1929 vs 2020 – my view

April 9, 2020

Plenty of discussion about V-Shape recovery, and how we’re going to avoid the depression, so before we start looking for a difference between 1929 vs 2020, how I see it, let’s define some basics :

The trigger – can be anything that can blow up the economy based on excessive debt. Now we have COVID19 which is nothing more nothing less, just a trigger checking how economy is powerful to survive in an unproductivity caused by too much debt.

Deflation – should be debt deflation. Economy collapse caused by excessive debt as a result of keeping artificially too low interest rates for too long aka “cheap money”. After financial crisis there is no return, so “cheap money” also must be supported by balance sheet expansion to push even more excessive debt, which finally turned counter-productive slowing down economy by itself and await for a trigger to unload. Economy depression in the cycle always comes up as a next crisis after financial crisis which by definition is a first warning of unsustainable debt. Depression unloads the debt seeking for productivity, punishing gathered unproductivity.

Overcapacity – if you keep cheap money for too low you build excess capacity same time crashing velocity of money so promoting 1% people living from financial assets. Economy is like physics, you lift up a stone to give it potential energy, you can change this energy into kinetic energy by dropping this stone from the height you lifted it up. To simplify that let’s imagine the whole economy produces X, you have 20 companies producing X, demand for X is 200. The cheaper the money the higher amount of companies producing X, raising exponentially, but demand is not following the same path only linear. Let’s imagine 20Ys ago we had 20 companies, 200 demand, each company was profitable and sell 10 X things. 10Ys ago we had 200 companies 300 demand, some getting losses. Now we had 2000 companies 500 demand and trigger came and this demand is 50… You got it? We will use those “2000 companies” in some examples later.

