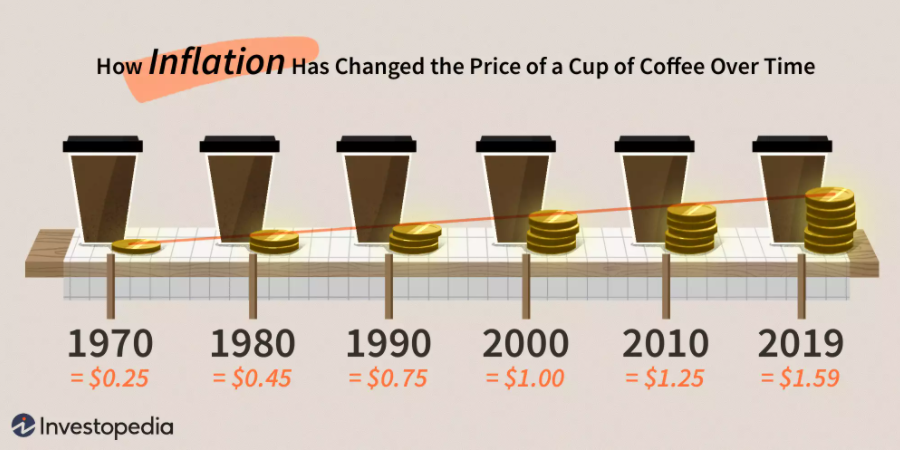

Inflation in stagflation and inflation in deflation. Same term and two different meanings.

October 12, 2020

The more we’re approaching to panic the more we have fight about interpretation of inflation. Despite the fact I wrote about that in my previous article here :

I think there is a need to clarify differences. I encourage to read the previous article from the link above, so you can move forward and understand more things.

Here is the table I created , but in general :

Secular disinflation or disinflationary cycle is a secular bond bull market and secular inflation aka inflationary cycle is a secular bond bear market

