10 myths I see and I fight against them

November 27, 2021

This topic will be quite short, as I want to say based on my experience where most of the fin-twits made mistakes based on my experience. People who are following me for more that 6-12Ms should really understand what I’m talking about, so let’s start :

1/ US Bond market shows “health” of the global economy not the US economy alone

Since couple years it was quite easy to say China leads everything as US got economical ruin thanks to the FED mon-pol allowing China to gain economical power since 2000 at the cost of the US citizens. US jobs, quality of the jobs, manufacturing, and finally time to give up last pair of socks : innovations start moving back to China.

Because the $ is the reserve currency and we can say even global one its move up and down doesn’t really mean US economy is growing or not, especially after 2018. $ down means Chinese economy grows, $ up Chinese economy is tanking. Fair to say 2020 round of direct stimulus checks allowed mostly Chinese economy to grow, while US not in REAL terms so much, what was really great explained in the film below.

That’s why the $ moved down Yuan got stronger and yields jumped exporting inflation globally. I set the correct min just watch it for 5min. It’ll be explained perfectly :

Most people don’t get it, that not really the FED, and for sure this time not the US credit, which is available only to the top 10% of society (which not really need it) driving the economy up, but removing labor and move more jobs to China does (which is the side effect of free stimmy checks). That’s why US Yields are 100% correlated to the power of Yuan and still so many people don’t get it, making 100% false assumptions, wrecked US economy can boost global growth where key economical engine is part-time leisure and hospitality low paid jobs. That’s an economical ignorance on the epic level.

2/ No, it’s not 2008 for US. US is in “artificially” good condition this time. Crisis isn’t starting in US, it’s 2008 for China.

Because of point #1 many people start saying that conditions of the US is good and there is no way to repeat 2008, and guess what they are 100% right. Unfortunately the same mistake they did on point #1 they don’t really see that we’re driving stock market at the expense of global economy. US pumps stocks, but China doesn’t pump global economy. No, just like despite many predictions we didn’t have 100$ on oil, we didn’t have 3% on US Yields too, because US doesn’t really have economy which is driving those both assets. Instead of that US moved the crisis driven factors out to Asia, driving USD Credit in China (real economy) to 30%. Yes, US won’t see any credit stress until Yuan will start weakening, that’s another basic rule. US Credit = Yuan, just like I’ve been saying, you won’t believe how many US banks are almost Chinese, and here it comes :

https://time.com/6123962/jamie-dimon-jp-morgan-apologizes-china/

I know US patriots want to get back everything from China, but sorry, the FED’s policies still got a key task to move more to China rather to move it back.

So the FED each time trying to rescue this pathetic US economy they got no other ideas than to print money give to people, the same time remove their jobs and send those free money back to China for goods driving Yuan higher (USDCNH pair lower) – that’s an amazing economical management, but as a side effect if the US will stop doing it suddenly China doesn’t have more money flow what is stopping the global economy from working.

Unfortunately Chinese economical mismanagement is also really good, forced by the artificial rates crash using QE mostly in the US – giving us a totally false impression doing some economical things are good, but in reality they are a disaster which we started to observe in 2020-2021.

So thanks to QE, central planners started to spend money in a way true economy would have never done driving artificially GDP higher (but with zero quality of this GDP) just because of the political reasons. So the US removes jobs and raising inequality while China spends this transferred wealth on totally counter productive political needs. So 2 key countries driving downhill slowly realizing it’s a downhill. US realized that giving free money driving inflation and wealth inequality getting problems with labor shortages, China realizes that spending this wealth which US prints on empty housing market while demographic is flawed isn’t really a good thing at the end.

2008 cleaned US a bit, but China made a rescue leveraged themselves to bail-out global economy and steer it. Seeking 2008 in 2020+ as a US can get a bust is another economical ignorance, but seeking 2008 in China – that is a wise move, especially if we consider US credit and yields depend on the Yuan much more than on the FED’s ability to print more reserves and US to spend more.

3/ Inflation or deflation?

I don’t want to get back again to the discussion because 99% IMO of the fin-twit operates with the “inflation” theory based on the “secular inflationary cycle” – which last time happened between 1946-1980. 90% of fin-twit can’t recognize stagflation vs reflation so 99% can’t get the difference between secular inflation vs secular disinflation. I was writing about inflation couple times on my blog don’t want to repeat that – you can find it, but this tweet explains that a lot, while the same time I keep saying

GregTheAnalyst

In a secular bond bull market, where debt is growing and there’s no debt contraction, deflation always progressing using inflationary spikes. Each spike raises inequality, forcing the economy to rely on smaller and smaller group of people, driving velocity of money lower. Once it’ll turn out economy relies only on top 0.1% of society, assets will crash 90% making everybody equal, and the secular bond bear market will start after it. The reason for the asset deflation will be found by itself.

