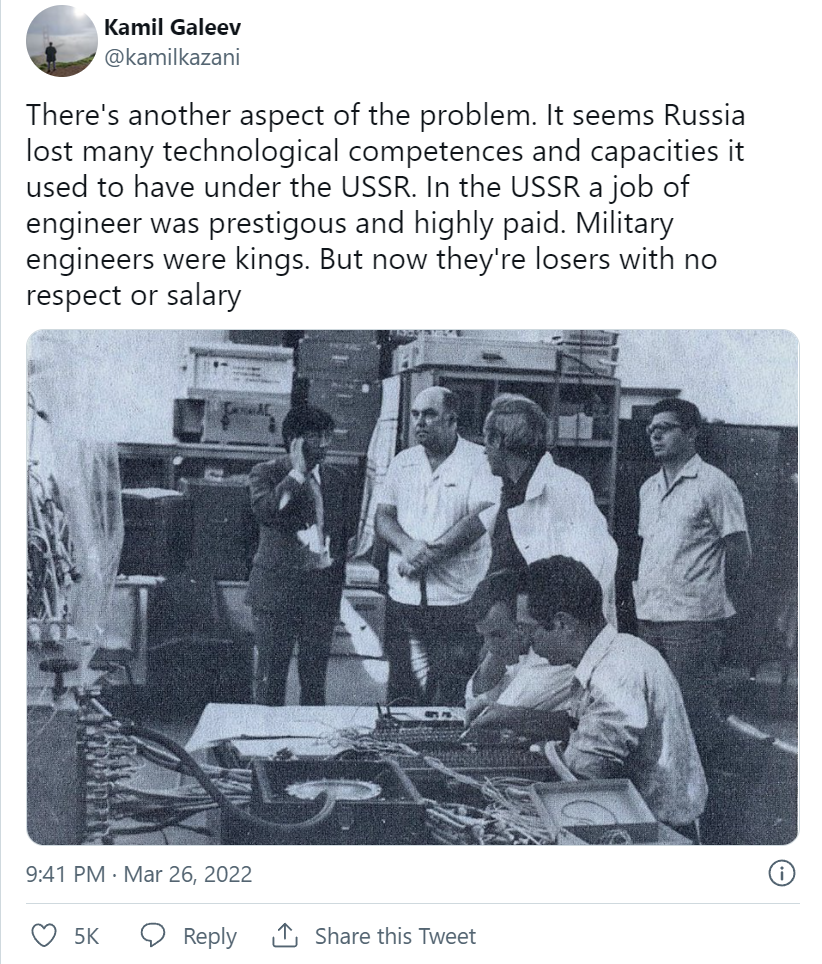

- From all those military screens we can clearly say Russian military budget was stolen and army got stuck in 1980.

- I analyzed lots of military officers in Russia and came to conclusion all of them are old grandpas which got stuck in 80s. Gap between Boomers & X is growing in Russia too.

- Putin needs some kind of victory to stop it, question if the USA seeing what’s going on will allow on that or will try to keep the war as long as possible.

- Cold war means big Russia’s turn towards China. China will never treat Russia like the West during last 30Ys. Russia will be vassalized and move back 30Ys in time, or even 50Ys back in time in the war will stay for us longer :

- Cold war means big escape of young, educated Russians towards the West. Oligarchs are also running away :

- Russia doesn’t even have one own company which can produce basic bearings required for transportation. All they have are western one now on sanctions.

- Russian military production was stopped after first wave of sanctions in 2014-2015 because almost everything required western technologies, same time Russia kicked out most of their top engineers back to the West while old one dying :

As a confirmation of my previous words who’s got right who’s wrong, bigger part of truth is on the Western side (no doubts). We can see how Putin cut “The Internet” or changed the law giving 15Ys inprisonment for saying different narration than Kremlin. My VPN provider even cut Russian entries explaining how Roskomnadzor wanted to control what’s flowing through VPN what was unacceptable.

Believe me, he wouldn’t have done it if he felt he’s strategically winning, instead of that he closed the country like North Korea and the West (mostly US) felt the geopolitical blood. Today Russia has the biggest sanctions ahead of Iran and North Korea, and as history says sanctions are not lifted very often. Even Cuba is sitting on sanctions from 1962 if I remember correctly.

Russia since some time claimed US starts to weaken – I really don’t agree with that, I’d prefer to say – Global economy starts to weaken – and when it happens some wars kick in everytime. I’m also far far away from saying it’s a full blown WW3.

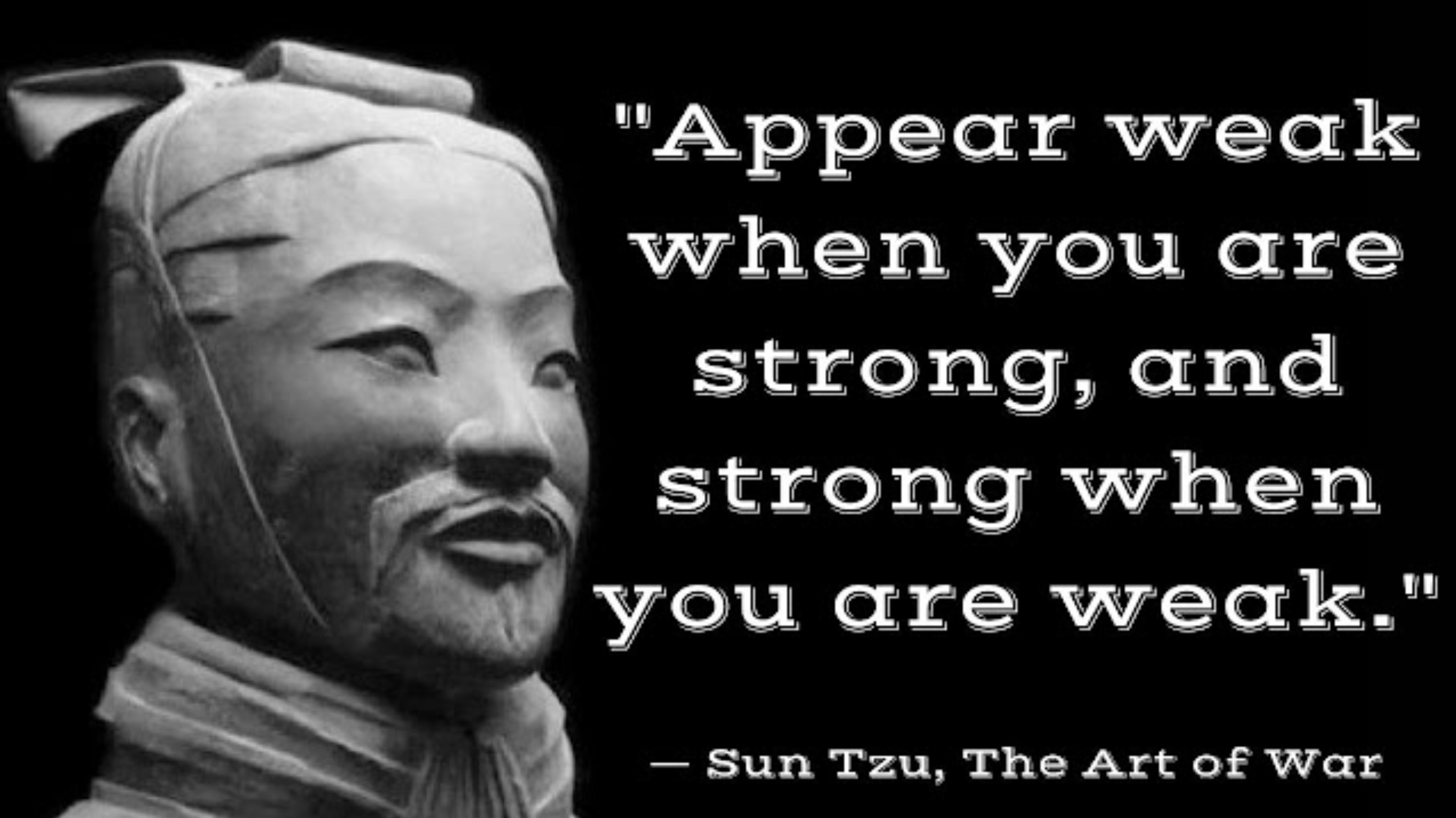

Now that’s really important. Today it’s really hard for me to say who provoked whom. I might risk a thesis US was just setting up a geopolitical trap on Russia (especially if Ukraine was fully aware in years ahead about Russian invasion), so they can really be sure about this fact they can easily jump into Ukraine and … got stuck which is in the best geopolitical interest of the USA and is in the worst geopolitical interest of Russia. USA wanted to feel weak. Withdrawing from Afghanistan, weak Biden, economical troubles – everything allowed Russia to believe Ukraine will be easy and the West will give up quickly. Economy is worth to be sacrificed in the name of geopolitics, because economical recovery requires innovation, freedom, entrepreneurship and demographics, most of which China and Russia don’t have.

I’m giving 25% it was planned by US and 75% it wasn’t planned, but for sure Putin felt it’s his moment asking for a new share of the geopolitical cake. Was so easy with Chechnya, Georgia, Ukraine part 1 in 2014, will be easy now.

Russian economy. The West needs Russia and Russia needs the West economically (but not geopolitically), China needs both.

