We are entering in the second junction … 2Q20 sit-rep

April 17, 2020

After initial drop, which surprised lots of people, we are entering in another junction or uncharted waters. You can cheat SP500, you can boost NASDAQ, but quite hard to cheat the key index which is not susceptible for manipulation = Dow Jones.

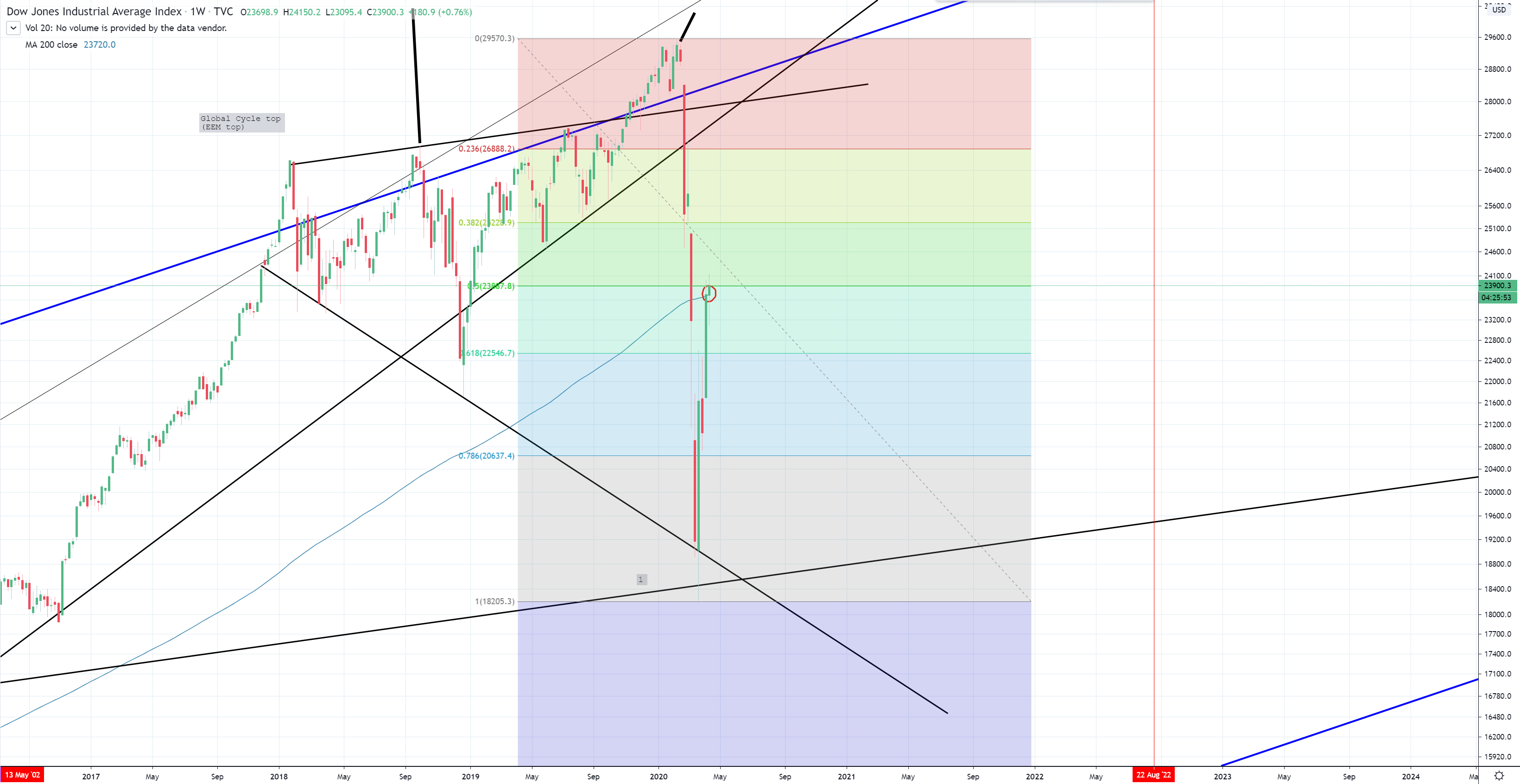

When the last depression was attacking in 1929 let’s see how first bounce was looking like (for better view click on each image right mouse button and tag open in new window)

It bounced from the top trend line to 50% FIB retracement, later dropped below (W)MA200, small bounce from top trend line and market tanked.