| Secular inflation (40-80) | Secular disinflation (80-20) | |

| Velocity of money | Going up | Going down |

| Debt | Building | Busting |

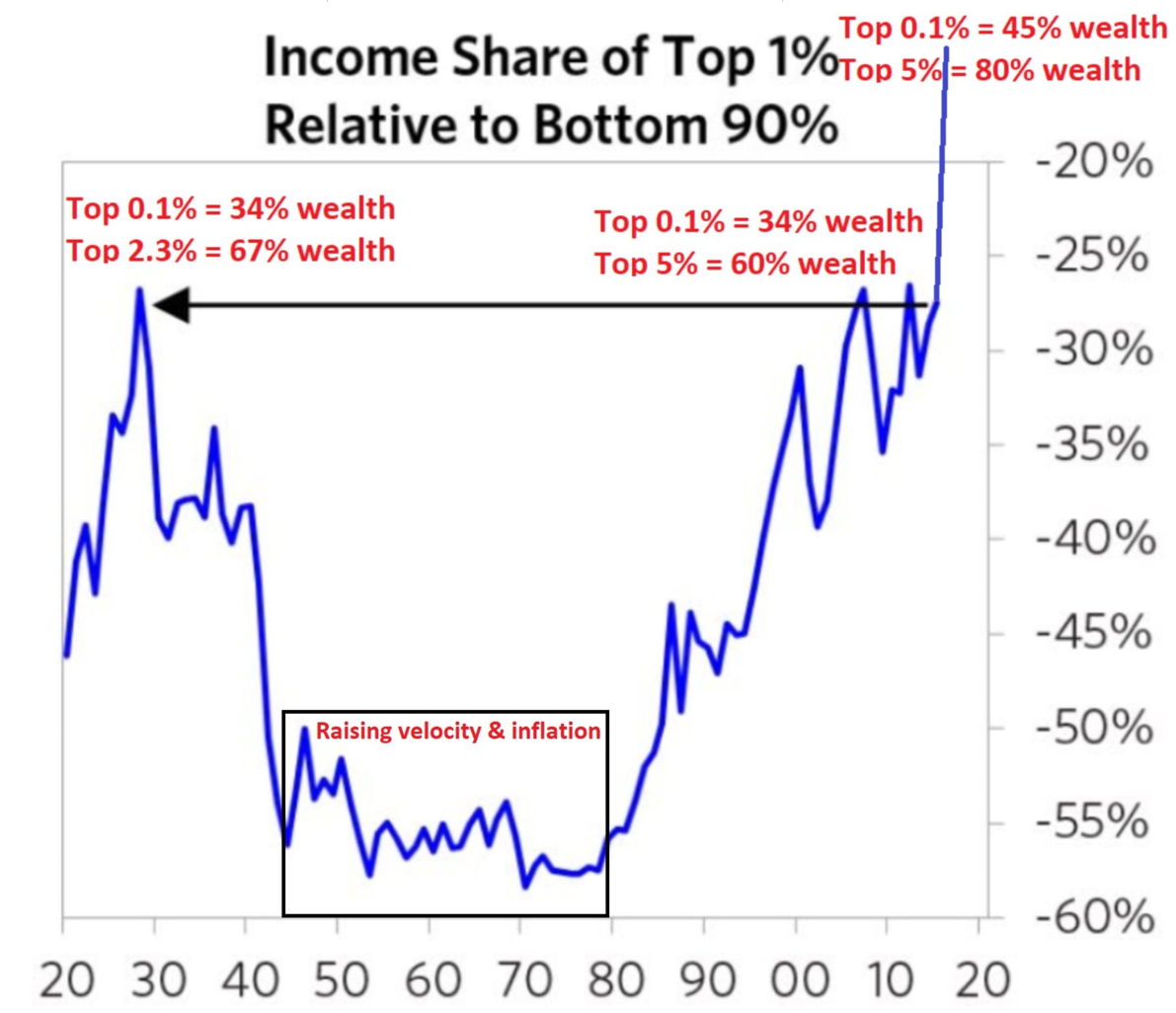

| Income share of top 1% relative to bottom 90% | Low | High |

| Biggest “inflation” problems | Cost of living inflation | Asset inflation/Housing market |

| Middle class availability | Very high | On extinction |

| Capacity to demand | Demand > Capacity | Capacity > Demand |

| Savings rate | High | Low |

| Agriculture | Crop prices record high | Crop prices record low |

| Type of crisis which forces the change | Stagflation/Hyperinflation | Depression |

| Bond market | Secular bear market | Secular bull market |

| Interest rates | Going up – can’t handle inflation | Going down – can’t handle deflation |

| Fertility rate | High | Low |

| Demographics | Positive | Negative |

| Housing affordibility | Most people | Top 10% |

| Technology break even point | Low displacement cars | First electric amenitities (30s) /Internet (2020s) |

| Bottom 90% wages | Keep going up | Stagnated – going down |

| Stock market | Secular flat | Bull market |

| Best investment | Real Estate/Gold/Commodities switch to stocks | Stocks/Bonds/Real Estate switch to liquidity |

| Political System | Communism/Socialism | Democracy/Capitalism |

| Currency benefits | Everyone wants to have strong currency | Everyone wants to have weak currency |

| Job market | Excess amount of jobs | Weakening demand and lower & lower paid jobs |