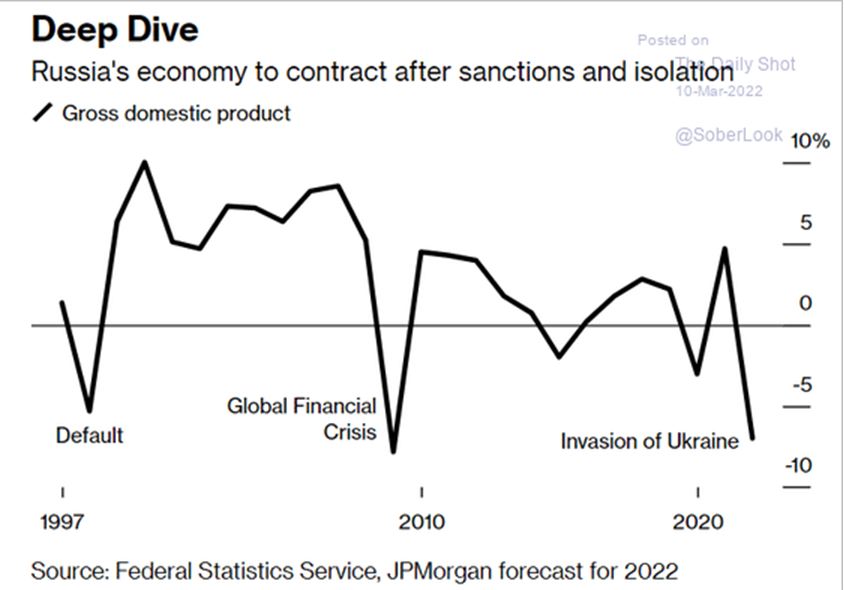

It looks like the cost for Russia (after 3 weeks) looks like this :

Longer term they might even moving back to 2005 year in terms of GDP that means -50% and it’s an epic 1929-1932 type of economical depression. Almost 20Ys of growth went poof in a very short time.

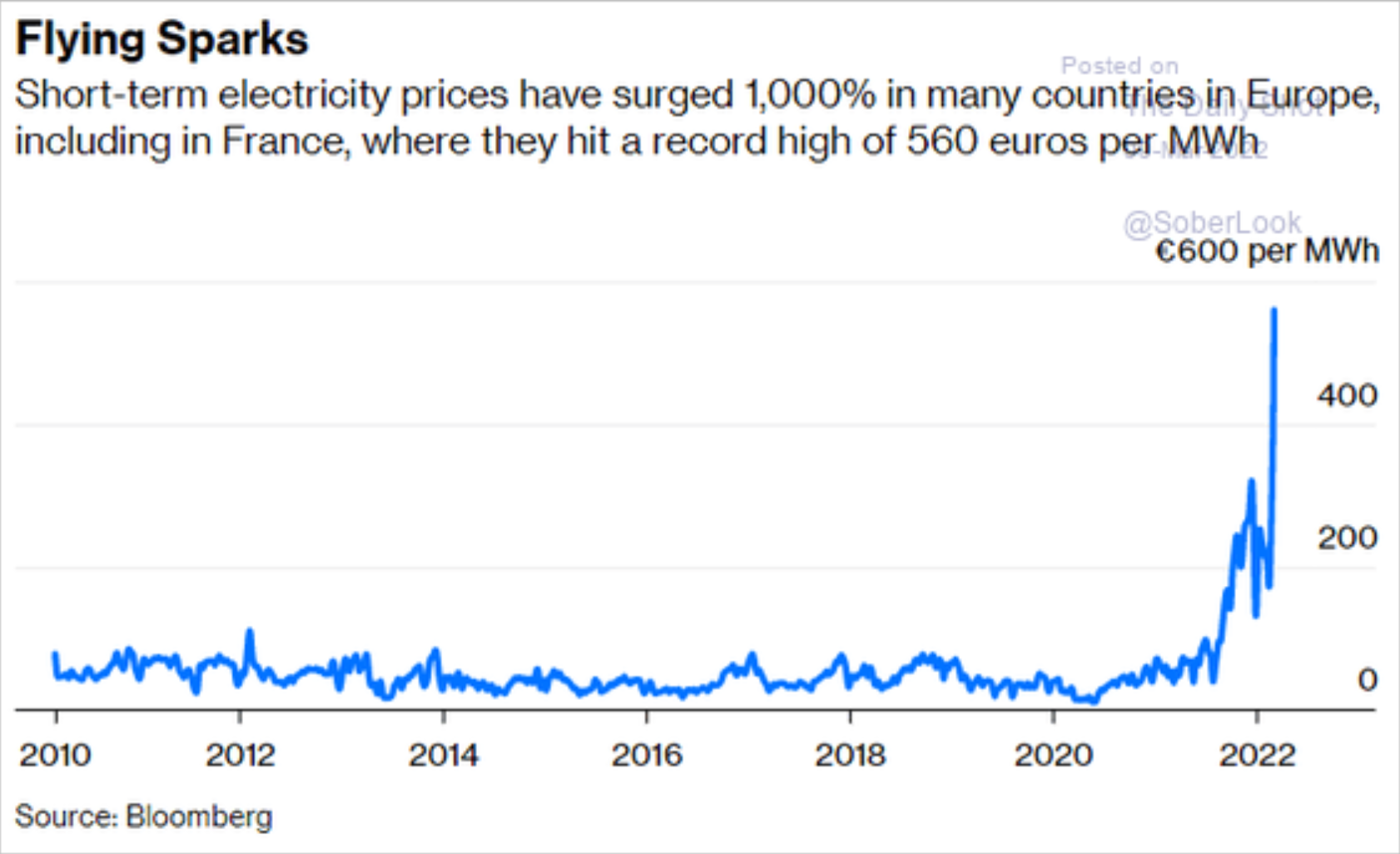

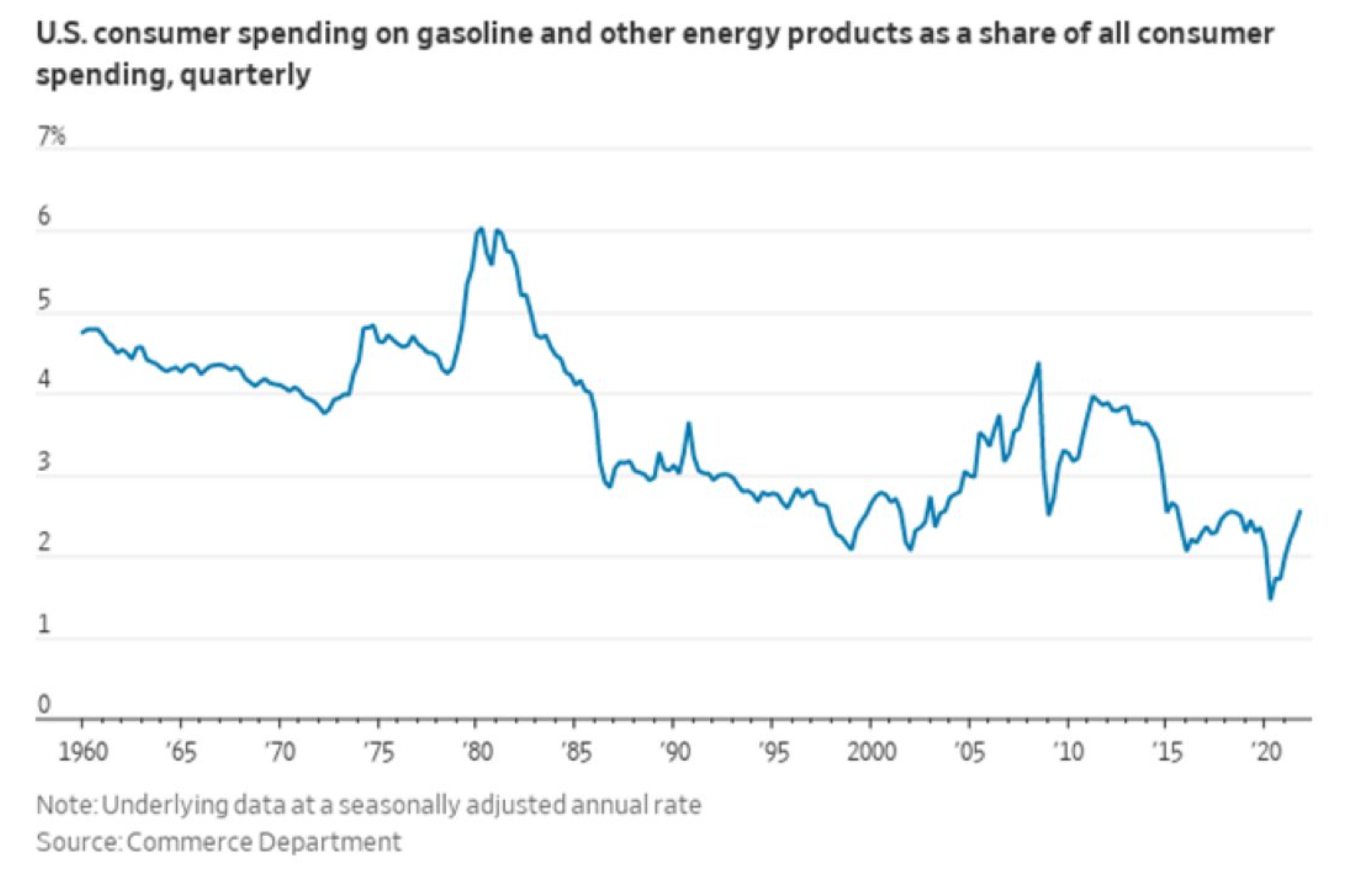

The West will pay its price too with higher inflation, but looking at this chart, the West can clearly stop buying goods they don’t need and just pay more for gasoline – yeah will be costly too – it’ll crash Western economy too – no doubts. West needs to rewrite their portion of economy towards more energy investments and innovation in this piece of the economy, while Russia needs to create entrepreneurship, innovations, new jobs and new society – way harder.

Russian economical depression means high energy prices for The West and faster move towards full energy independence. Nobody wins in a such a case especially talking about us – ordinary people. The lower the Russian GDP is the higher energy prices should be until global recession kicks in.