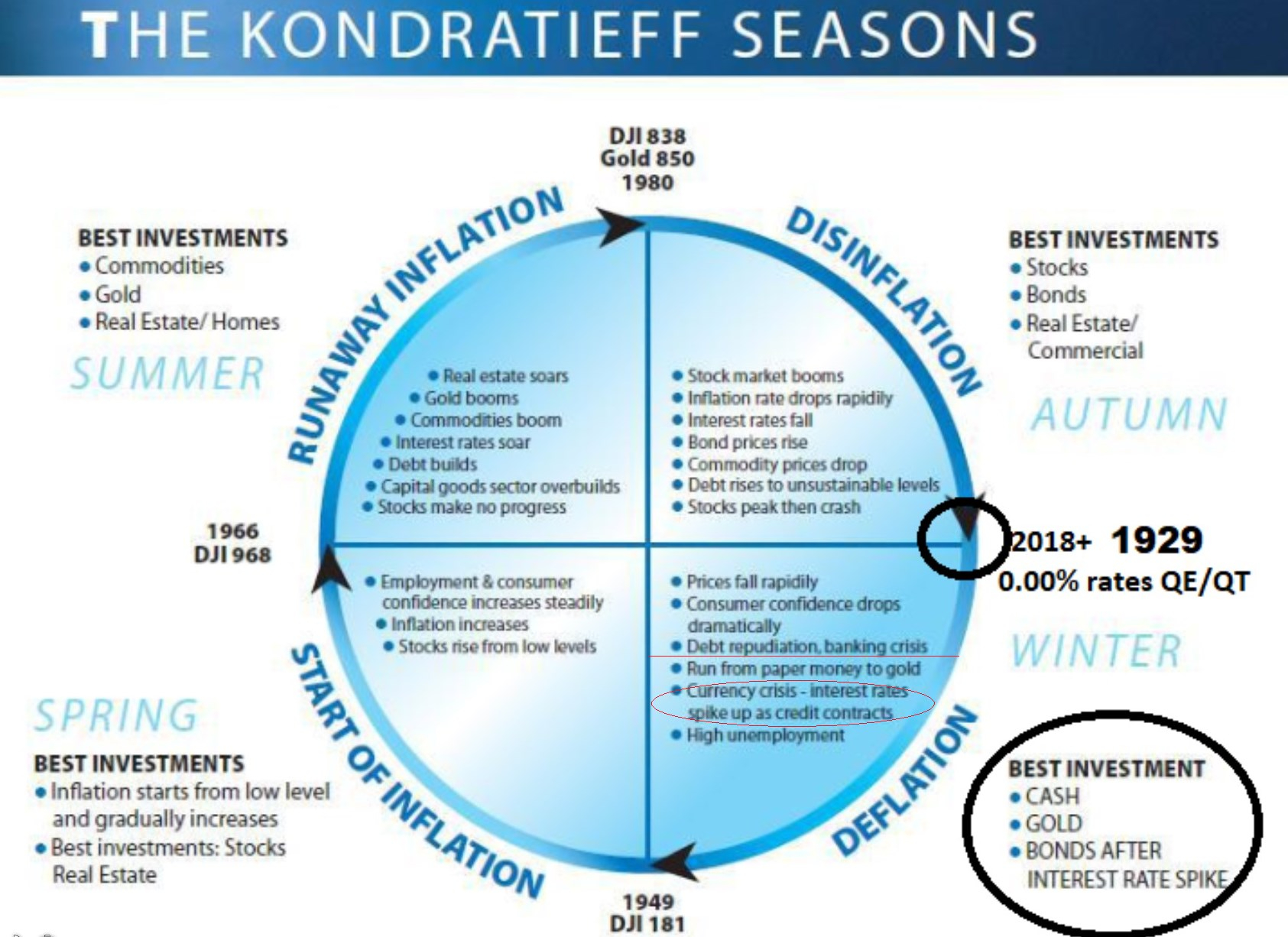

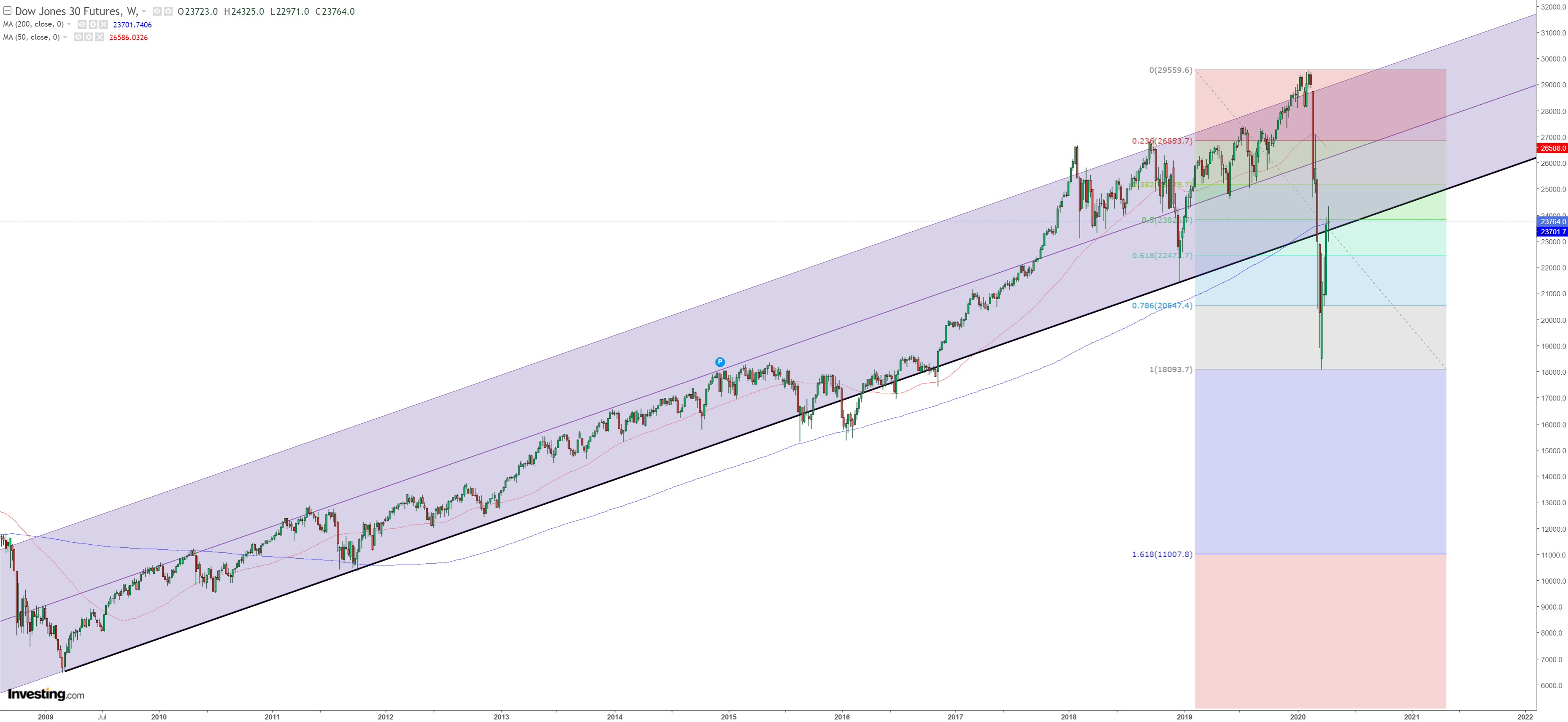

I have a good reason to use this chart, showing that 1929 went beyond the trend (blue line). The key point I’m doing it, is because returning DJI to the 1929 levels in 1954 signalling end of depression, and return to the mean like below, market underlined by crossing the mid-blue-line (marked with pink dotted line).