| Education | Appreciation | Devaluation |

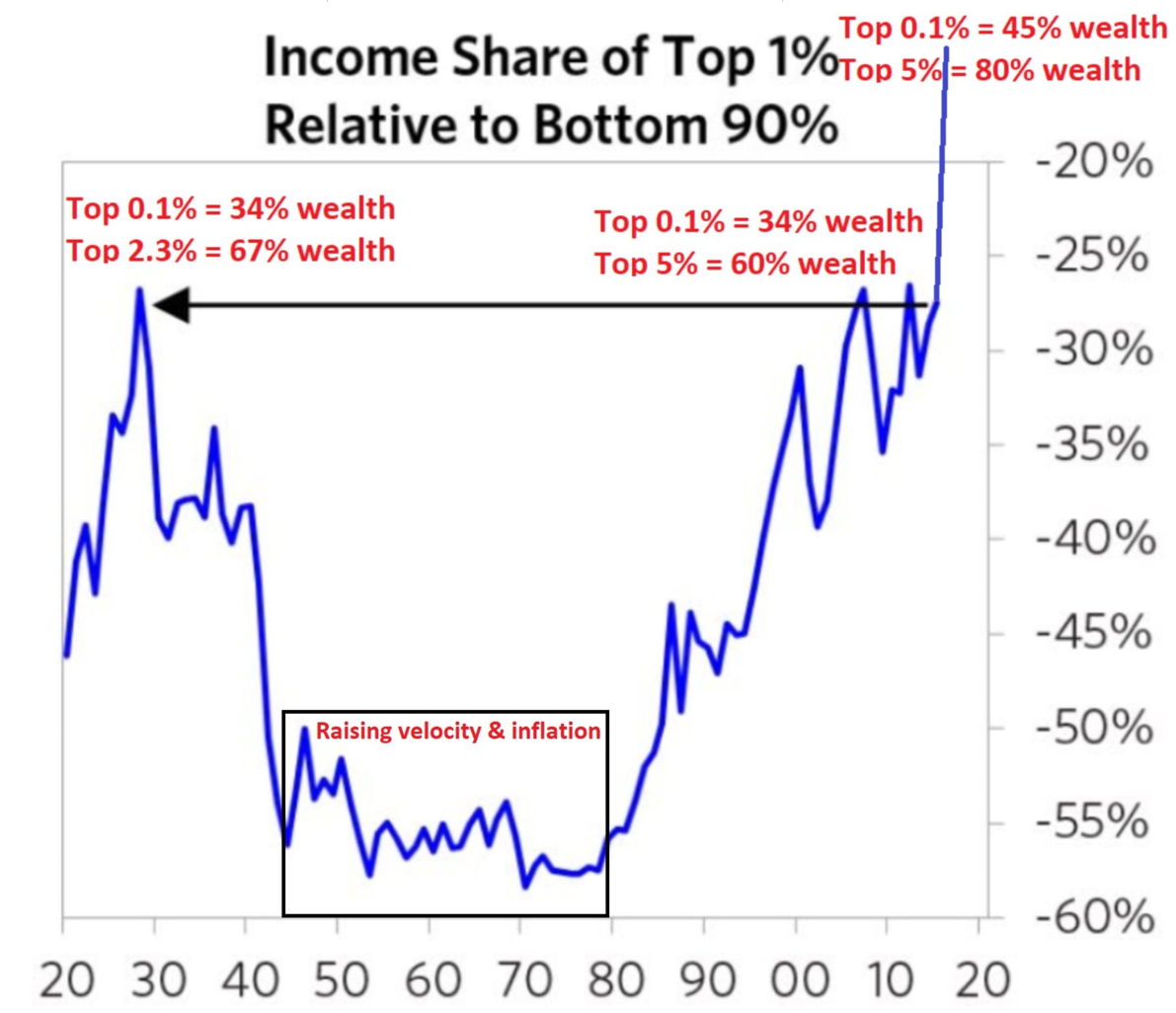

And I’ll repeat the chart maybe in 2022 top 5% will get 80% of wealth, but this will have consequences.

Summarizing this chart :

There’s no secular inflation without middle class

What’s more important is that deflation progressing using inflationary spikes. Reasons are 100% different than those in secular inflationary cycles , so by definition which I exacerbate as much as possible to visualize it as strong as possible we have :

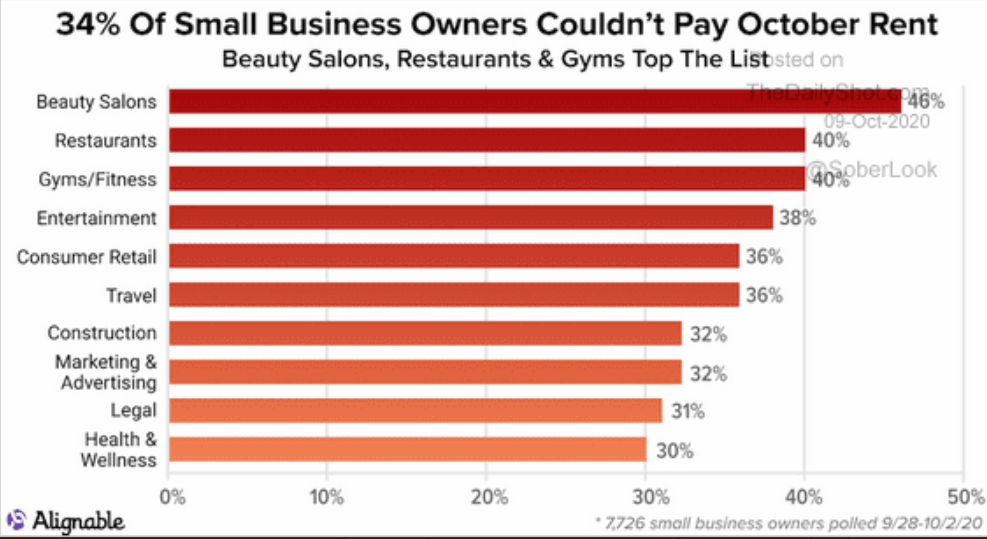

Deflation is the moment when housing market is becoming worthless because too many people classified as a middle class working in small businesses like restaurants is push to poverty as wealth inequality caused in disinflationary cycle only allowed them to work on weaker and weaker business models, where excess capacity keeps raising and raising during the whole disinflationary cycle, until their margins are negative and bust occurs.

What trigger you’re going to use to achieve it – doesn’t matter, but I’ll tell you those triggers will be mostly inflationary spikes, but let’s define what is a secular inflation and let’s call it stagflation :

Stagflation is the moment when excessive middle class starts chasing with excessive money much more goods than supply side can give them. In stagflation supply side is very much limited to the purchasing power of the middle class. Middle class is so wealthy here that economy isn’t able to give them enough goods to consume, so they keep chasing those goods which left.

Does it mean in deflation prices are falling down?

Of course NOT – or not all prices, but calling secular stagflation from 70s in 2020 is the same mistake like calling 70s to 30s. In 70s and 30s inflation was indeed spiking, but in 70s till they realize building debt might give them a chance to get out, in 30s that bursting debt might give them a chance to get out. Both periods show the same symptoms of economical crisis. If you see riots in Venezuela and riots on US streets there’s really not much difference. Venezuela was a great example of working socialism (till 2014) and US the greatest example of capitalism. Outcome is same, but let’s talk how deflation unloads using … inflationary spikes! Let’s use restaurants example. It’s a synonym these days of the middle class collapse. Here you got all the synonyms of middle class collapse progressing.

Top 3 : Beauty salons, restaurants and gyms – the most oversupplied to demand and probably those which hire the most people, or at least most jobs created in the credit cycle (2000+) were allocated to those sectors.