Disinflationary cycle allows us to get excessive supply side to tha moon, vs real demand. Driving inequality higher using inflation in disinflationary cycle is killing real demand forcing this excessive supply to … shrink. Inflationary cycle is the opposite, where after asset deflation there is excessive demand on basic goods, which is above supply levels, and additionally demand grows faster than supply side can adjust to growing demand side.

In 2021 we can say – OK there isn’t enough of supply because of COVID. I say – no matter how high those prices will jump – most of people can’t afford them and … DON’T NEED THOSE PRODUCTS at all – that’s a big difference. 2020-2021 spike of inflation exacerbated the inequality and moved back the border again higher, prices will not fall, but consumption of Apple products will be forced to decline driving employment lower, because economy grows mostly on consumption of goods most people don’t need and can’t afford.

The pre-requisite for the depression to drive down asset prices is simple. Drive down velocity of money to zero and lift up inflation so 99.9% can’t afford on anything. It has nothing to do with money supply at the end. So we left in a consumption driven economy where 99,9% can’t buy anything except food+energy.

GregTheAnalyst

Economical depression happens only in disinflationary cycles and always as a next crisis after financial crisis. GFC happened twice in 1921 and in 2008. In both cases recovery happened by artificial interventions which ended very bad in 1929 so far.

GregTheAnalyst

If you steer the monetary policy manually the same time you agree to have secular disinflationary cycles ended up by depression and secular inflationary cycle ended by hyperinflation and long term stagflation.

GregTheAnalyst

Each disinflationary cycle has its leader which goes bust. During previous one it was US which went bust in 1929, in the current one it’s China which has to go bust like US in 1929 style.

4/ $$$ isn’t dying. If you want the $ collapse you need first China to pass the economical depression to the world.

$ isn’t dying what many people saw. Considering those couple points you should understand that the $ power doesn’t really depend on the money supply, but much more on the velocity of money which is getting faster towards zero. You won’t move velocity of money higher without epic asset deflation especially in China. If you are a $ long term bear you really should understand first you need $ parabolic move up to destroy $ debt and once it’s done the whole world will start moving money where true economy is. Because true economy is in China, the world will rescue China not the US. As China will pass the economical crisis to the world and deflate the assets velocity of money will start going UP tanking the $ and probably remove it as a reserve currency and yes that will be a moment where we can celebrate transforming US into Venezuela, but probably US will go on a big war during that time.

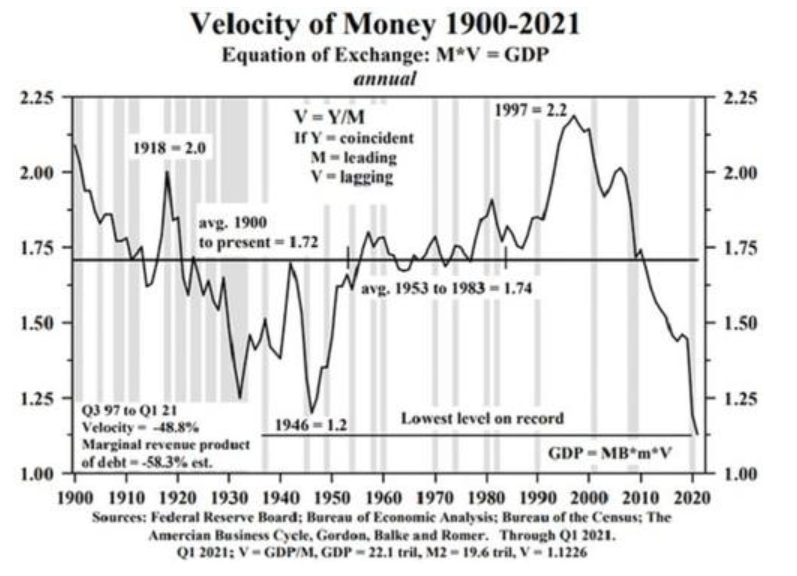

We should also be aware that low velocity happened in the last 100Ys 3 times. Once in 1932, once in 1946 and once in 2020. In 1932 we know what happened – economy cleaned finally itself from excessive zombification, so had lots of room for productivity and real growth, same time it removed inequality. In 1946 the same economical effect, like in 1932, but caused by the war. What will happen in 2022?