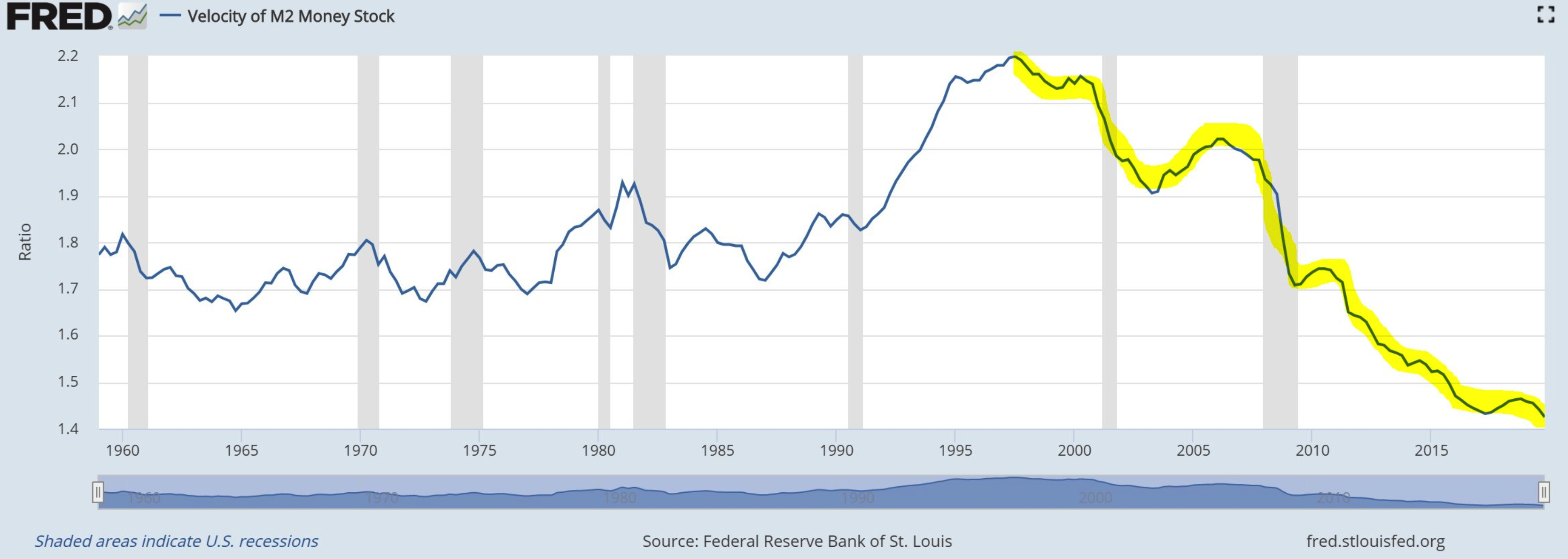

Velocity of money – it’s showing how money is circulating in the economy. It’s a good measure how monetary policy works, where is a peak of middle class, and when monetary policy started to be unproductive. Good interpretation is also when we finished natural business cycles and when credit cycle has started. Easy to see FED screwed the economy around late 90s. Looking at interest rates that’s around 6%. So neutral rate of interest rates is 6% it means it sustains productivity, eliminate very fast unproductive companies, sustaining middle class and their wages. The lower the line goes the bigger unproductive debt which by itself stopping economy removing any shields to any shocks.

Trade wars – when final overcapacity hits the economy and demand for goods collapsed as velocity of money crashed exacerbated by a trigger, but initially it was crashing due to excessive debt, economy is not able to absorb more easy money – we’re going to see trade wars, which are growing the more economy can’t absorb cheap money, like in May 1929. Action = more cheap money – Reaction = more trade wars. If country A produces X, and country B produces X and demand went from 500 to 50, you’re trying to limit access of country B to markets of A at any cost especially if for example 30 from the 50 demand left belongs to country A trying to save its own companies, who cares about country B anymore. Ain’t that so simple?

Some time ago Bernanke said :

The Great Depression was caused by people, while COVID19 is a natural disaster

I think this chart below showing key difference between 1929 vs 2020.

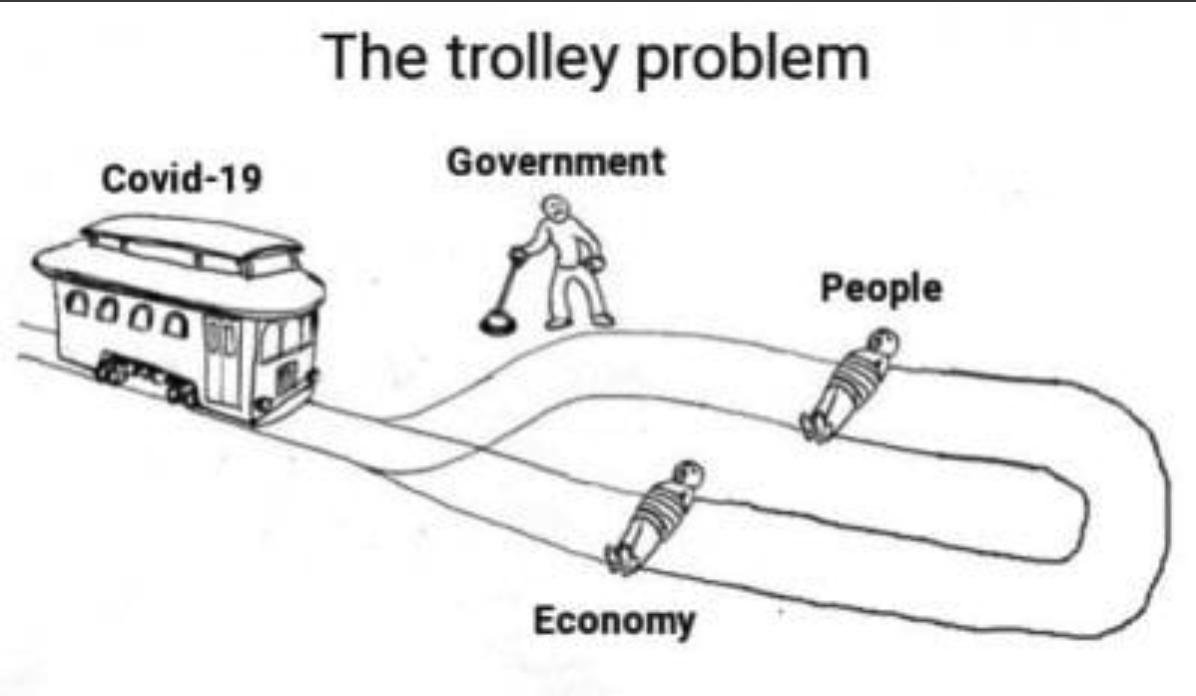

Let’s replace COVID19 by trigger – it can be a man’s mistake, or can be a natural disaster which just triggering deflation – checking how economy is well prepared to recover. When a cycle trigger arrives you can have 2 possibilities/options trying to rescue the economy.