Lack of consumption will cost the West for sure – but here we should remember where those goods are produced. In China. We’ll back to China too, but saying other words, China produces goods using Russian commodities, the West consumes. If the West stops consuming, Chinese autocratic economy, which also got stuck in one way of thinking, will get very deep in troubles too, and probably … the most what gives me an impression the game isn’t really for US to push out Russia, but damage China using Putin’s ambitions which for them means another 20Ys+ of supremacy even if -50% crash will occur.

The West is really addicted to useless consumer spending, now needs to change it towards true productivity spending.

Economy will find the way to eliminate counter-productivity using inflationary spike of basic goods like : food+energy+shelter asking for innovation and entrepreneurship to replenish the hole in counter-productivity bust, unless the hole is so big, only war economy needs to be introduced.

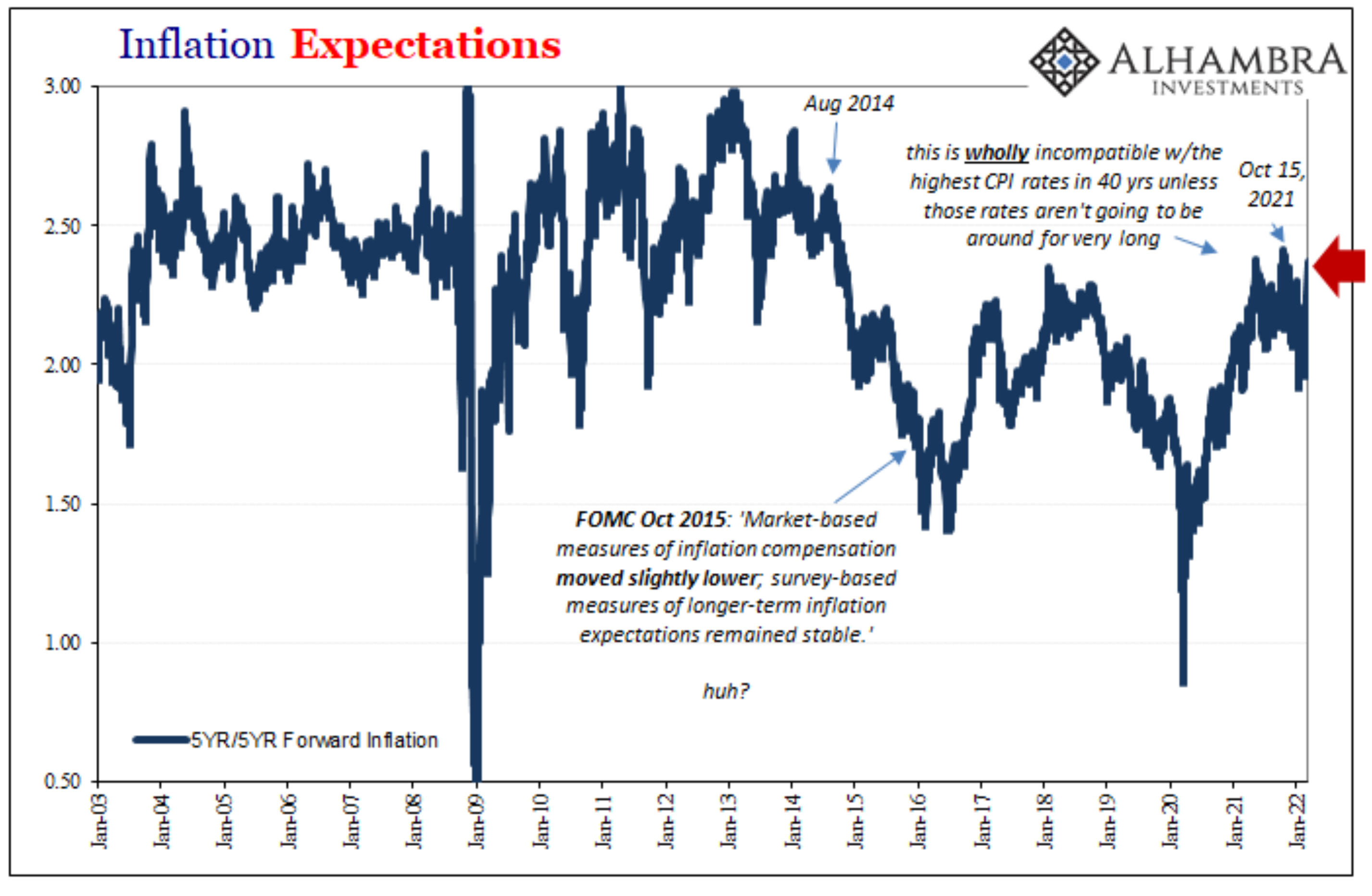

So The West must live in a world of lower consumption that means cuts in counter-productivity. The higher the inflationary spike on food+energy, the less people got money to spend on, as I love to say, goods people don’t need and can’t afford. That’s why inflation expectations aren’t really going higher despite oil prices doubled forcing financial assets to melt-down (deflation). US economy is like almost 70% consumption.

I’m talking about excessive amount of restaurants, hotels, gyms, or driving cars people can’t afford, new iPhones, exclusive spending, excessive house flipping. The amount of counter-productivity I measure as a % GDP global Central Banks keep holding in their balance sheet and that’s around 30%. 30% of the economy must go poof. Money was not allocated correctly, that’s why we got inflationary spike. This empty hole left after wave of bankruptcies must be used for independent energy part.

Russia will have free energy, but technologically move back to 1960. They will have inverted problem, 70% of their economy will go poof and will need to establish full economy from ground zero level. Question if they can?

Ukraine – #1 in Europe in uranium ore resources

I had an opportunity to talk with couple Ukrainian people exactly on 8th of March 2022. They told me : One Russian old ex-military told long time ago :

Never touch Ukrainian nation – they’re like bees. They will be taking this honey to their homes, but if you try to disturb it, they will attack like a swarm without looking if they’ll die or not.

Second one which had a family close to Donbas said :

The whole war on east from 2014 was a parody – Russians were calling to Ukrainians “Hide – we’ll shoot a bit”, later “Ukrainias called to Russians now it’s our turn hide”. None of them really understood what the hell is going on after fire was ceased.

None of them told me about Nazi part, that is so often raised by Putin, but all of them were laughing out from Zelensky in 2019. After 2 years of his presidency they told

We have never seen so many new investments in our country ever. Yes it’s still hard, still some corruption, especially in hospitals, but it’s been cutting. At least we’re seeing it’s moving forward in some areas. It’s clearly visible.

One thing is also important. Ukrainian people are extremely reliable and hard working employees and they are valuable employees for the West. 7% of all truckers in Germany are Ukrainian people, and in Poland 70% of the crew buliding underground were Ukrainians.

Nobody was also saying there were not accidents but considering 0.5% of far-right nationalists (which are everywhere) as an Ukrainian nation is a bit abusive (Azov battalion). Based on that we can say that Russia is an Arabic-African country too – insane way of thinking, or their Wagner team leader looks like … or better google Dmitrij Utkin.

In 2014 we had an opportunity to see “green soldiers” in Crimea and poor Ukrainians. Great information campaign from Russian side, but it’s not a secret since 2014, Ukrainian army took their lesson and started to learn what does modern warfare means. Considering the fact BlackWater was in Ukraine in 2014, we can only imagine that Ukrainian army let’s say hired top US/NATO trainers. In 2022 it’s all flipped. We see drunk Russian soldiers, equipment from 60-80s and information campaign from Ukraine, while I can’t really see anything from Russia. Russian army was created based on old Soviet style tactics -> quantity not quality (mothers will give more children), what is in line with autocratic regime (nobody cares about a single unit), and question is if in 21st century this is still a valid tactic, in the age of declining demography and kleptocracy of the Russian military budget. Also Russian army knows how to trap enemy, but they can’t really operate in a circumstances where they got trapped. I’m also bypassing the key problem. Ukrainian people and Russian people are just friends by default.

I’ve heard from bigger amount of sources, and the most important, I got this information just straight from an Ukrainian person, saying, Ukraine got big resources of gas, oil (nobody in reality knows how much), good soil, and rare earth metals.

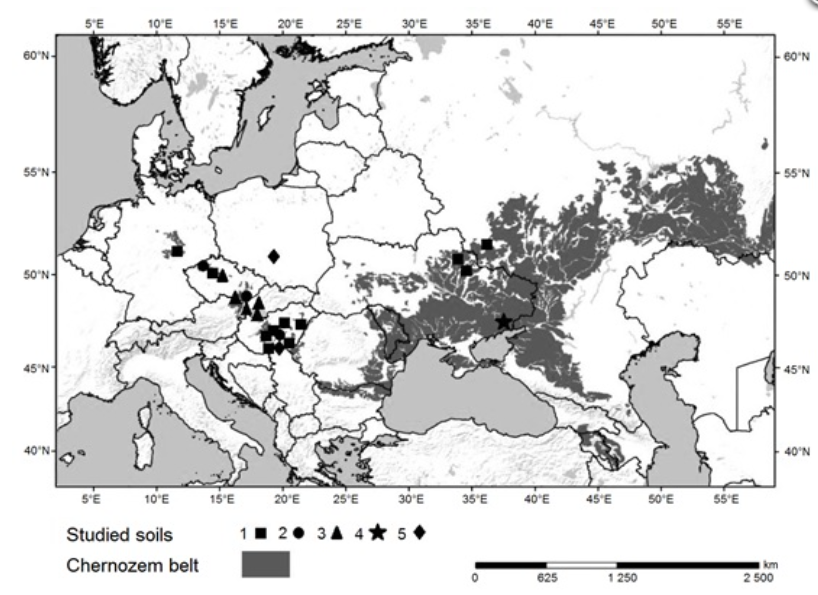

Well I started digging and here’s what I found. I won’t comment about Ukraine food exports, we all know it. Ukraine has the best soil in the whole Europe, sharing them with Russia. It contains 25% of the global chernozem allocation (molded-soil). During USSR time people said “Ukraine is feeding the whole USSR”.