5/ Oil got bigger chances to reach -100$ than +100$

We live in a world of artificial growth where we had to accept negative oil prices :

That only shows how this economy is flawed if we can have negative prices of commodities! There is a basic rule. The higher the debt the lower the oil prices until debt is contracted and removed. Oil so far jumped above 2018 levels only because we managed to get one around of free stimulus checks (MMT), but the cost for it is epic. Wealth inequality exacerbated, job market destroyed. I’ll repeat my thesis that everything what happened from November 2020 should not happen. So we are now operating in a 12Ms of an economic miracle vs gravity which just postponed the impending danger, the same time it made this impeding danger power tripled.

6/ Inflation isn’t driven by the COVID, it’s driven by economical counter-productivity

The FED is well known from its perfection that any failure isn’t the result of their policies

I still claim the overshoot of the technical targets above November 2020 is mostly caused by the FED and their TIPS buying market creating epic stagflationary environment because market would have collapsed probably between June-November 2020, but at least we bought some time. Market would never drive the inflation so much unless the FED touched something they should not -> illiquid TIPS market. Better to sit this time on a really high horse thanks to the FED.

GregTheAnalyst

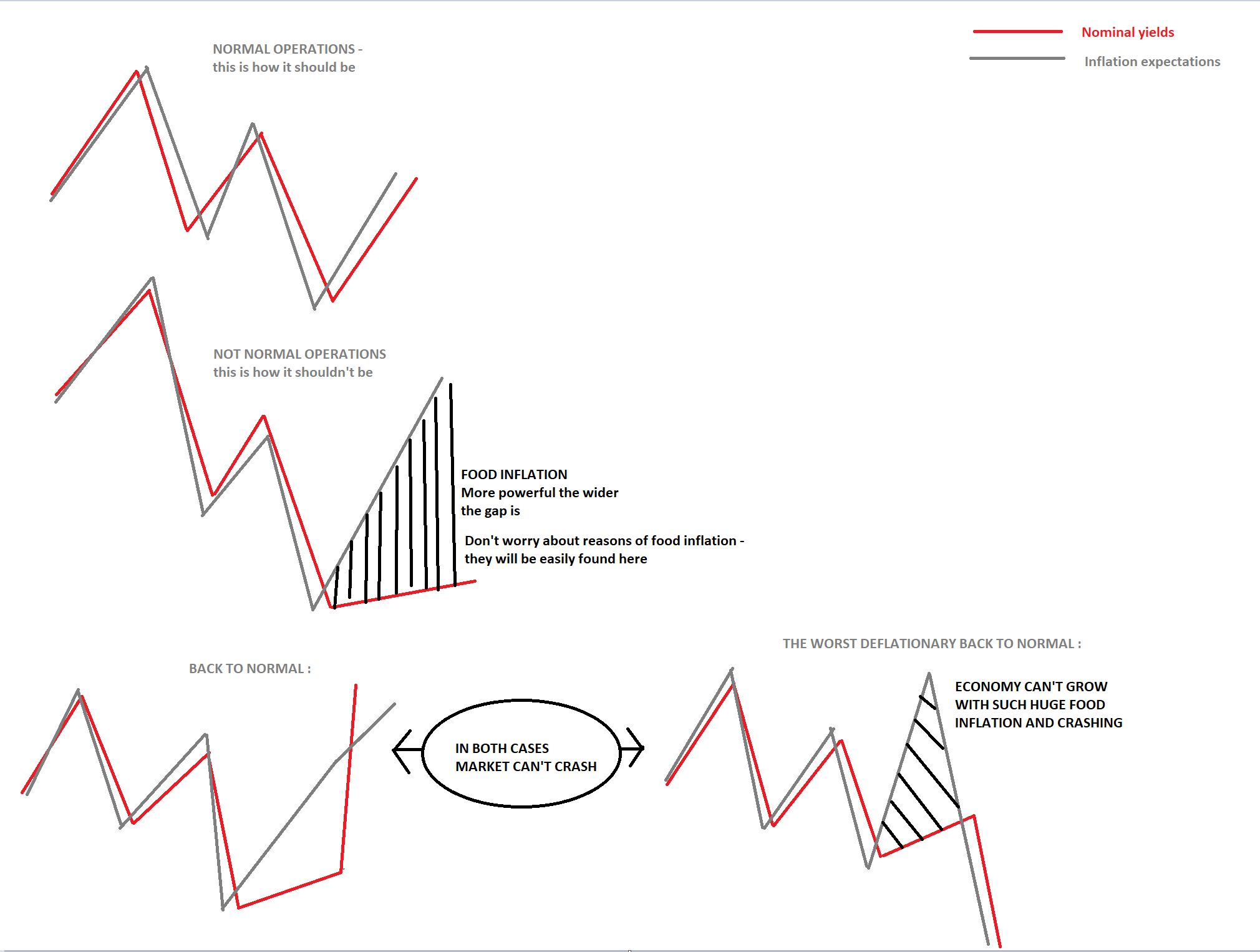

The biggest mistake made by the FED was buying the TIPS market driving inflation expectations artificially higher without real growth signaled by lagging nominal yields. I bet this is the worst decision the FED has made in 2009+ economical cycle.

FED, like 99% of people can’t really understand the difference between stagflation and reflation. I was explaining that couple times, but to remind it quick it’s this paint chart :

Reflation requires nominal yields to be above break-evens, stagflation the opposite side, but the market and the FED don’t really see the difference until it’s too late. Stagflation in disinflationary cycles gives additional power to deflationary forces (because deflation progressing using inflationary spikes). Both stagflation (in downturn) and reflation (in upturn) won’t last forever they are changed into deflation (more downturn) or disinflation (more upturn). FED in reality can control inflation, but the economy decides if that’ll be stagflation or reflation.

So the FED was moving everything to China, allowing 10-30 people to have more money than 160Ms in the US and economy has just exposed the fraud of the QE. If we can do it better maybe soon 10 people will get more than 250Ms and finally we can get to a definition of the economical depression where 0.1% can’t really fuel demand for goods where excessive supply on everything was made. Even 10Ys ago in Europe there were middle class car brands. These days in Europe only cheapest one is selling called Dacia, while the middle class brands market share was taken by BMW, Mercedes and Audi. If we can get it better in the next 10Ys we will have only 20Ys old cars and new Bentleys. You see how it works? Yep that’s the cleanest interpretation of declining velocity of money (and if we invert velocity of money chart we’ll get the inequality chart).