- First people later economy (1929) – not political, painful, fast

- First economy later people (2020) – political, more painful, slower

That’s the general difference between depression of 1929 vs 2020.

Here’s how it works :

In 1929 they were constrained by gold-standard. It means lack of possibility of infinite money printing. Now we can say that was great, because they were not able to pump economy so long on easy money as a result on a final bust paid just lower price (if 25% unemployment is low price paid, watch 2020+ levels from option #2). We don’t remember, but FED was printing trying to get out from 1921 financial crisis which is a first and last warning of unsustainable debt deflation. Next cycle by default so far always leads to depression. The expansion after 1921 wasn’t going like it should, FED slashed interest rates to super low levels and as expansion still had some headwinds, so it offered balance sheet expansion buying Treasuries as a stimulation between 1924 until 1929, when another depressionary symptom kicked in – trade wars in May 1929. They weren’t allowed to stimulate more thank God, so as a chart above shows Government decided to run the tram over People first so used option #1.

We shouldn’t forget about the productivity boost and first electric amenities, radio, advertisement. Depression has its own technology, which excess needs to unload. They were all believing those times the new technology will be always selling to infinity especially in 1929 in late October ignoring the fact economy was dropping like a stone way before Black Monday as it was not able to absorb more supply with lowering demand on crashed velocity of money awaiting for a trigger to arrive to unload it. 90Ys later all those clouds, internet, social media etc – just saying.

Anyway, almost 25% unemployment hit the economy, riots exacerbated, panic and poverty couldn’t be hidden. Adolf Hitler in 1924 was even predicting the collapse, when social unrests started to climb as wealth inequality started to kick in, and his populism was raising and raising and in 1932 he become the final leader telling people – “I told you so, Jewish bankers screwed you up on those loans”. And all said yes he is right. Economy unloaded, unproductive overcapacity went bust, economy found new way how to utilize unemployed and party restarted. Quick and simple.

Cycle made a turn. Destruction of productivity forced inflation to appear, many from those “2000 companies” collapsed, the same time, due to lack of them, demand for goods exploded. Overcapacity was removed for good. Now demand > supply = inflation. Inequality started to be equality and capitalism was replaced by socialism. Those bankrupt resources were utilized, started to fight against inflation now in a productive way inventing low displacement cars limiting expensive oil consumption. 5L/100km instead of 40L/100km – huge difference. Inflation stabilized, crisis in late 1980s passed and switch again to deflation. Interest rates started to drop to repeat another time 1929, building overcapacity, slashing demand and raising inequality. Rinse and repeat.

In 2020 the FED was working really hard to sustain overcapacity and transferring wealth to top 1% as a side effect. As velocity of money has been crashing for years (mostly peaked in 2000), FED’s cure was same to crash this velocity of money more = bigger inequality gap = less resistance to any deflationary trigger / shock. As you can imagine shock unEXPECTEDLY arrived in the worse moment. Earnings were in decline (due to lack of ability to absorb in a productive way more money), and in general economy was melting down way before the trigger hit. Instead of taking fast path, this time Government decided first they want to roll over economy and as a side effect trash people. So as demand crashed and will never return as velocity of money crashed too, FED’s been pumping more money = allowing unproductive companies to stay in the market and promoting them to harm the economy further. Effect? So far probably 30% unemployment and record GDP contraction, we’re going to beat 1929 I think easily. Others going to devalue their currencies in its way to zero crashing their own economies, as without significant cleaning, economy will never restart like many predict in 2H20. It won’t happen at all without bankrupting 90% from those “2000 companies” (this amount of restaurants…) to meet a real demand issue, forcing 90% from those “2000 companies” to rethink and find new productive alternatives. But years of FED’s rescue made all those companies such unproductive, that even Boeing was better in cooking books and financial tricks he forgot how to make planes. Plenty of companies around, everybody can cook books and not much more. Years of sustaining unproductivity harmed so much, that people and companies lost totally ability to think and implement real changes to move back to productivity. The bigger the harm was done and longer it took, the bigger the price we’re going to pay. That’s an alternative #2. It will be way way more powerful and more depressionary than alternative #1 but it will be in slow-motion.

There is no way you can avoid depression. Without it, after a big trigger economy will never recover.

At least, these are my thoughts.