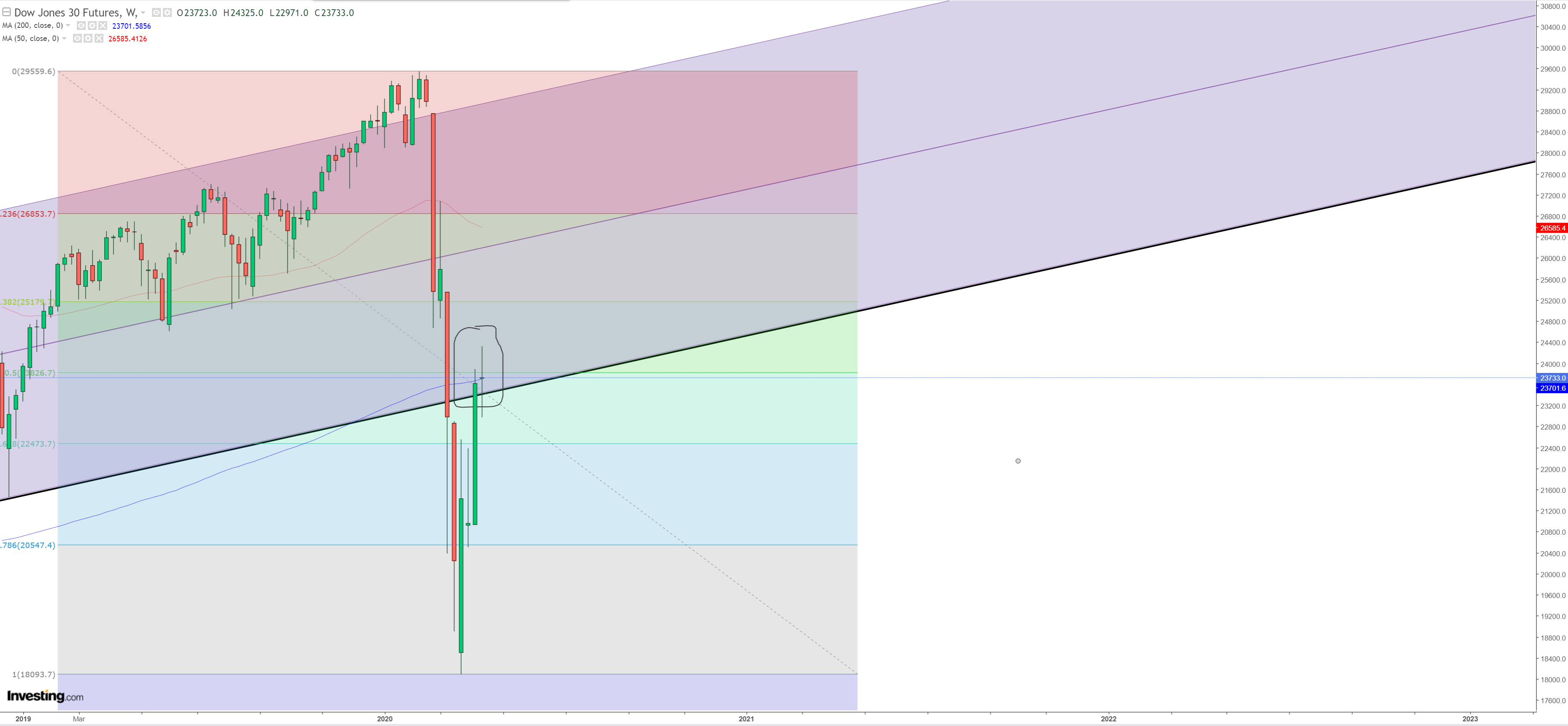

Now if we look at the current setup. First long term log chart. The top blue line is the same blue line 1929 was bouncing from. This time it wasn’t overshot so much, market crashed and bounce from #1 line that is a trend line based on 2001-2008 tops (similar line was top blue line in 1929, based on tops of the previous cycles). Also worth to notice it’s the same Fibo 50% retracement and also (W)MA200 level :

If we look at just a cycle trend non-log we can see it even better, so cycle trend + (W)MA200 + 50Fib retracement are all in the same place. Around 23800 (looking at futures, or 23900 looking at cash) point DJI and now creating one big weekly DOJI star – what might mean reversal …

I do really understand so many people believing Central Banks got our back, but just like they failed to prevent QT blowup in 4Q18, then crash in 1Q20 as they were trying by 4Q19 repo bailout IMO, now depressed economy keeps squeezing everyone and put lots of things to the economical mixer where in a “moment” it will release another trigger with boiled unemployment levels, poverty, scare and frustration, wages which went down, lowering velocity of money, revenues slashed, buybacks dropped to zero, CAPEX zero, 60% profits drop, sales drop and people are doing really unpredictable bad things during such times. 1200$ checks and food banks won’t restore confidence for a long time, especially if we lost in the US 12 years of job gains (low paid anyway) in just 4 weeks. You see how long it needs to go, and how fast it might be wiped out. The bigger the debt, the faster the collapse. Jobs are an excellent example of this fact.