So the global economy is approaching to 30% of zombification. I always try to calculate it dividing global central banks balance sheet by GDP to get a real % of the zombification. If 30% of the economy is worthless and not allocated correctly you shouldn’t be surprised we have a soaring inflation on everything while the same time looking at velocity of money we really don’t have middle class to save the economy, unless buying 10th yacht for 200M$ is driving the economy up. Each economy needs a trigger to unhide the fraud, and yes COVID is this trigger, but it’s a trigger not a main culprit.

7/ Chinese Yuan drives everything and the FED’s activity is just a noise.

From volatility, US credit spread, US stock market, US yields, FED’s easing, inflation and deflation. There’s no US “economy” without Chinese currency. If the FED moved everything to China you shouldn’t really be surprised. I don’t want to give another charts this time, but if you take a look what happened when this pair USDCNH was approaching to 7.20 and how US unemployment was looking there you got it. Summarizing, economical activities will be going “up” as long as there will be a room for Yuan to get stronger (USDCNH pair down). Fair to say this pair can’t really go lower than 6.40 so far, and if you start to see how US yields are capped to this 6.40$ value, how many stocks got troubles to go higher from that moment, and how US credit is stopped you’ll be amazed.

The problem is that with higher levels of QE we move to higher levels of zombification that means we are exacerbating only true stagflationary period as long as break-even yields are above nominal yields.

That’s the side effect of it. USD Chinese HYG :

I always consider economy as a math where 2+2 = 4 (not 14). So if this pair USDCNH go lower pumping the economy in a counter-productive manner lifting up stagflation, yields on USD HY Chinese junks must go higher. Until Yuan is kept and not rallying like the VIX yesterday not much will happen in everything. From US Credit to stock market. But Yuan isn’t really free floated currency, that’s the same example like … US unemployment and inflation numbers. We steer the economy on fake KPIs and the troubles have arrived and progressing fast.

If the FED won’t make more MMT there won’t be more room for Yuan to get stronger because most of those $$$ are flying to China. If Yuan can’t be strong and will start weakening, US Credit will deteriorate really really fast, because if Yuan will start its rally (weakening, USDCNH pair up), and it will, and will be fast, the FED will have to start making MMT on 5000$ levels removing lots of small & medium enterprises by a side effect making it full banana republic throwing labor market directly to the rubbish bin.