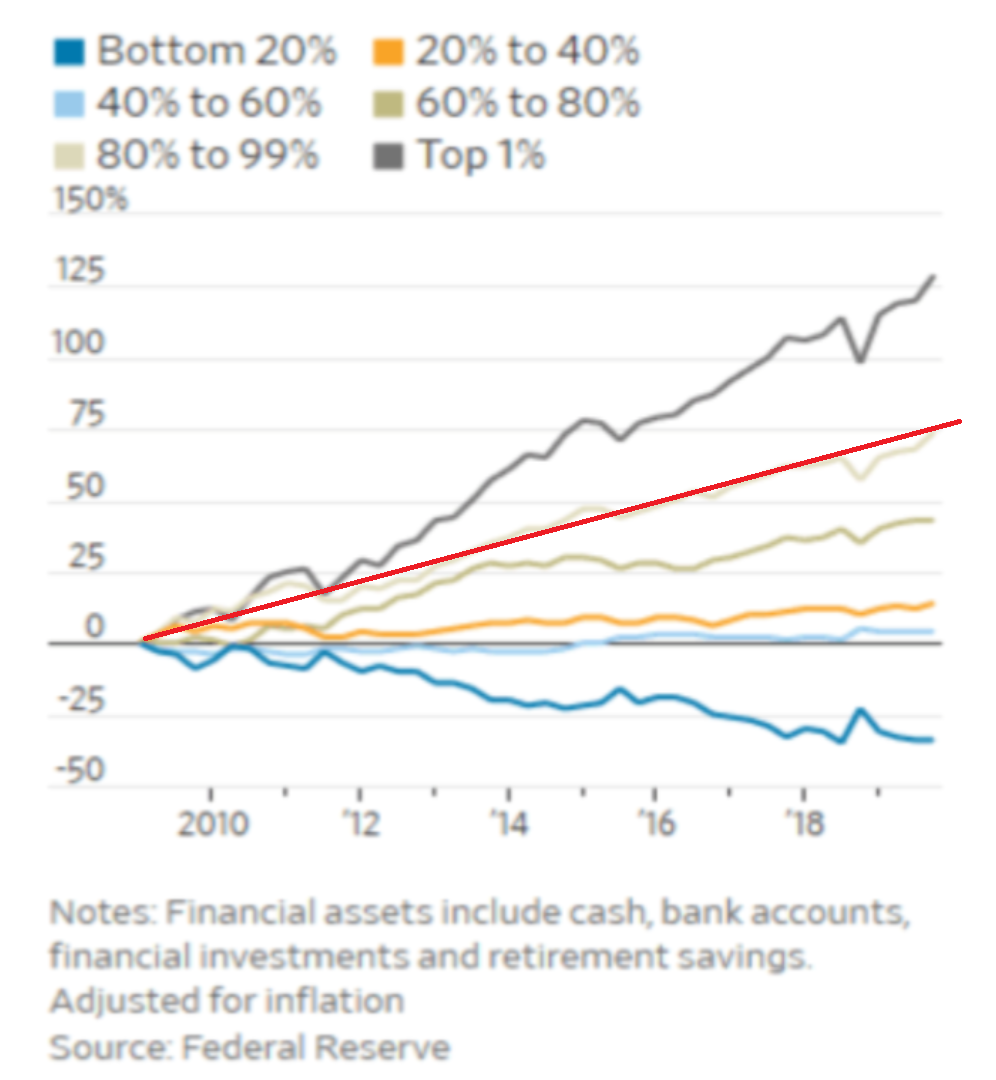

Each crisis shrinking their margins transferring the difference to top 1% using asset inflation widening the inequality gap further like below. I additionally put the real cost of living line – the RED one (it’s an assumption and simplification) so we can clearly see how it’s going :

Fair to say if you want to earn something, you have to have not 1, but 2, later 10, later 30 restaurants (excessive expansion – one of the key reason of deflationary collapse), as the lower rates going the higher amount of middle class small business you have to have to get through break even point. So my favourite example :

Let’s say in 2000 you had 300 restaurants and 300 demand, as cheaper money only stimulates supply side in disinflationary cycles to get as much expansion as possible, so 10 years later in 2010 we had 1000 restaurants and 500 demand. Demand never can even catch the supply side in disinflationary cycles, and in the final stage of disinflation supply side getting ^2 or maybe ^3 faster than demand can raise. In 2020 let’s say we have 3000 restaurants and 600 demand, but as trigger arrived this 600 demand has been shrunk to just 300 and now everybody can see the problem of excessive unequal expansion (but Central Banks using tools to raise up this unequal expansion to higher levels) which additional was set as a permanent :

We push the wealth to this bag :

And removed the wealth and cut permanently demand from this bag :

In economy nothing is for free, so now busting occurs economical gravity kicks in and :

Let’s say 2500 restaurants left (500 is already removed from those 3000) but demand is still 300 and it won’t raise, because wealth was already transferred (you see the first chart and this line towards top 5% and 80% wealth). If the next recovery cycle would occur, I bet we’ll end up with 6000 restaurants and 400 demand. That will happen if it’s a recession and liquidity problems are just the only one problem, but it might be a break even point where you can’t do it anymore and economical gravity keeps bursting it so will adjust supply side to demand. By definition it’s called economical depression which is a total reverse of this excessive expansion paradigm. Now you’re going to see how 2500 restaurants which will be shrinking to 300 no matter what you’re going to do, rather seeing 6000 restaurants anytime soon.