Not so many people know that only 5% of Ukrainian food export goes to EU,

While most of the agro-export goes to China, Africa and Middle East, but let’s take a look at more valuable resources :

So as I risk a thesis before, Ukrainian problems are way more powerful problems for China than … EU…, but looks like China was ready to sacrifice their nation counting on fast geopolitical move from Russia. Everything failed here.

Here comes the resources I managed to find :

- #1 in Europe in uranium ore resources

- #10 in the world in titanium ore

- #2 in the world in manganium ore

- #2 in the world reserves of iron ore

- #13 in the world shale gas resources (most of it is on the Eastern side)

- #4 in the world based on the all amount of natural resources

- #7 in the world of coal resources

- #8 in the world in wheat export

Looking at export/import structure, we can say, while Ukraine feeds Asia, Russia feeds Middle East, and EU exports food.

If somebody will have a full blown food crisis, that’ll be definitely not EU, but China and Middle East. Wrong calculation by China, that Russia will take Ukraine in a blink of an eye trapping them more into economical troubles which slowly are going into first plan ahead of geopolitics. Seeing those resources and first defeats of Russian Army I know for sure … The West won’t allow Ukraine to collapse and will put lots of efforts in that, even if Biden will be kicked out after 2024. USA got now bigger game outside of their borders (geopolitics) than inside (economy). This is Russia be or not be confirmation, and Chinese be or not be confirmation too. If Russia will lose Ukraine and the West will put its hand of it, geopolitical Chinese dreams will evaporate really fast same as Bretton Woods 3.0.

Most resources aren’t being extracted, what is caused, as you can probably imagine, by the fact Russian influence was so big there, they were just not allowed to do that, because that would have decreased the amount of money Russia got in their budget. Gas resources are on the Eastern side mostly but some on the Western, that’s probably why Russia wants the East and that’s why I don’t believe Ukraine won’t stop and will try to take back Lugansk and Donietsk. Uranium is mostly in the middle of Ukraine below Kyiv.

Ukraine doesn’t have technology to extract its resources, it can barely extract ~30% of its own uranium demand and needs Western technologies to go full throttle, same time going 100% nuclear energy dependency requires Western technologies, and Ukraine made a deal with US company, something that Russia for sure can’t ignore, same as US won’t ignore either. I don’t believe in thesis the war will stop once Russia will make a corridor towards Crimea. It’s not in US interest and it’s not in Ukrainian interest! US doesn’t give up easily once they got deals with somebody, and it looks like US smells huge business deals in Ukraine and huge geopolitical deals.

Now if we know it way better time to understand this tweet below. Why Ukraine will be fighting for Crimea & Donbas … being backed and blessed by USA there is a chance. You will get independency, freedom, democracy, we’ll quickly rebuild you and you’ll pay in valuable resources, same time we’ll kick Russia and China out of geopolitical game. Got it how important it is? It’s worth the pain, stock market crash, inflation, and even recession and 20% unemployment.

Global economical cycle – first deglobalization step?

Economy moves in circles, those who follow me for years remember my words when I said, and even couple my blog entries are about that.

Economy will finally remove the power of money supply when velocity of money will be approaching towards zero. That’s a moment where the economy has eliminated Central Banks from the game and the economy keeps dealing the cards using powerful geopolitical events.

In economical downturn whatever decision you’ll make it’ll be bad or bad, in upturn good or good

And here it comes. The more we abused and cheated the economy the more powerful punch in the face we’ll get until counter-productivity will be cleaned as economy will be throwing more and more triggers to ignite that. Russian-Ukrainian clash is another trigger which is mostly coming from the economical troubles of the global economy.

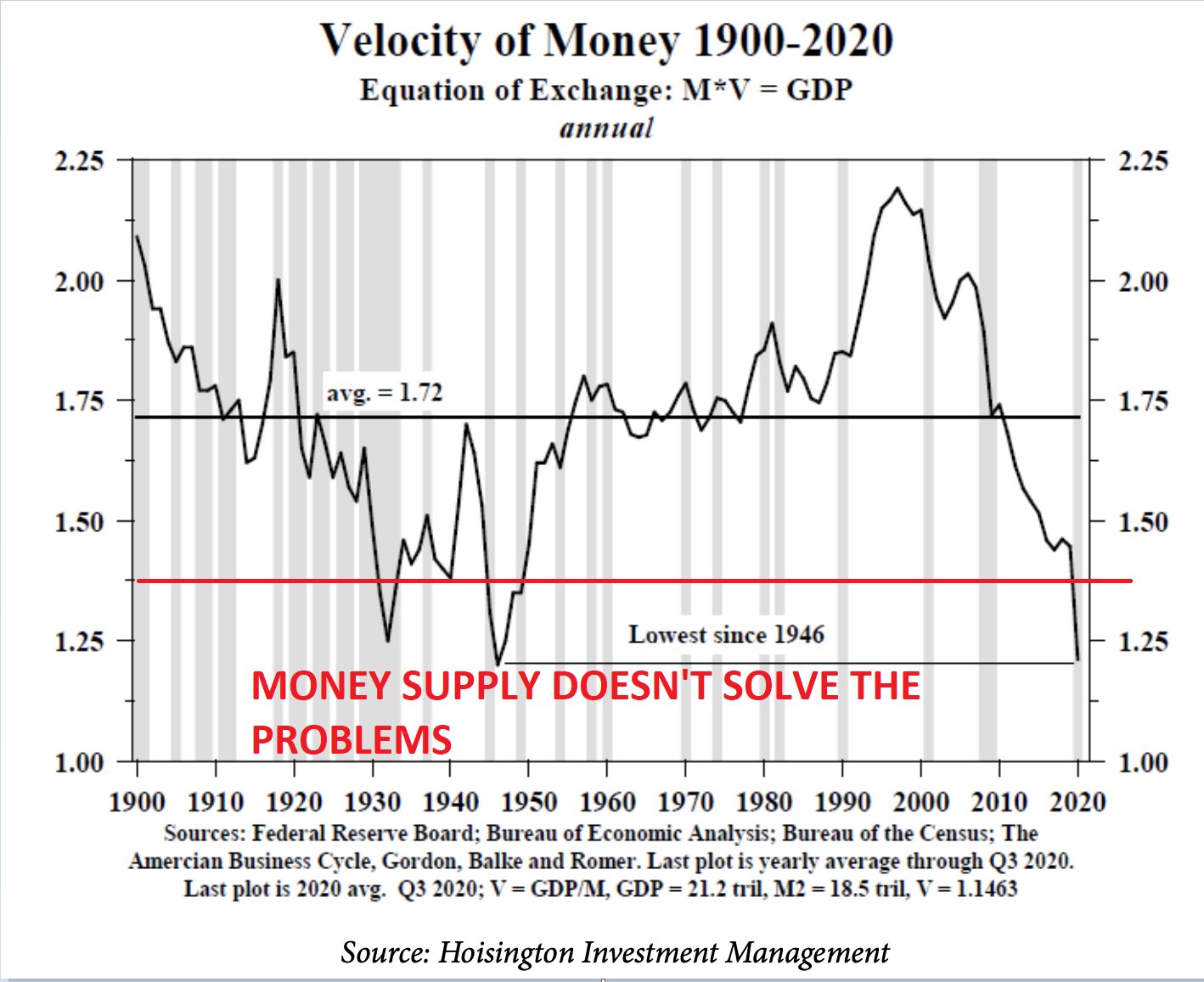

If we take a look on a broad measure of velocity of money (today it’s 1.12) :

I put a line below which money supply just doesn’t work. In 1930 it ended up by economical depression, it moved up to 40s where WW2 started to move again below the threshold line to move up and to finally move down again in 2020 and sticking this value even today. As money supply doesn’t work the biggest economical gravity events arrive exactly in those periods below the red line. That’s why I often say – the power of Central Banks following true big economical cycles, in upturn they are heroes, in downturn they can just hide to a bunker, as they can only fuel more bad events using their policies. Drop of velocity signals big economical cycle change. If you look at Kondratiev cycle, you’re going to see 1929-1949 period called deflation where most of “bad” events and so far the lowest velocity of money happened, giving us a hint of the beginning of the end of globalization era.

Fair to say, velocity of money lifted up in 1930+ thanks to big asset deflation and economical cleansing process from counter-productivity and cheap credit, the second moment was around ~1943 – market started lifting up feeling the end of WW2 (I think it’s all about German defeat under Stalingrad (Feb 43)- break-even point in WW2 where Germans started losing the war). Those two moments (1930+, 1943+) where velocity of money started raising up were connected with asset deflation, giving me a hint – you won’t see velocity of money raising without significant asset deflation marking full deflation in Kondratiev cycle like between 1929-1949. Today we are like this :

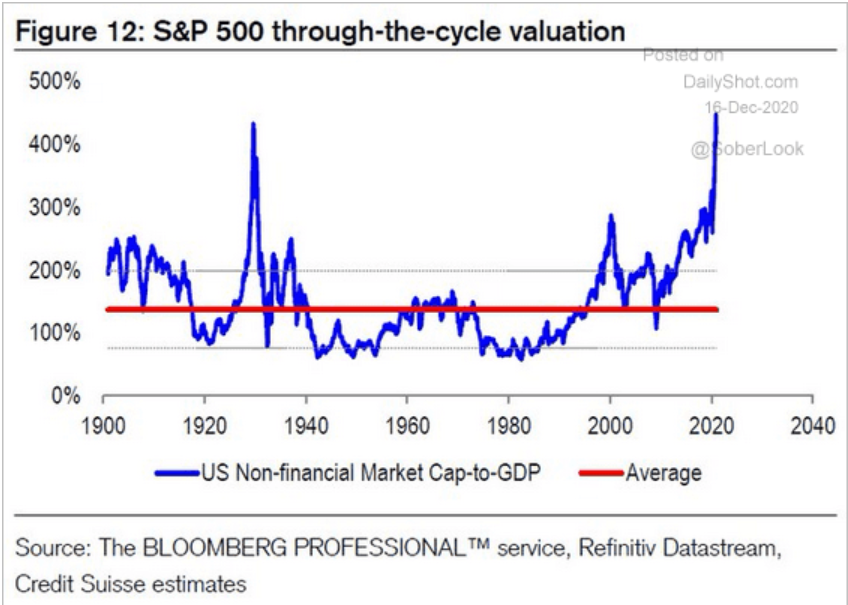

Just like we need to go back to the mean in velocity of money around 1.75, we need to go back to the mean around 150% in the chart above as a natural healing and cleaning proces, rebuliding the economy back to productivity and wise economical spending. Yeah it’ll be painful. We should also add one thing to those charts. In most cases raising up velocity is also connected with demographic boom, while declining with demographic bust.