So the FED got 2 choices which are forced by the economy :

1/ Driving more MMT removing more jobs, bankrupting their 90% of job market -> small & medium enterprises, finally getting 30 people rich as hell and 250Ms getting nothing approaching to velocity of money = 0, driving zombification towards 100%.

2/ Crash asset inflation, balance everything and remove zombification, so 30% of the economy is out get pain to rebuild and rediscover true economical needs.

One thing is sure … Interest rates toolkit doesn’t work from 2018, QE doesn’t work from 2020. MMT got sugar high in 2021 and fading.

We can summarize our point #1 here. Either US yields will drop, or Chinese economy will have to pay 50% on their yields collapsing factories of the world into one big bankruptcy spiral.

8/ US corps are more depended on true economy, so Chinese economy, than to its domestic banana US one.

I won’t give you much details, but try to observe the dependency between Chinese Yuan and US Corporations. I’ll give you a hint of 2 my favorite. Deere ($DE) and Caterpilar ($CAT).

I call those two – semi Chinese companies. They always got fuel upside when Yuan is getting stronger, but crashing fast when Yuan starts weakening. Since some time Yuan got troubles to be stronger, same time CAT dropped -20%, DE just -10%, but one thing is sure, both got peaked exactly the same moment USDCNH pair noticed bottom at 6.35$ in May 2021.

I bet those 2 companies will be massacred while USDCNH will jump to 7.00$.

I think it’s also fair to look at top US Banks, especially when Dimon from JPM is on knees in front of Chinese Communist Party (CCP).

Banks like HSBC, Credit Suisse, and most European banks look technically worse than Lehman Brothers in a year before collapse. Technical charts know always 100x more than any fundamental analysis. While Lehman was tanking they were till the end using their accounting gimmicks to hide losses. Market knew about it, digits from their official reports did not.

https://www.businessinsider.com/report-lehman-brothers-used-accounting-gimmick-to-hide-the-size-of-its-balance-sheet-2010-3?IR=T

9/ Emerging Market currencies are ready to collapse.

From Mexican Peso, Chilean Peso, Turkish Lira, Brazilian Real and Russian Rubel. They are all going to blow up or … just blowing up.

The $ power is more dependent on the velocity of money than on money supply, what I wrote in point #4. That’s what I’ve been saying and here comes the side effects. Considering previous 1921 financial crisis and … Weimar hyperinflation, these days we started from Venezuela in 2014 to get more and more problems in EM F/X land. Argentina joined the club in 2016, 2020 Turkey with Lira, Brazil is also on the verge and Russian Rubel just got couple sigma move.

Weaker moves up of the $ are causing bigger troubles in EM F/X land, but $ needs to weaken a lot these days to get EM F/X stronger. Why?

- Zombification is hitting us

- We got thanks to too cheap money kept by too long wrong allocation of economical resources in 30%

- More money supply boosts more inflation and lower growth

- Some countries came to conclusion thanks to money supply that relying only on one-two sectors of the economy is totally OK – well it’s not.

- Growth is being fueled only thanks to Chinese Yuan but China needs to pay 30% on USD HY bonds as 30% of the economy is dragging everything down

- The world needs more $$$ to sustain economical miracle, so increase level of zombification, inflation and inequality. FED can’t print faster than the world needs $ to sustain zombification and now inflation has arrived.

10/ Basic economical and mathematical equation driving everything

Math is still simple :

Money Supply (MS) x Velocity of Money (V) = Growth (G) x Inflation (I)

If MS is approaching to infinity and V = 0 then

MS approaching to infinity x 0 = Growth x Inflation

0 = Growth x Inflation

Let’s say Inflation can be 20% so

0 = Growth x 20%

Growth = 0

It’s a simplification, but that means the lower the velocity of money goes (true economical gravity) the less money supply really means to the economy what I think we observe these days.

I’ll risk another thesis, the economy declines velocity of money faster than the FED can grow their balance sheet raising zombification.

If that is true, the $ value should approach the infinity in very simplified theory of course.

Yes that’s how it progressing. It’s a math. If you try to bypass it one way, economy will adjust the second side. There will be a moment where EM will be forced to raise rates when credit will be contracting in their domestic currency.

The economical downturn has not ended yet… We’re still operating on 2009+ overextended cycle.