Disinflationary cycle by definition has 1 task using inflationary spikes – remove excess supply side (amount of restaurants/hotels/airlines/beauty salons/taxi) to rebalance the economy. Yes, it will use inflationary spikes to do it, but not the one everybody thinks including Central Bankers. The more you try to resist the bigger the spike will be.

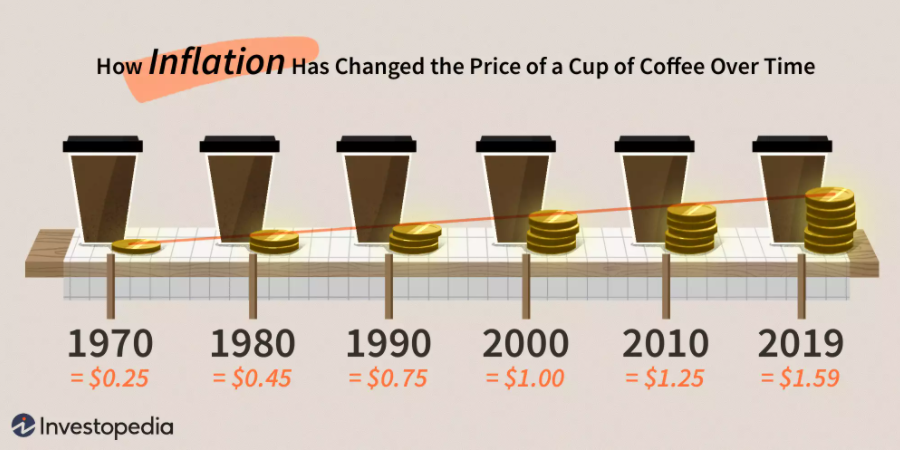

Imagine you started your work in 2000, you earned 2000$, now Millennials entering the job market and in 2020 they earn … 2000$. This inflationary wealth difference, as we all know 2000$ in 2000 isn’t same as 2000$ in 2020, is of course in asset inflation which is the only one secure position which can bypass inflationary problems of the disinflationary cycle until of course gravity kicks in.

Let’s imagine we have 3000 farms (equivalent of basic cost of living inflation). Prices of crops keep going down till, just like restaurants, you get negative margins caused by excess supply so you start selling crops below their true value and your living standard deteriorates. You can always try to chase expansion to ^3 level, but once you hit negative margins on everything, you are ultimately done and finished and being removed from the system.

If the farms will go bankrupt, shrinking excess supply will raise the prices of the food (just like shrinking taxi drivers will lift up taxi prices and shrinking amount of restaurants will raise their prices) – that is inflation, but caused not by too much money chasing too few goods, but rather too much excess supply is bursting trying to find fair value which will be always higher than today. So this inflation has nothing to do with “prosperity” where middle class keeps chasing goods, because their wages growing faster than amount of goods in the economy.

Prices will be raising to a level where farmers can sustain their normal living style, but due to the wealth inequality each step higher in removing excess supply will make prices skyrocketing raising basic cost of living as supply side is shrinking, but demand is still desired for basic services (you need to eat, drink, pay for electricity and all that with lowered wages), despite the fact it’s so far still relatively small. This inflation will be removing useless consumption of iPhones (etc. example like restaurants) as people will be chasing basic goods, which cost is raising, in the name of deflating asset bubble and making equality great again, removing wealth from top 10%, which concentrated their money around useless excessive consumption mechanism. So the prices of useless consumption products will start falling down as they will be offset by much higher raise of basic cost of living and declining wages – that is a true deflation on which top 10% made a fortune. Useless consumption products prices deflating – the definition of deflation.

So inflation is not raising because too many farmers would like to buy too many cars and factory just can’t handle the production, but because too many farmers can’t stay alive with too low prices. So now raising basic cost of living is killing excess consumption which is a deflationary loop to our restaurants, hotels and airlines to cleaning staff, and lower and lower level of employment until that will come to housing market which when will blow up – will destroy the whole banking sector and lots of currencies. That’s an economical gravity of deflation.

Disinflationary cycle (capitalism) requires buying infinite amount of goods you can’t afford and in reality they aren’t needed and their prices are deflating

Inflationary cycle (socialism) requires saving infinite amount of money which you can’t spend on goods you want and need, because they are unavailable or limited because of too low supply side and their prices are inflating

Based on the restaurant example and/or farms you can understand the meaning :

“Liquidity can’t solve economical insolvency”

Liquidity problems = typical recession problem, solution – raise up supply side as long as margins aren’t negative for bottom 90% businesses = 6000 restaurants 400 demand, which will make this chart below exploding to the upside and maybe even can reach 95% for top 5% (30000 restaurants with 1000 demand).