Chinese economic miracle and geopolitical interest

I’m fully aware about Chinese position in the world and mostly tracking Chinese and Hong-Kong stock market. The whole boom started in 2001 when Clinton allowed China to be in WTO, that was a natural process of secular disinflationary cycle – seeking cheaper labor. China is no doubt key economical engine of the long-term disinflationary cycle and because they’re key leader of it (like US in roaring 20s), they’ll “decide” when and how deep we’ll enter into economical crisis. China like Russia is an autocratic country. Just like Russia’s view was rather short sighted on their military problems, Chinese view on economical growth seems to be also short sighted.

I’ll risk a thesis that :

Chinese economy is strong on paper, just like Russian army – crisis can give them fuel to learn from mistakes unless you’ll be removed from power or you just aren’t able to learn from those mistakes. Longer term it might be a win for both, but there’re too many ifs. Russian army keeps shelling regular towns, when they failed to progress, China builds castles on the sand, when they run out of ideas how to grow due to lack of freedom, true entreneurship and lack of self-fulfilling innovations.

We live some time with China and last time I was trying to understand what Chinese products I’m using or even know and what type of innovations I’m using from China (close your eyes and try to name Chinese companies). Except Huawei, Oppo, Xiaomi, Alibaba and Haier I can’t even call 1 more Chinese brand and can forget about real innovations. Last time I tried to buy from China RAM cooler hoping for some miracles (ALSEYE C-RAM COOLING SYSTEM) vs Corsair products, and now I can admit it’s a low quality crap and still nothing has changed in China. Once you guard them they can produce quality. Once you ask them to create something, it’s mostly a crap.

Without freedom there’s no real innovation – that’s what I’ve learned. No innovative nation – long term exit time from recessions.

Of course China tries to buy some Western brands. It owns for example Volvo in some part, but still a question is about Chinese brands and Chinese ability to learn how to innovate on your own. They just don’t have it in their blood. So we can clearly say that for today Chinese products which reach the western nation are just phones and nothing more. Chinese cars can’t even pass western crash tests, while sending Chinese people on US universities can’t make from them real entrepreneurs, especially if you might end like Jack Ma. Freedom and innovations are all fully connected with sharing political power with entrepreneurs which are supporting the economy, something what China won’t achieve anytime soon, while in Russia their “entrepreneurs” are moving money always abroad to support western economies.

I came to conclusion when first mobile phones started to appear around 2000. That means for me, China is around 20Ys behind the West but at least their economical marketing is decently packed – they still keep trying but autocratic cult is very effective in killing own way of thinking and same time killing innovative thinking gaining economical advance in reality.

Without democracy and freedom there’re no innovators. There’s no room for making mistakes in autocratic regimes which are so important for innovative way of thinking. China has adopted full capitalism and full authoritarianism benefiting from both. They have to choose in a moment because they can’t have both working long term. Russia isn’t the same. Russia has never adopted capitalism the way China has. China has way much more to lose using capitalism than Russia.

Chinese demography looks like uber crap. This is a headline from a February 2022 :

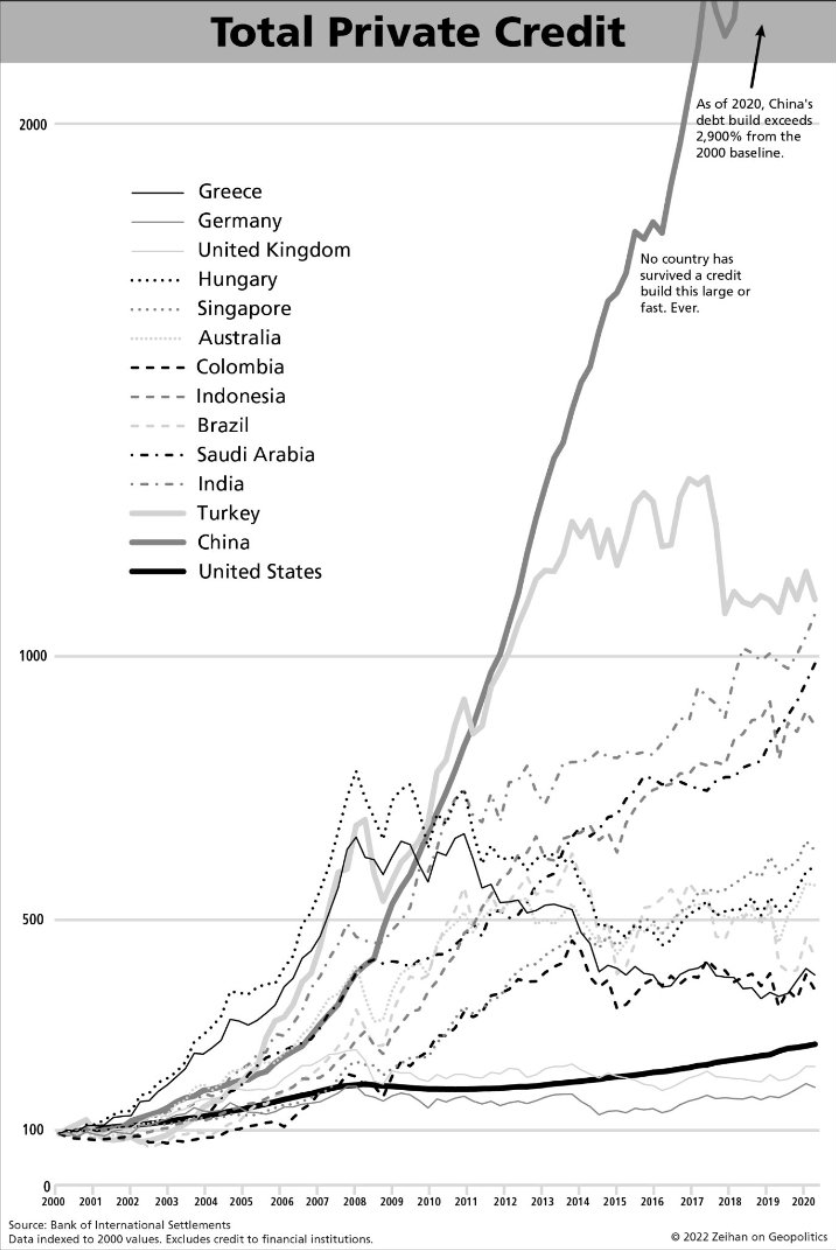

My experience shows, demographics is inversely correlected with the amount of credit supply. Because China went on “killing-spree” with the amount of credit automatically they got a big crash in demographics. Took great example from Japan.

The train has passed away. China enters into secular downturn from demographic point of view and from the “growth” point of view, as an autocratic country they also made lots of economical mistakes like centrally managed capitalism using USSR way of thinking lifting up the weight of the economical gravity awaiting for being released. Based on that we’ll be able to judge : Is China ready for getting a piece of geopolitical cake? All depends how they’ll survive the economical gravity which will confirm if their strategy was right or totally wrong. The economy will verify that for sure.

Reckless central planning and economical quotas led to failed domestic and abroad investments which were nothing more like USSR way of drinking capitalism like vodka without even getting any hangover. For me this hangover hasn’t really happened YET. Ghost towns are just one from many examples of domestic initiatives, and this chart shows the problem :

I think China hasn’t learned anything from this rally. I’ve learned one thing why US is so innovative. First somebody told me, second I used to work 10Ys for one of the top well known US corporation and here’s my summary :

In US way of thinking they know you are forced to make lots of mistakes if you want to succeed. I was truly encouraged by my US bosses to make mistakes and try. They were supporting me even I was making mistakes giving me more power to finalize some projects. In autocratic countries making mistakes is considered as being weak. Also in US way of thinking lots of decisions are decentralized on lower level, on autocratic – everything is super centralized, because the leader knows it always better.

I still remember when I had an ability to approach Vice-President of my corp and told him directly what I see is wrong what is good and why I disagree with his opinion. That was totally normal approach, which boosted productivity at the end. From the other hand I had on another floor Chinese tech company. Was funny looking at them going on lunch. Easy to see : first was going probably the boss, just behind them lower “ranks” going in one queue. So easy to see the workforce structure. That was around 10Ys ago.

So China keeps playing the same counter-productivity disco style like the global economy, investing more and more into wrong sectors, because GDP growth quotas bro at any cost!, but if I keep laughing from EU or USA style of counter-productivity where worthless companies are worth 10B$ in China I bet the problem is way way way way bigger. There’s just one big difference. EU & USA are very matured economies which try to innovate using counter-productivity which will fail at the end too, but China tries to build their economy and growth using counter-productivity. Question if China is matured as much as the West in reality. That’s a 1M$ economical question.