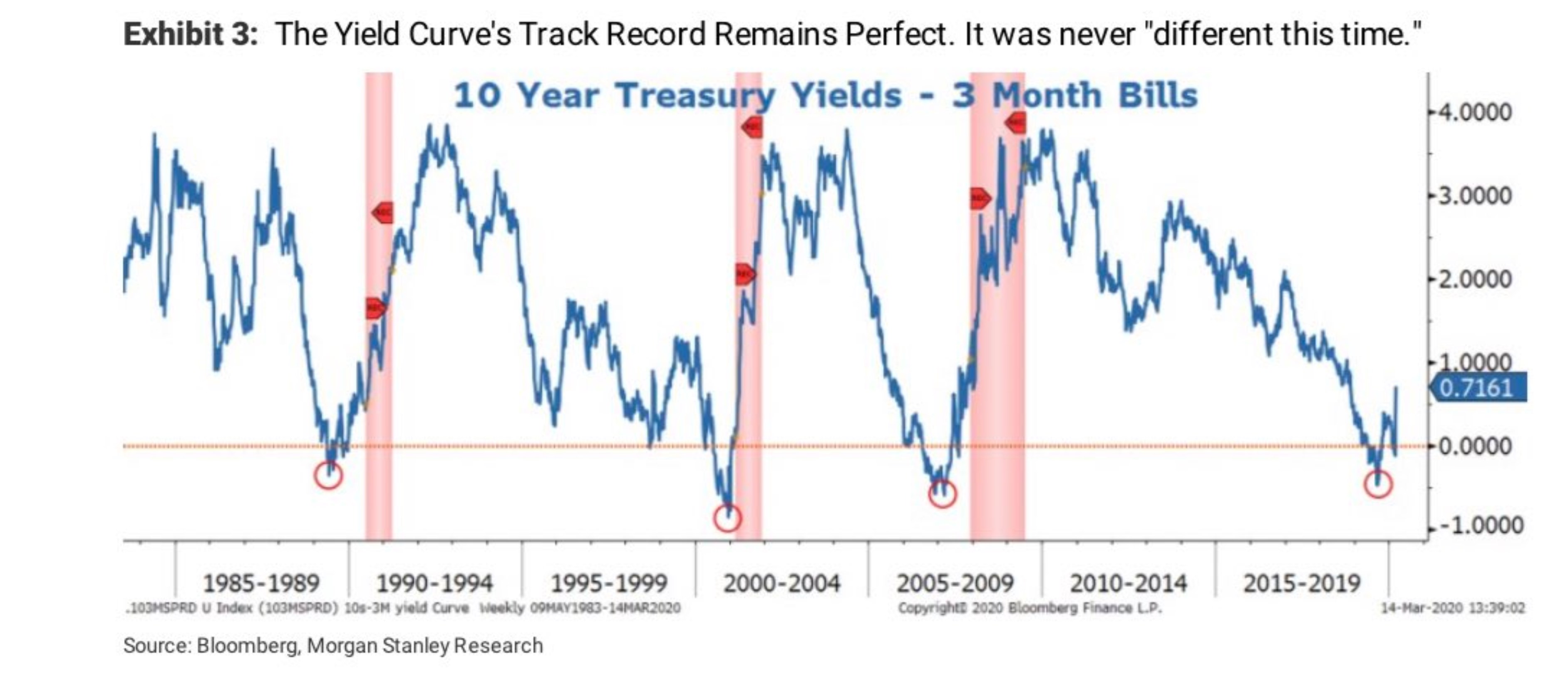

The yield-curve inversion is way way in depressed levels, it needs to go towards 3.5-4.0, if Central Banks will try to manipulate it and artificially intervene in the market, we’ll have a permanent state of depression like in Japan which stock market peaked 30Ys ago… Japan was first trying those monetary tools. The first who tried it – won the monetary experiment, now all countries will try Japanification, what at the end might just speed up the collapse. Worth to notice Japan tried that on the beginning of disinflationary cycle, now we are at the end of it with crashed commodities to record lows.

We have to clean the economy to build fundamentals for the next growth. Without it … No way.

Again, it’s not something you should be all-in – always manage your risk. I’ll prefer to sit in a bull-market doing nothing and chilling, but risking bets only against a market during bear markets without playing moves up honestly concentrating on scaling on larger moves down. But my credo is – take all the money out from bull-market sit in liquidity and spend them at the bottom.

Saying more… I sit 90% in liquidity (cash/gold/bonds) from 2018, and only 10% of money today is on the broker account, where 35% is placed as a bet against the market, so as you can see I risk less than 3% portfolio.

You should make money during bull markets, during bear – you should save your capital, not necessarily doubling it. Unless you like changing your positions every 1h or 1 day. That’s not me, I prefer weeks/months/years.

Golden Pareto rule :

20% of portfolio will generate 80% profits

So considering good shots on the downside on leveraged bets 20% of portfolio really might give you 80% of profits.

Considering the whole my liquidity portfolio is 100%, keeping it from 2018 was a good bet so far.

Cash gave me +10% – 70% portfolio

Gold +41% – 30% portfolio

Bonds +100% (kept 3x leveraged long) – 10% portfolio, but OUT and returned to cash.

As you can see I almost don’t have any risk of the capital, it’s just fun now. This wheel I stick the most in my investments. A little pity we’ll have to live in inflationary period next, but you just need to prepare for that.