The same time global profits are being transfer to smaller and smaller group. Considering this path we can create the equation based on points from 1997, 2017, 2020 telling us (if it’s a linear approach) that in 2026-2027 there shouldn’t be even 1 profitable business in the world excluding top 100 companies :

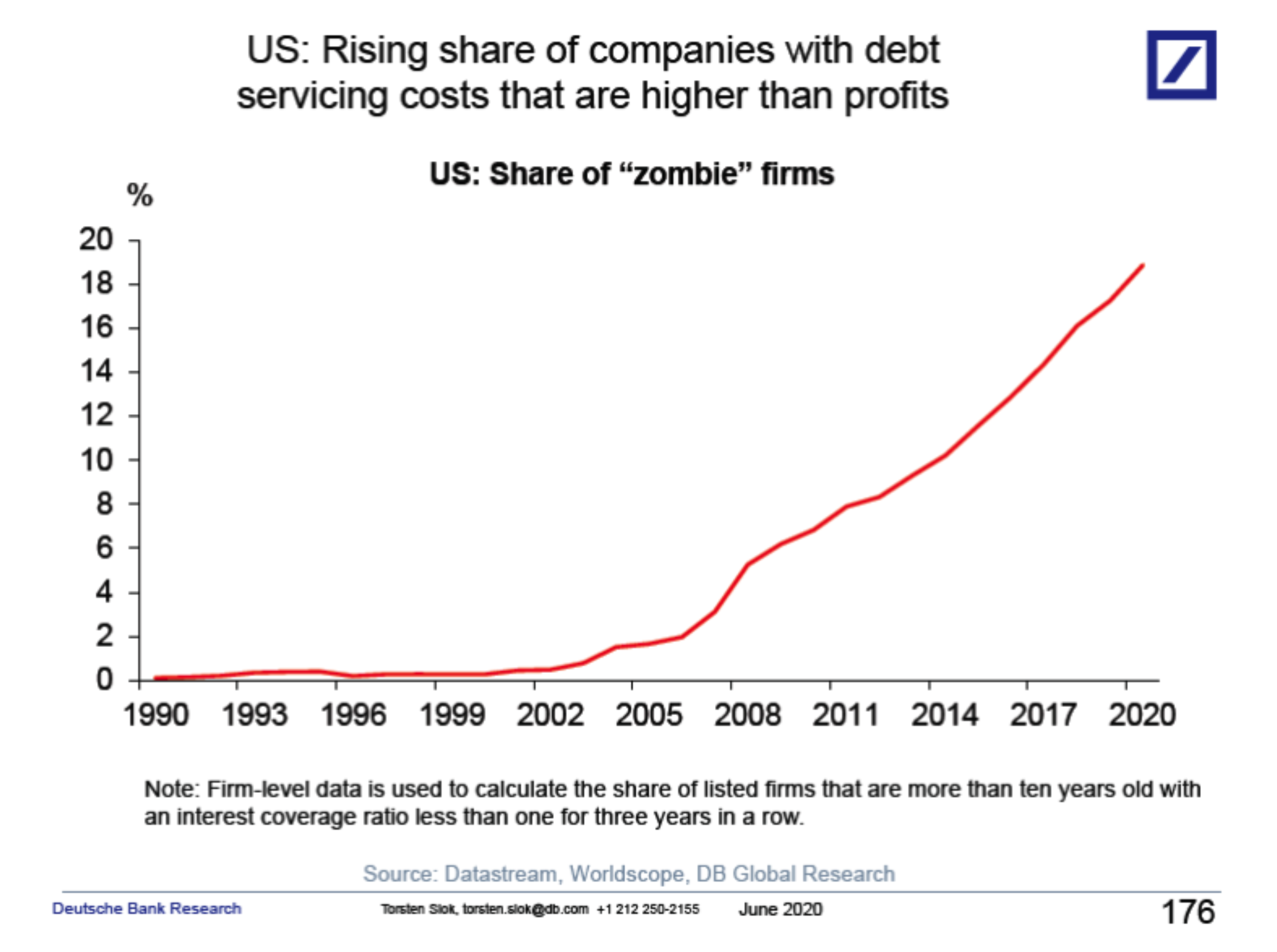

Considering wealth inequality levels we can see below that negative margins started to raise as zombification kicks in, so again we can do quick find and look at the level of interest rates which was a “break-even point” excess supply started to be a problem so does zombification – I bet 5-6%. This means the more you chase expansion to cover lower margins the bigger the failure you’ll get. Doomed loop. Of course it doesn’t mean every business is going this way, but most businesses which belong to the bottom 90% for sure are going this pattern.

If economical gravity will kick in, this line on chart “Income share of top 1% relative to bottom 90%” will start moving lower, that will mean supply is shrinking (zombification is being removed) to meet demand, throwing away people to permanent unemployment until economy will uncover new branch of the economy which will be able to absorb those people. If the line will move higher, it’ll mean economical recovery is possible but expect another wave of restaurant expansion.

Insolvency problems = economical depression. The whole economy is insolvent and most businesses owned by bottom 90% are on negative margins = expect 300 restaurants and 300 demand shrinking process from 3000 example.

As you can see even Central Banks keep giving up. Their QE supply side stimulus tool can’t really create expansion to 6000 restaurants so far. They know it, so asking for fiscal stimulus. Fiscal stimulus is like a final injection of the meth to your blood, last breath … and big light and you died, but that’s a different topic. Expect short living recovery on each portion of fiscal stimulus offset by, I think, much bigger economical gravity to step in.