I don’t believe in two things. Chinese economical data and JP Morgan’s Jamie predictions

Just like Russia resigned from spending on growth accumulating reserves but keeping Russian economy in stagnation since 2014 and kept low debt/GDP, China resigned from moving its economy from export driven to full consumption driven, still being just a factory of the world. Maybe they didn’t want, maybe they just can’t do it.

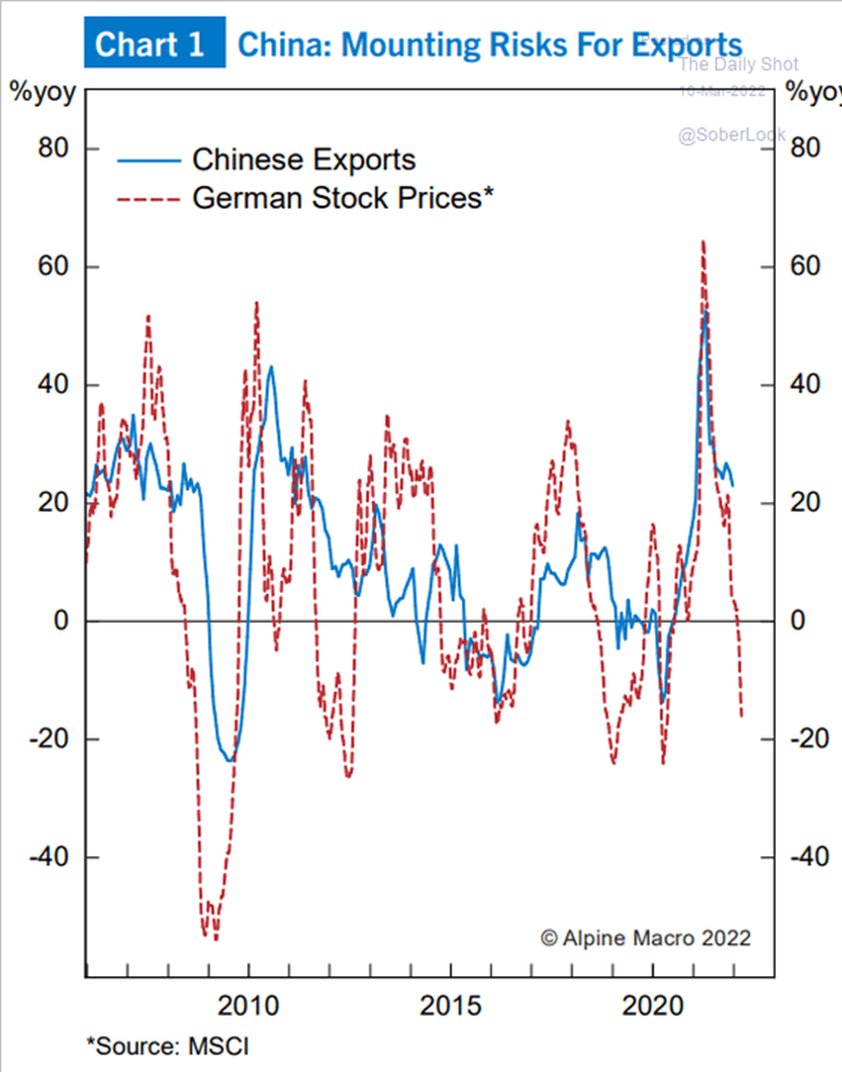

Saying other words with a new mathematical equation : if Germany got slow-down, China follows, because China is still just a factory of goods for the West, exacerbated by counter-productive local economical initiatives, and still nothing more. That’s really sad truth. Chinese government overslept the moment of moving forward using capitalism which at the end might be the biggest economical trap for China.

China is scared what the West did with Russia especially this Bank of Russia move, and even more scared they can’t import food from Ukraine which seems to be quite important partner for them, but in the name of geopolitical game he will have to face some internal problems.

Everybody thought US is geopolitically weak and it’ll be piece a cake throwing US out of EU influence. We all know China knew about invasion, but asked Putin to postpone it because of Winter Olimpics. I bet Putin promised Xi – 2-3-7 days all done and he placed his head on Xi’s plate for that. The fact that Putin now going all-in is the fact that he wants his head to be taken out from Xi’s plate, because as of today Russia can be only a one weak vassal of China, while China needs way more West than Russia to export their goods! As Putin’s crashed German stocks it crashed Chinese economy too, welcome to global economy. If Putin will not deliver gas to Germany forcing German economy to enter recession, China will get enormous amount of troubles. That’s why China has a big political problem trying to stand between a rock and a hard place. The longer they stand like this the more economical gravity they additionally get.

Nobody was taking that scenario can happen as Russia will stay on Ukraine for longer than 7 days with some heavilty losses and lack of supply. First signs showing all contract soldiers had agreements up to 20th of March 2022 – they were so sure about winning. Once you are so sure the opposite happens.

No matter if Russia will win or not, economical troubles they spread to the world including China are growing everyday and China can’t afford on that way more than the West.

If you ask me if China will help Russia – my answer is – not so much. They’ll pretend to help them but in reality they will do something what Putin always trying to avoid. They will rob another piece of Russian economy. The lower the Chinese stock market the less willing from China to give hand to Russia, and more willing to rob rest of their economy. The lower the Chinese stocks are, the bigger internal economical problems, thanks to their adoption of capitalism, as gravity payback time has arrived, which requires big entrepreneurship to get out from those problems. Something China just doesn’t have. China treats Russia same as US – cheap source of commodities. We still don’t know the true value of Yuan – we still don’t know how Chinese economy really performs.

The West was trying to approach Russia in a democratic way, what fails, Russia slowly understands they could have been on the Western side or Chinese side, there’s no Russian side the longer the war takes time and the Western side is now officially closed.

While the world was shocked how Russian army got stuck in 1980s with soldiers without teeth, steeling chickens, as their food is 7Ys after the term. That ignorance might wipe out global Chinese geopolitical strategy of moving towards the West deleting some portion of US dominance! There was never any true alliance between Russia and China – all is geopolitical business. Russia was playing a middle-man for China to pass their influence towards Europe. China was thinking they could do it the same way US is doing, but you can’t really replace US if your economy is build on castles on sands way of thinking. It won’t pass towards The West.

Now it flipped even so much that so far some sport players are getting rid of their advertisment contracts with Chinese giants blaming them for cooperation with Russia. That’s not what China wanted to happen! Based on the mistakes and so narrow perception of basic problems we see both China and Russia build their power based on totally false assumptions, especially if we consider their love to remove US influence (called freedom and democracy) from the EU. To remove US influence you either need to kill the whole world or deliver more freedom and more democracy.

So the larger prices of energy in EU, the more powerful downturn in China, because the West isn’t consuming enough what China produces, and guess who is guilty for that? Of course Vladimir Putin. Scarying EU of high energy prices is also scarying China of huge economical downturn forcing China to choose between their geopolitics or their benefits from capitalism and Western markets, which might give them straight forward economical depression.

It’s not about now who’ll win, but the longer the clash between Russia-Ukraine lasts the more powerful troubles China will have. I’ve never treated China as an innovative economy, still rather factory of the world, believing in their blindness (caused by capitalism) they can dominate rest of the world in an economical manner US did. I still don’t believe they really can do it.

This toxic mixture of autocratic regime and capitalism is coming to an end, the same way like the end of reckless consumpion on the Western side. How Chinese government will solve it I have no idea. We are about to know how Chinese economy works after economical crisis which will unravel all hidden dead bodies exposing their true value of “innovation” and 6.6% GDP growth. Miracle? or extremely powerful connection of capitalism and central planning which this time is a success? 1929-1932 for China, or maybe just 2008 or maybe just 2000?

The Western block – USA & EU

First of all there’s no USA without EU and no EU without USA from the geopolitical point of view. EU is the extension of the USA power and influence. It’s more or less same example as Russia and Ukraine in Dugin’s doctrine, until in 2014 Russia kicked Ukraine towards Western hands, or maybe the West wanted to take Ukraine (no idea for what, I’d say freedom influence was moved more towards the East naturally). The West has its own problem. Capitalism went too far there too, debt levels are high and they have same type of problems like China with one exception – they got freedom and innovations. Maybe a year ago I was strongly commited to say EU is really about to break. Political troubles different interests and Putin’s influence were so big all was about to collapse. and the war started and everything was flipped.

And I could have written lots of dependencies here and problems based on German & France point of view which are ultimate middle-men of the Russian interests in Europe, but even Germany started delivering weapons to Ukraine – something I still can’t believe even today – that’s probably my biggest geopolitical shock since the last 15Ys, not sure if I should trust it or not, but it happened.

The whole world is deglobalizing and wants to look like that. We need to build the puzzles once again. It’s not such a big mess yet, but in some time (5-10Ys) probably will look like that.

We’re going to split the world into 3 different powers :

1/ Russia supplying commodities

2/ China produces goods

3/ The West consumes those goods, innovate the world and move back to #1

All those 3 are fully dependent on each other, so it’s not that simple. If there won’t be consumption, there won’t be employment in China and commodities demand will crash. Additionally Russia came to conclusion if The West can sell innovations using $$$, why they can’t sell commodities using their own currency, same time China wants to sell produced goods using Yuan? Everybody wants to print currencies towards infinity. There’s still no answer on that question. To get an answer first we need to deflate the financial asset bubble and take a look how the system will look like after it.

Which country is the simplest economy? Russia – commodities can be taken from different sides of the world, factories can’t be build in months and to create innovative nation you need decades and lots of freedom.

The West treated Russia really good. I have nothing against Russian people, sometimes it’s just funny how they behave abroad, but since last couple of years even that was changed – it was easy to observe how Russians traveling abroad are more sticking to the Western culture than to typical Russians drinking vodka on the swimming pool punching each other and when the police was called they threw them into a swimming pool (my observation from 2004 – Turkey, 5* hotel).

Looks like the more freedom you spread the more you control the financial system, that’s the US strategy so far, those 2 screens show the power of freedom and differences between the West and the East. It reminds me the same type of values my US corporation was representing during top management meetings.

So far I wanted to show you and prove you my way of thinking which I believe : those rulling & innovate the world who are providing global freedom and democracy allowing free entrepreneurship to grow, because at the end you are gaining power using true economical advantage. I have no idea if this model will survive, but at the end people and innovations are running out from recessions and problems, so governments are pushing on geopolitical changes, people/nations fixing and rebuilding the economy putting all the puzzles together.

The West got its own problems, maybe we should call it global economy and financial system. Debt levels, inequality levels, demographic levels. Everybody needs deleveraging, but the question is still who will collapse the most and benefit the most from it. Will it be the West? Or maybe it’ll be China which afraids that moment the most? It might at the end wipe out the government which in autocratic countries is “always right and makes no mistakes”. My friends are telling me – yeah it’s more expensive but who cares, it’s worth to get some pain a bit just to remove some Eastern influence. I won’t go on more expensive vacations, I won’t buy new car and I won’t spend more on traveling – happens. As Europe and USA are fully aware about recessions, China not so much. They don’t even know what people really think. They don’t really know about their hidden dead bodies in economical wardrobes.

Summarizing, the West is sharing exactly same problems like Russia and China. Inequality, demographics, inflation, debt problems. While Western capitalism started to become cronyism (where corps gaining too much power), Eastern autocracy started to become KimDzongIsm (where governments gained too much power). I don’t really see any other difference honestly.

The problem is everybody believes the West is finished. I’d say – wait for economical crisis in China and watch their ability of moving out from it. You’ll get a clear answer on all your questions who is a winner and who is a loser.

Predicting the outcome based on market structure

Russia + China

But calling first $USDTRY crash, later $USDBRL crash, later $USDRUB crash now $USDINR left in the queue seems to be also easy. Market structure of USDRUB was a consolidation of 7 years and trend of the currency has been only bullish. Probably we’ll see a retest towards 80, but that kind of a retest didn’t happen during 2014 :

I learned long time ago – ignore macro – it doesn’t matter – charts knowing way more, you just have no idea what events will be triggered but events will be always found (market started going up when Germans lost the battle under Stalingrad – 2Ys before the war ended).

Russia from the market point of view – no doubts invading Ukraine was interpreted as a big mistake at least from the economical point of view. During Crimea invasion in 2014, USDRUB went up from 35 to 80, during 2nd invasion from 80 to 150. USDRUB wasn’t even able to drop below red (M)MA50 (Moving Average) – market clearly knew what will happen. Russia despite weak 2% of global GDP contains valuable resources which are needed for the West, from the other side Putin isn’t able to create new army without the Western technologies, Russian military development got stopped in 2014 and now it’s rolling back in time from 2022. No doubts Putin’s power consolidation will be probably stronger. This war gave him a great opportunity to become next Kim Dzong Il closing the country even more. I really got big doubts seeing Goldman Sachs and Morgan Stanley going out from Russia we’ll face any unfreeze anytime soon. No doubts Putin failed in a first stage bigly. In couple months Russia will be left with empty shops while West will be left with double digit energy inflation, all benefits of the West have vanished, and all benefits of cheap resources have vanished too, unless West will replace them with Angola, Venezuela, Nigeria or others, but Russia can only ask Chinese more autocratic brother which probably in case of Russian economical failure will take whatever they’d like and people in Moscow or St. Petersburg will love new Chinese products and innovations (which they don’t really have). Rest of Russian people don’t care.

I also got big doubts about Chinese help. China from the market structure point of view is being signaled as a totally weak economy unable to innovate by themself confirming my thesis. Beautiful buildings in Shanghai, might me like Russian military parade on the Red Square, lots of medals. Looking behind the scenes it looks very scary. Russia never wanted to be an economical power, but China wanted. China understood that economical power sometimes is way bigger than military one, but again with autocratic central planning looks like they might fail to deliver this thesis.

Hong-Kong Hang-Seng 50 on my charts entered exectly secular bear market. Yes secular. What’s my definition of a secular bear market? First drop below (M)MA200, second “death-cross” between (M)MA50 and (M)MA200 :

As you can see for the first time even March 2022 is the moment where candle is red and below (M)MA200. It’s super strong technical signal. Based on that thesis I’m raising doubts China will be able to hold USDHKD peg to the $ – it’ll be impossible for me. That’s a clear sign – Chinese economy coming to a final “CHECK” moment. Years of failed central planning, infrastructure building nobody needed will be verified. What is productive and what was not.

Same time $FXI looks also as bad as HK50, below (M)MA200 – China is super weak on technical charts.

The $ (DXY)

The $ made a secular break after 2014 – yes exactly the same moment Russia entered Crimea and push Ukraine towards the West. A moment later Chinese bubble bursted. In general we can say period 2014-2016 was a technical $ break. January 2018 was a technical retest finished by collapse of XIV ETN. Fair to say bullish golden cross (M)MA50 crossed above (M)MA200 happened around 2017. $ as a reserve currency isn’t going technically anytime soon, rather it’s raising its influence. The so-called de-dollarization technically failed around 2014-2015, when $ breaks above the trend.

Chinese Yuan, US Yields and inflation

I’m still sticking to a basic rule. The stronger the Yuan (lower $USDCNH pair) the higher the US Yields and higher “global inflation” and higher commodities. Here’s is the Yuan chart with inverted US Yields.

The lower the $USDCNH pair, the higher the US Yields, but the reality is that China so far keeps tightening their economy like crazy (or US keeps easing like crazy because that’s the same statement) as Yuan is going stronger delfating Chinese asset bubble.

Summarizing – China doesn’t have the economy which can defend by itself so far, but it left its channel signalling further possibility of more powerful Chinese deflation :

But from the other hand we’ll soon get a full recognition phase in China, this HKD peg is artificial allowing to China to cheat the world. Either Chinese economy works great and has decoupled from US Yields (and US Economy) or is about to blow up moving $USDCNH > 7.20$ – my 1M$ question – Chinese economically CHECK. Somebody will give an economical MATE. Either US to China or China to US. Technicals are on the US side. Now Yuan and HKD peg needs a full resolution to show us if the king is naked or not.

US Bond market – on the verge of secular bear market, but still a lot needs to happen.

$TLT failed to bounce on key 2009+ trend line. Break is break. Market retested the 2009+ trend line and moved down lifting up yields same time making Yuan stronger towards 6.30 and even below. Still got lower long term trend around 121.5$ which makes me think we’re going towards the bottom line. Yields will be forced to go higher the longer asset bubble will stay with us. US stock market doesn’t need to be commented as there’s still not a “clear” sign except long term consolidation. TLT is based on 20Y bonds.

If we take a look at my secular bond bull market based on 10Y yield channel it looks like this :

Each time it touches the red line yield-curve inverts and recession is imminent, but as velocity of money is super low, there’s a possibility of a technical break above this line, which will mean a cross towards “inflationary” cycle. Technically market wanted to reverse in 4Q20, but we rescued it. Break above (best on (M) candle) means game over for secular bond bull market ~2.50%.

US stock market + Yield curve

From the market structure, US stock market is still bullish, but really not much left. There’s no US bear market without financials and looking at $BKX we need to push it below 2007 peak so we can say it was a bull trap. Hasn’t happened :

Dow Jones Industrial trying to hang on the top secular trend. I bet it’ll go deep down the same moment BKX will move below its 2007 peak :