Central Banks keep looking at inflation type of “secular inflationary cycle” ignoring totally deflationary side.

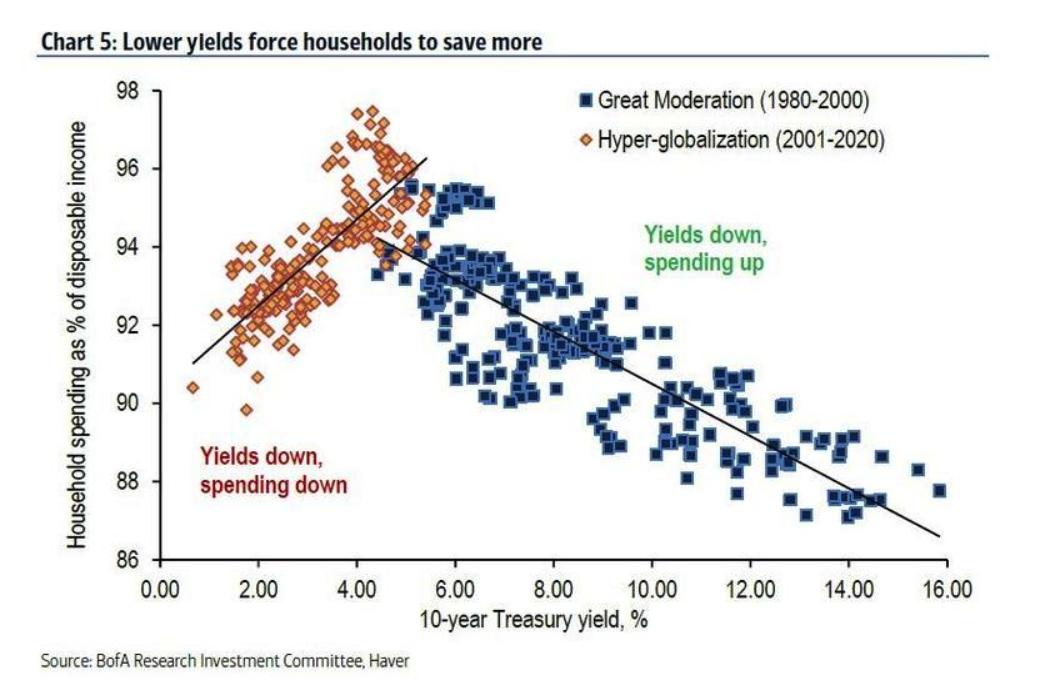

Considering 1980-2000 we had a disinflationary business cycle process which “silently” was wiping out middle class. As rates went too low we have switched from business cycle to credit cycle (the moment when zombification started to appear), which now openly killing middle class, but they see this moment as the “greatest economic recovery ever”. This chart shows that lowering yields will require from now 6000 restaurants, but demand still getting down as spending keeps collapsing declining the margins. Bottom 90% is almost removed, so maybe 30000 restaurants is a cure with 1000 demand?

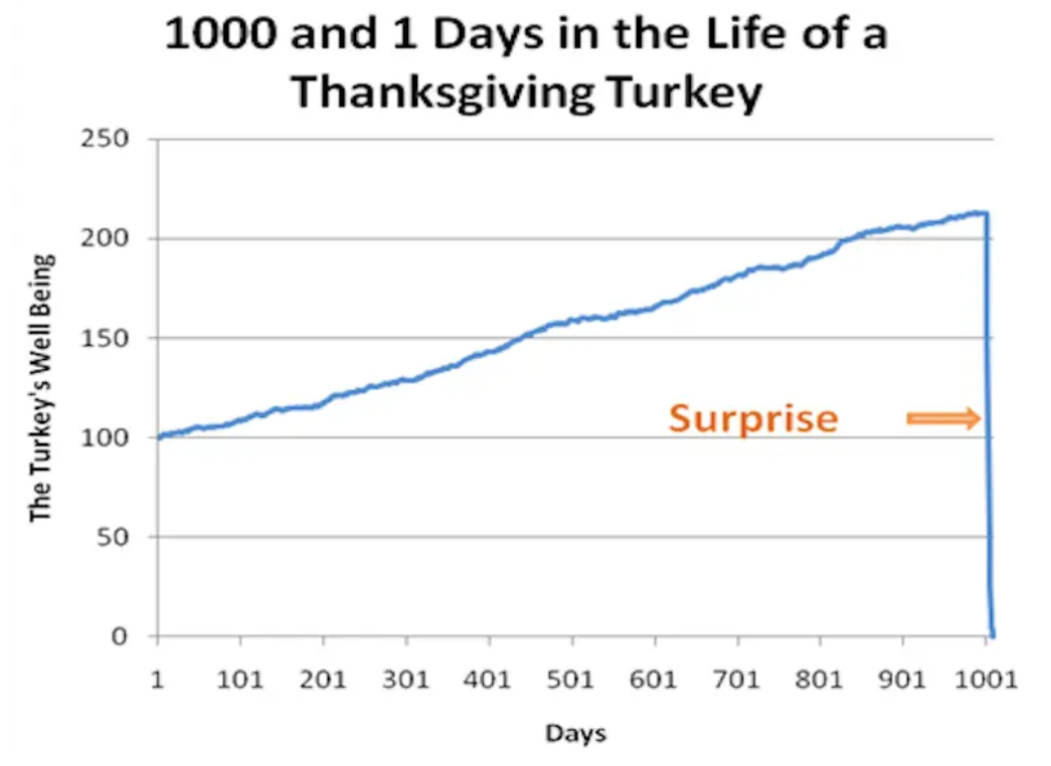

It’s a 1001 Turkey day for middle class. They ignore the fact that every Saturday the owner of the farm arrives with an axe and some of your friends missing. While owner goes out from a small building all in blood – you still get your free food (fiscal stimulus) and you don’t even pay attention on that moment, it’s all ok… So here is your XIVed (collapse of the short volatility instrument with ticker $XIV in 2018) event my dear middle class with just a small trigger called a virus (prefer calling it the trigger) where you can’t even handle to stop for 2-4 weeks on your negative margins which went deeper negative and banks started seeing it as a money losing worthless business. Economy said … CHECK who is swimming naked in its poker game – trying to see if more liquidity can make the true recovery raising amount of restaurants, or this time it’s not possible.

So economical rebalance process is really long and painful, but how it’s processing?

Well, take a look at the table on the top of this article, which compares secular inflation to secular disinflation. You’re going slowly to see a transition from right column to left one. In 30s it required The Great Depression + World War II to clean excess supply of goods and rebalance the economy (20 years) and restore the middle class, how this time will be I don’t know, but I know couple things :

- Basic cost of living will be going higher

- Any stimulus will be offset by much higher cost of living (to remove useless consumption)

- Fiscal stimulus will be raising permanent job losses adding velocity to food inflation

- Agriculture and food inflation lead first inflationary spike. Way bigger & faster than any help/relief you can deliver trying to sustain 6000 restaurants using any type of stimulus

- Economy has an idea where all those unemployed will be employed, but only big long lasting shock can deliver this solution

- Big value / growth rotation – we just don’t know what value still is (maybe those shitty food processing which nobody wants)

- Tons of excess reserves & savings

- CPI might be negative but CPI of basic cost of living will skyrocket. You can rent a condo these days in 2010-13 prices, but still nobody can afford on that. All is offset by cost of living and declining wages for the bottom 90% of society.

- Generation born is credit cycle (2000+) is a lost generation by default, will earn less than their parents and will be less educated.

- Education is devaluing because productivity is devaluing (zombification)

- Triggers will be arriving much more often and much more powerful, but looking weaker.

- Currencies will have problems. All this excess supply sustainability will be popping using F/X, starting from EM F/X. Borrowing to 6000 restaurants running negative margins starts to be impossible. The umbrella is being taken by the banks. You had it when sun was shining, now as it rains banks are taking it back

- Economical problems keep flowing this time from Asia/China

- US is in the best position in this economical cycle.

- China will pay the biggest price just like USA paid the big price in 30s

- There is an equivalent of Nazi party somewhere in the world which keeps gaining power

- Fascism theory was the ultimate solution how to transfer wealth from top 10% to the bottom 90%. Look for more and more from this theory around the world to be visible, as politicians need to stay in power so need to embrace new model

- Banks will be tightening until supply side will finally meet demand side

- Top 10% productive businesses gathered around the Internet will face a big headwinds and will have to decline their prices removing profitability.

- Only government can try to offset banking tightening process – but it won’t last long as cheating economical laws have always way bigger consequences

- First stimulus always works the best, next one will be weaker and weaker and weaker, but will require always more money you can deliver

- Housing market will get frozen, rents will be dropping, for new jobs you can only apply to the top 1% companies. Expect FAANG to absorb the whole unemployment (I know it’s unreal – that’s the case)

- Real Estate kings will get totally clobbered … AirBNB etc … You see trigger has found a way how to do it. Real Estate is the biggest loser in deflationary process

- There will be a moment where EM will be raising interest rates on their F/X , but economy will be destroyed in this moment.

- There will be a moment where first currency from DXY basket will behave like Turkish lira or Argentinian Peso, but that will be a moment where a lot of EM F/X will be like Venezuelan Bolivar

- Once that’ll happen it’ll be slowly time to get out from USD as it’ll be the the beginning of its death.

- Central Banks can’t print demand, food, and basic stuff and social stability. Economy will always offset their moves with much bigger power until it’ll remove excess supply side.

So what does it mean when Central Bankers keep saying they will let the inflation go hot? Well couple things :

- Excess supply will be shrinking raising basic cost of living inflation and declining real wages

- Stimulating more if we crossed the rubicon and trying to achieve 30000 restaurants with 1000 demand they will be facing cascading wave of bankruptcies in a big wave offset by raising cost of living inflation

- Digital currencies won’t make a solution for a cleaning counter productivity

- MMT will be always offset faster by raising basic cost of living to clean excess capacity – you won’t hide it