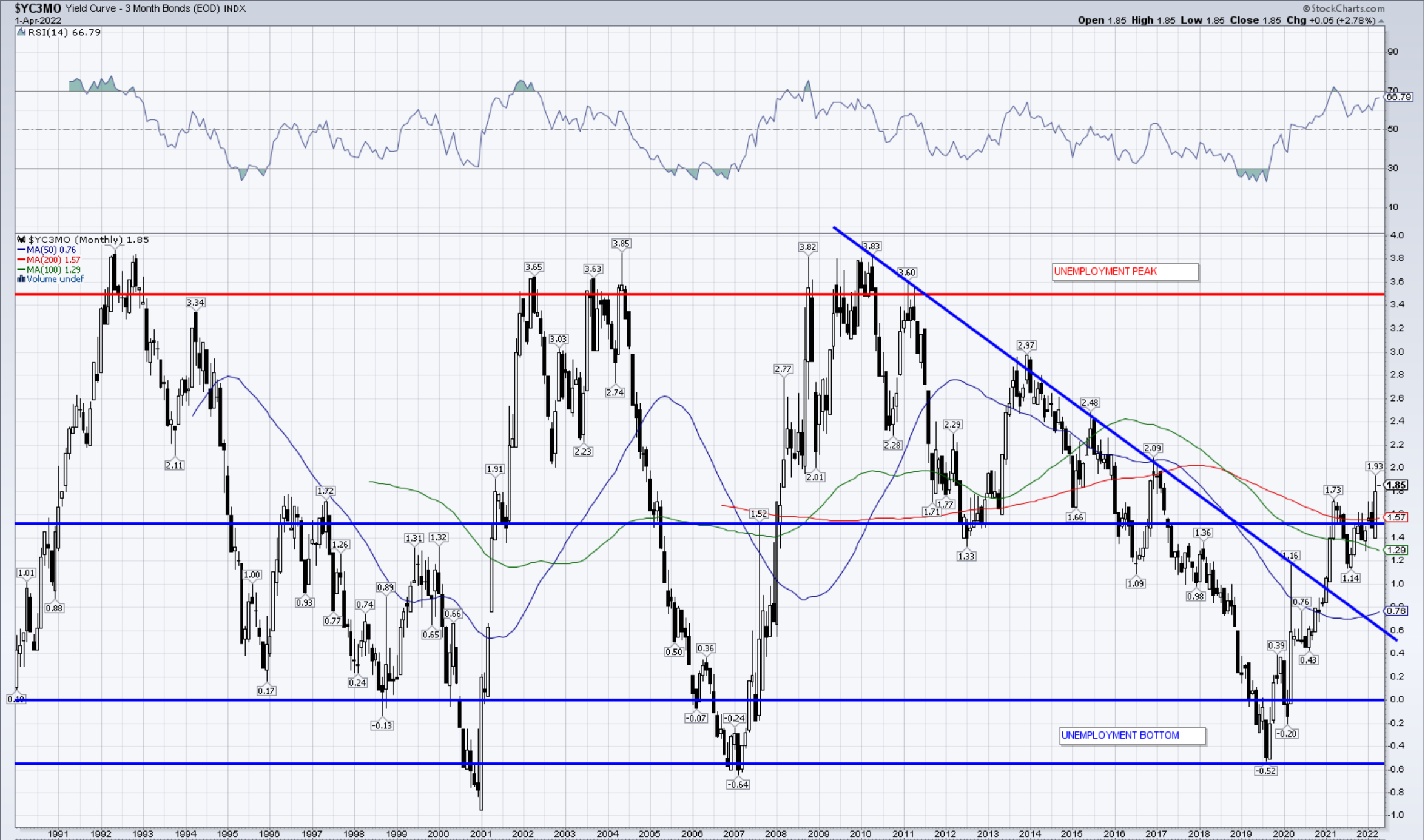

The yield-curve 10Y-2Y signalling recession imminent.

10Y-3M is flat, because 3M is a lagging indicator. If you ask me WHY we got so big differences here, without beautiful technical words about maturing, bills, Central Bankers etc here’s my answer :

10Y-3M still needs to be considered > 350bps to say downturn cycle coming to an end.

Not happened. Based on charts we can say 2009 cycle is over from around 2H19 when 10Y-3M inverted and started bear steepening. 10Y-2Y inverts again in 2022 predicting new bad event ahead of us and … the FED behind the curve. We can read from charts that since about 2021 (I bet the moment $FXI peaked in Feb21) inflation started to become stagflationary variant which killed the economy at the end and flattened 10Y-2Y curve to inversion once again. The same time FED did nothing and the economy did exectly what I predicted – stagflation has tightened the economy by itself without even the FED. Next steepening from 10Y-2Y = deflation to spread and as usual the event which will force it is about to arrive.

Germany

Let’s concentrate maybe on the common denominator : $, so we’ll use $EWG (Where Germany goes, China to follow). Break below (M)MA200 – blue curve indicates long term secular downturn.

Food inflation & commodity index

What I can say, bullish ($RJA) – (M)RSI > 88 – huge beginning of a secular bull market. We urgently needs a correction (deflation), but the beginning of food inflation bull market is ongoing.

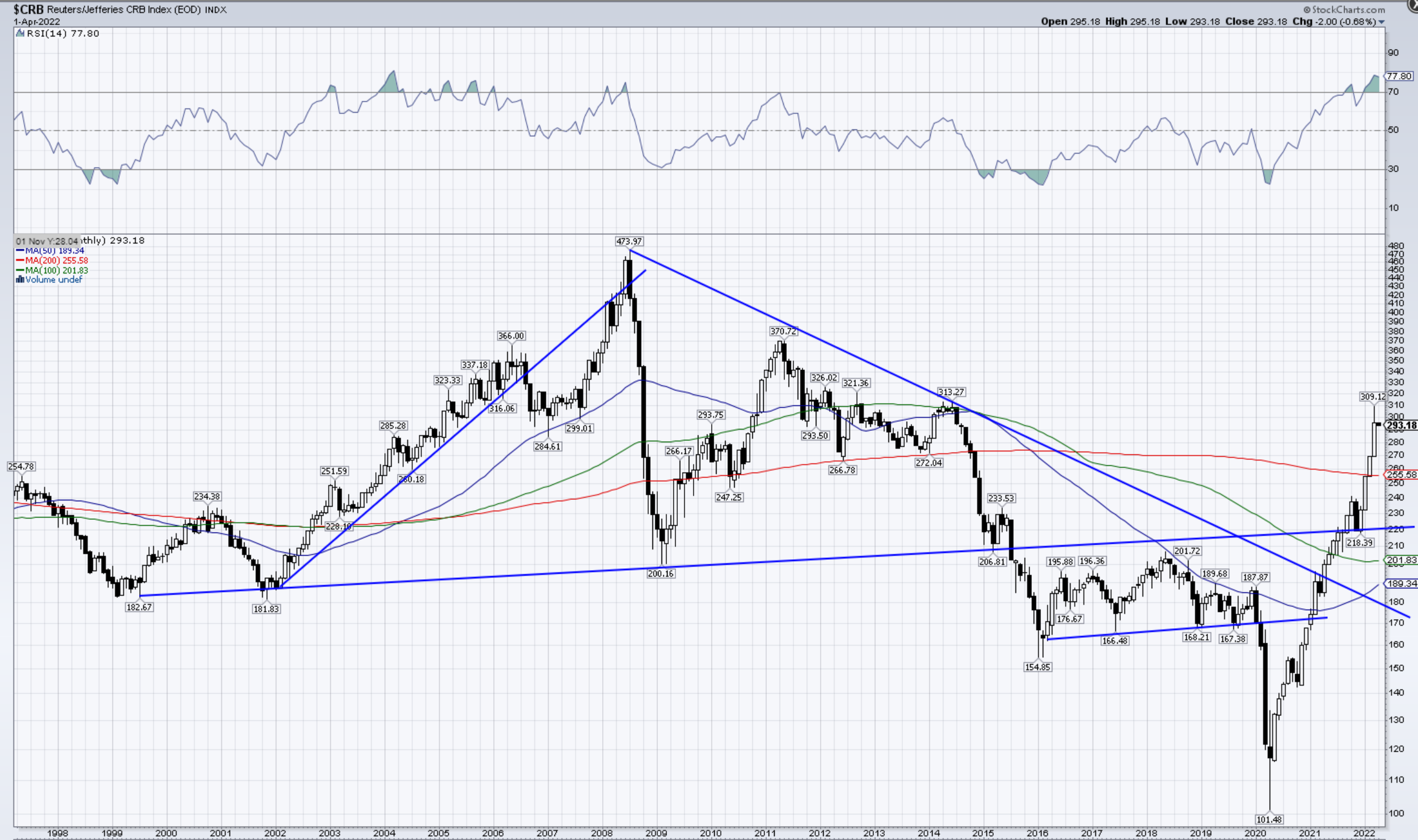

Wide commodity index CRB also will require some correction, but that’ll happen only when US Ssock market starts going down :

Summary

I’ll prefer to make summary in points :

- Global geopolitical conflict has just started. Just like during secular inflationary cycle which ended up by cold war led to transition to secular disinflationary cycle, we’re observing the same path just to the opposite deflationary side.

- Putin made a colossal mistake judging the power of The West + Ukraine. No matter if he’ll win or not the cost for it is from another space and looks like closed the new Iron Curtain.

- Military trend is bullish and parabolic, just like basic inflation. The task is to wipe out counter-productive asset inflation. It’s mostly caused by economical cycle transition which forced geopolitical issues. The key GDP factor will be once again military for the nearest future.

- Putin prevented EU from breaking and unite EU like never before.

- True escalation of the clash will be when asset deflation will clobber the global economy. We’re still in an epic bubble.

- The fight is still about to kick in US from their level of influence mostly stimulated by China. Russia is just a proxy for US-Chinese conflict the longer Russian-Ukraine war lasts. Initially it was US-Russia, but now slowly transformed into US-China.

- It’s still way too early to judge $ collapse. I’m still defending my thesis, the only power to remove the $ is the ultimate strength of it, which we still can’t see. First Chinese Yuan must be “unpegged” so we can really see what Chinese economy is really worth.

- Chinese economy is about to get their first true economical crisis, the equivalent of 2008 for US or maybe even 1929-1932. All eyes on them how they will be able to move out from it. I personally think Chinese economical miracle is vastly exaggerated.

- The measure of inflation/deflation can be measured so far by the power of Yuan relative to USD. Strong Yuan -> larger global inflation, weak Yuan -> larger global deflation.

- The peaceful life on easy credit, where everybody can afford on everything is officially over.

- Basic inflation (food+energy) raising, lowering real wages means less spending on goods you don’t need and can’t afford.

- Economy restores productivity – if it wasn’t able do it using economical gravities regularly cheated by Central Banks it’ll do it using way more powerful geopolitical events once velocity of money drops too low.

- Each period of extremely low velocity of money has its own Hitler. Nazi Party was the answer on economical and geopolitical troubles of too low velocity of money 90Ys ago, that’s how economical cycle forced velocity to move up.

- I’m extremely disappointed by the power of Russian Army. I’m far from saying who’ll win who won’t, but the West changed perception or Russia for good understood how vastly exaggerated Russia in almost every aspect of economical, military and geopolitical perception. Era of centralized army passed away in 1980s, era of decentralized army kicked in 2022.

- Russia totally antagonized Ukraine. Russian occupation of Ukraine will require enormous efforts and money and time using Gestapo style and way of thinking. There’s no way it’ll happen. From the other hand rebuliding Ukraine will take > 10Ys but as a source of valuable commodities worth trying.

- US wants to avoid 2 fronts. Eastern and Pacific. US also judged Russia wrong unless that was a strategic trap “2 birds with one stone”.

- There won’t be Bretton Woods 3 without asset deflation and without Ukrainian war end.

- 1929-1949 was a period of Adolf Hitler. 2018+ has its equivalent in place. Last time disinflationary bubble and low velocity of money required Nazi way of thinking. Economy and history rhymes again :